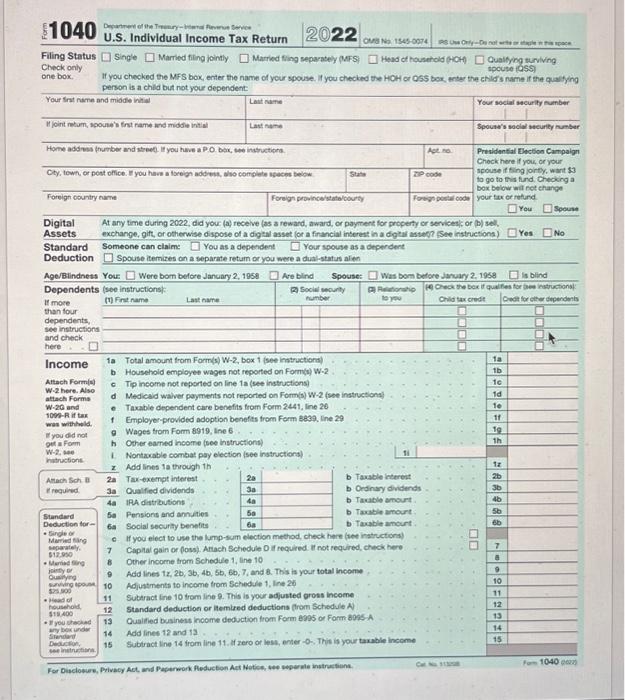

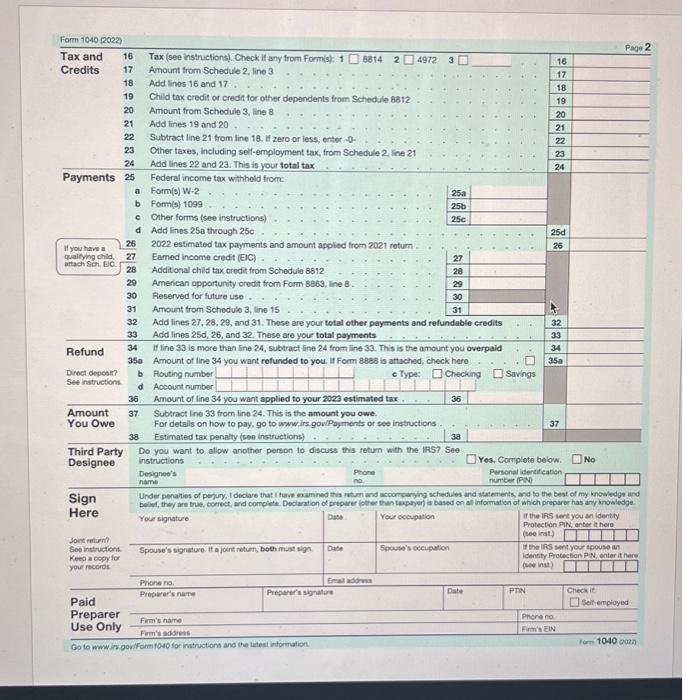

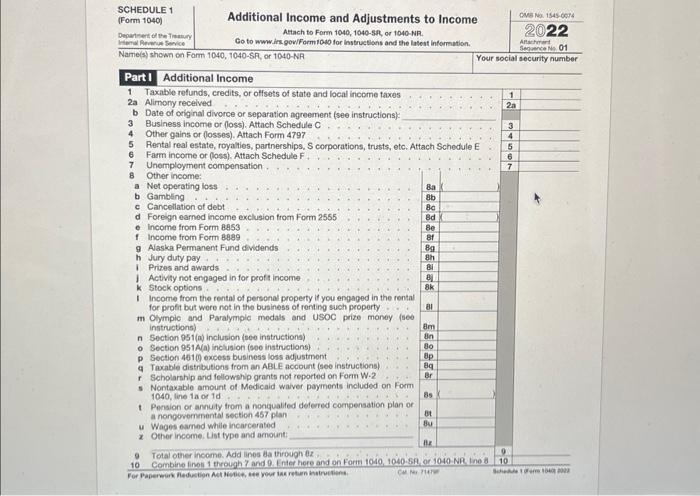

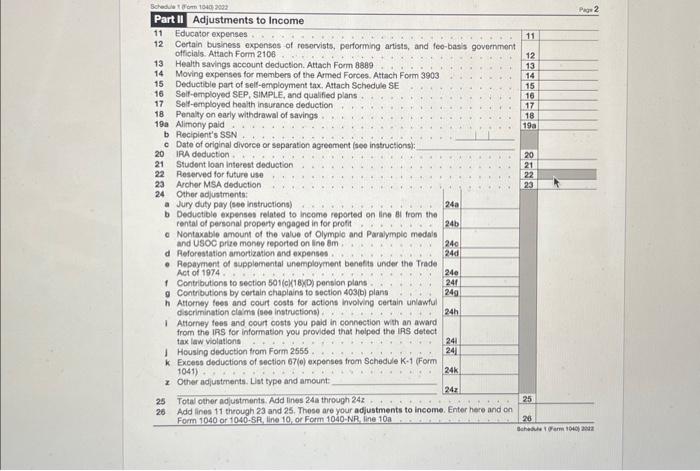

Question: This assignment requires you to complete four tax forms (Form 1040, Schedule 1, Schedule B, and Qualified Dividends and Capital Gain Tax Worksheet, using the

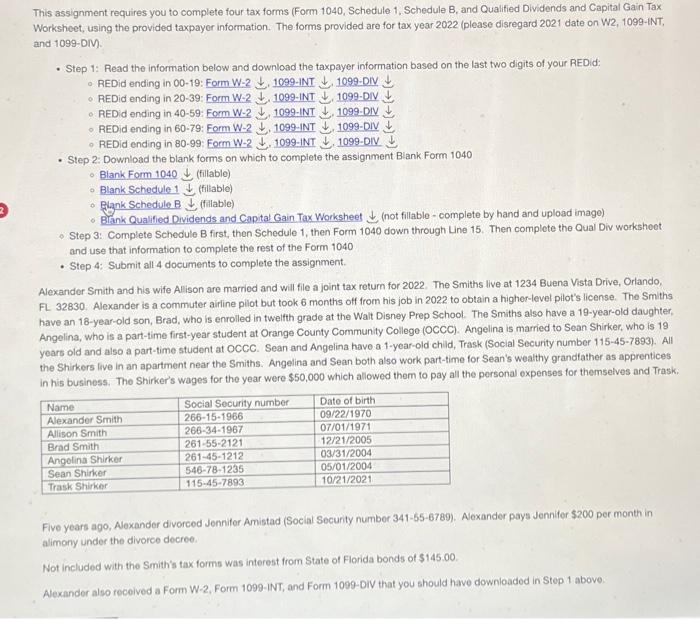

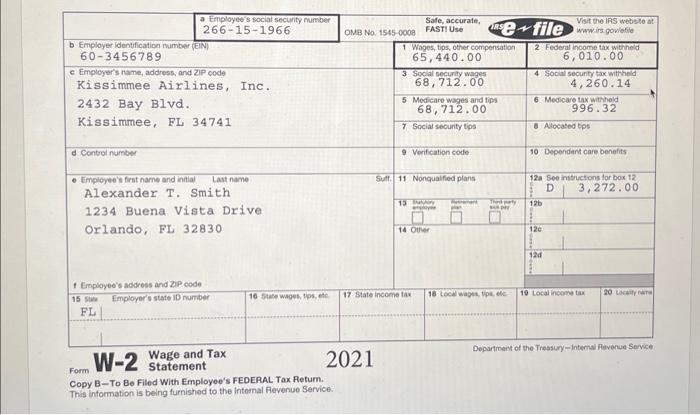

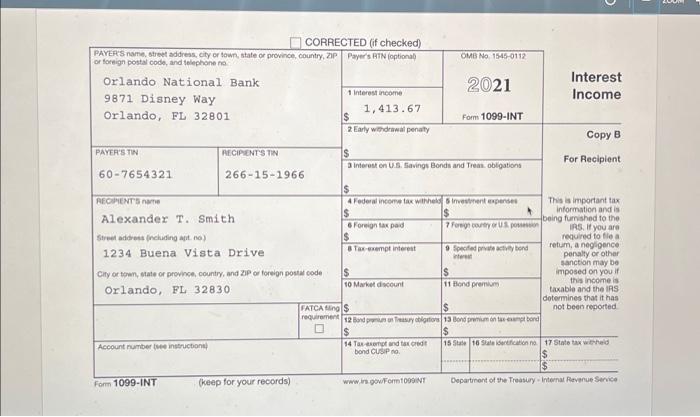

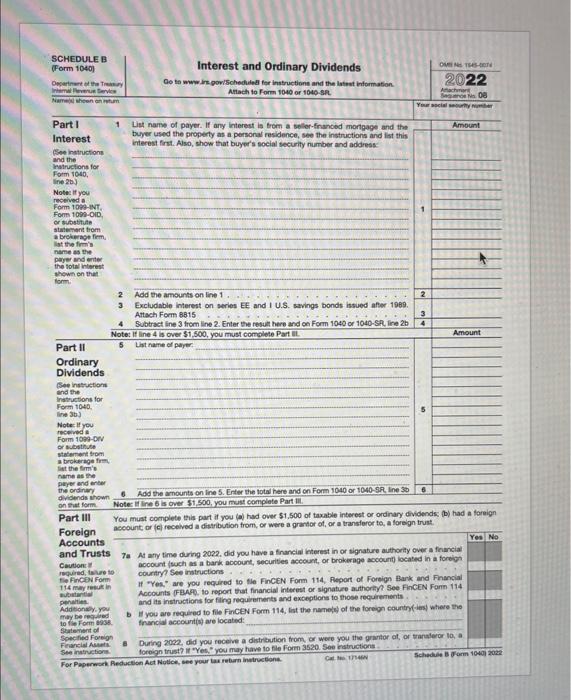

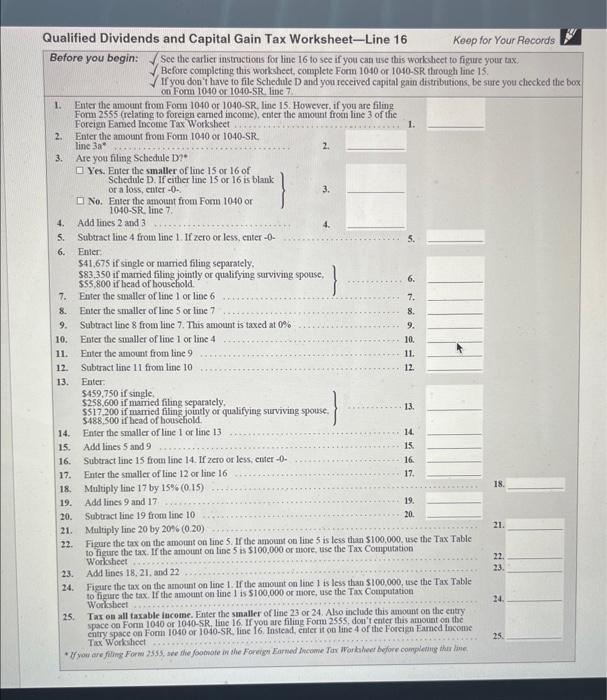

This assignment requires you to complete four tax forms (Form 1040, Schedule 1, Schedule B, and Qualified Dividends and Capital Gain Tax Worksheet, using the provided taxpayor information. The forms provided are for tax year 2022 (please disregard 2021 date on W2, 10991NT. and 1099 -DM). - Step 1: Read the information below and download the taxpayer information based on the last two digits of your REDid: - REDid ending in 00-19: Form W2,10991NT,1099-DIV - REDid ending in 20-39: Form W-2 , 1099-INT ,1099DIV - REDid ending in 40-59: Form W-2 , 1099-INT , 1099-DIV - REDid ending in 60-79: Form W-2 , 1099-INT , 1099-DIV - REDid ending in 80-99: Form W-2 , 1099-INT , 1099-DIV - Step 2: Download the blank forms on which to complete the assignment Blank Form 1040 - Blank Form 1040 (fillable) - Blank Schedule 1 (fillable) - Pqlank Schedule B (fillable) - Blank Qualified Dividends and Capital Gain Tax Worksheet (not fillable - complete by hand and upload image) - Step 3: Complete Schedule B first, then Schedule 1, then Form 1040 down through Line 15. Then complote the Qual Div workshoet and use that information to complete the rest of the Form 1040 - Step 4: Submit all 4 documents to complete the assignment. Alexander Smith and his wife Alison are married and will fle a joint tax return for 2022 . The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830: Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level plot's license. The Smiths have an 18-year-old son, Brad, who is enrolled in tweltth grade at the Walt Disney Prep School. The Smiths also have a 19-year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandtather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask: Fivo years ago, Aloxander divorced Jennifer Amistad (Social Security numbor 341-65-6789). Alexander pays Jennifer \$200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DIV that you should have downloaded in Step 1 above. Copy B-To Be Filed With Employee's FEDErAL 1 ax return. This information is being furnished to the internal Revonue Service: CORRECTED (if checked) CORRECTED (f checked) Form 1099-DIV (keep for your records) wiring gowformtog9ON Depatmen of the Treasury - interal Aevenve Sorvce Standard Someone can claime You as a dependent Your spouse as a deperdent Deduction Spouse itemizes on a separate retum oryou were a duallatave aimen Age/Bilindness Your Wore bom beloce January 2, 1959 Are bind Spouse: Was bem betore Jasuan 2,1958 is blind Forn 1040(2022) \begin{tabular}{lll} \hline Tax and & 16 & Tax (see instructionsi. Creck if as \\ Credits & 17 & Amount from Schedule 2, line 3 \\ & 18 & Add linos 16 and 17 \end{tabular} 19 Child tax credit or credit for other dopendents from Schedule 8812 20 Amount from Schedule 3, line 8 21 Add lines 19 and 20 . 22. Subtract line 21 from line 18. If zero or less, enter -0 - 23 Other taxes, including sel-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23 . This is your total tax Payments 25 Federal income tax withhold from: \begin{tabular}{|l|l} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19 & \\ \hline 20 \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline 24 & \\ \hline \end{tabular} a Form(s) W-2 b Fom(s) 1099 c OAther forms (see instructions) d Add lines 25 a through 25c II you have a 262022 estimated tax paymerits and amount appled from 2021 return qualiting chlid. 27 Eamed income credit (EIC) atach Ser EC \( \lcm{28} \) Addit onal child tax credit trom Schedule 8812 29 American opportunity oredit from Form 8863 , line 8 . 30 Reserved for future use . 31 Amount from Schodule 3 , line 15 Third Party Do you want to alow another person to discuss this retum with the IRST See Designee instructions Here Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony recelved b Date of ceiginal divorce or separation agreement (see instructions): 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 . Farm income or (loss). Attach Schedule F. 7 Unemployment compensation . 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Forelgn earned income exclusion from Form 2555 e Income from Form 8853 I Income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay 1 Prizes and awards j Activity not engaged in for proft income k. Stock options . I Income from the rontal of personal property if you engaged in the rental for profit but wore not in the business of renting such property m Oympic and Paralympic modals and USOC prize money (see instructions) n Section 951(a inclution (seo instructions) o Section 951A(a) inclusion (90e instructions) p Section 4610 excess business loss adjustment q Tacable distributions from an ABLE account (seo instructions) r. Scholarship and fellowehlp grants not reported on Forn W-2 s. Nontaxable amount of Medicaid waiver poyments included on Form. t Pension of annuty from a nonqualifed defered compensation plan or a nongovemenental section 457 plan u Wages eamed while incarcerated x Other income. List type and amount: Soledive form 104a 2002. Part ill Adjustments to Income 11 Educator expenses 12 Certain business expensos of rosorvists, performing artists, and feo-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax, Attach Schedule SE 16 Self-employed SEP, SIMPL.E, and qualified plans 17 Seli-employed bealth insurence deduction 18 Penaly on early withdrawal of savings 19 a Alimony paid \begin{tabular}{|l|} \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline 16 \\ \hline 17 \\ \hline 18 \\ \hline 19 a \\ \hline \end{tabular} b Apcipient's SSN c Date of original divorce or separation agreoment (see instructions): 20 IRA doduction. 21 Studont loan interest deduction 22 Reserved for future use 23 Archor MSA deduction 24 Other adjustments: a Jury duty pay (seo instructions) income reported on line ai from the rental of personal property engaged in for profit ... . . . 24b. o Nontaxable amount of the value of Olymple and Paralymplo medils and USOC prite money reported on line 8m d Peforeatation amortization and expenses . - Repayment of aupplomental unemployment benefis under the Trade 1 Contributions to section So1(c)(18yD) pension plans . 9 Contributions by certain chaplains to section 403(b) plans h Attomey fees and court costs for actions hvolving certain unlawful discrimination claima (see instructions) 1 Atorney fees and court oosts you paid in connection with an award from the IRS for information you provided that helped the IAS deteot tax law violations I Housing deduction from Form 2555 . k Excess deductions of section 67(0) expenses from Schedule K-1 (Form 1041). x other adjustments. Lit type and amount: 25 Total other adjustments. Add lines 24a through 242 26 . Add ines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 10405SP, line 10, or Form 1040-NR, line 10a d the box This assignment requires you to complete four tax forms (Form 1040, Schedule 1, Schedule B, and Qualified Dividends and Capital Gain Tax Worksheet, using the provided taxpayor information. The forms provided are for tax year 2022 (please disregard 2021 date on W2, 10991NT. and 1099 -DM). - Step 1: Read the information below and download the taxpayer information based on the last two digits of your REDid: - REDid ending in 00-19: Form W2,10991NT,1099-DIV - REDid ending in 20-39: Form W-2 , 1099-INT ,1099DIV - REDid ending in 40-59: Form W-2 , 1099-INT , 1099-DIV - REDid ending in 60-79: Form W-2 , 1099-INT , 1099-DIV - REDid ending in 80-99: Form W-2 , 1099-INT , 1099-DIV - Step 2: Download the blank forms on which to complete the assignment Blank Form 1040 - Blank Form 1040 (fillable) - Blank Schedule 1 (fillable) - Pqlank Schedule B (fillable) - Blank Qualified Dividends and Capital Gain Tax Worksheet (not fillable - complete by hand and upload image) - Step 3: Complete Schedule B first, then Schedule 1, then Form 1040 down through Line 15. Then complote the Qual Div workshoet and use that information to complete the rest of the Form 1040 - Step 4: Submit all 4 documents to complete the assignment. Alexander Smith and his wife Alison are married and will fle a joint tax return for 2022 . The Smiths live at 1234 Buena Vista Drive, Orlando, FL 32830: Alexander is a commuter airline pilot but took 6 months off from his job in 2022 to obtain a higher-level plot's license. The Smiths have an 18-year-old son, Brad, who is enrolled in tweltth grade at the Walt Disney Prep School. The Smiths also have a 19-year-old daughter, Angelina, who is a part-time first-year student at Orange County Community College (OCCC). Angelina is married to Sean Shirker, who is 19 years old and also a part-time student at OCCC. Sean and Angelina have a 1-year-old child, Trask (Social Security number 115-45-7893). All the Shirkers live in an apartment near the Smiths. Angelina and Sean both also work part-time for Sean's wealthy grandtather as apprentices in his business. The Shirker's wages for the year were $50,000 which allowed them to pay all the personal expenses for themselves and Trask: Fivo years ago, Aloxander divorced Jennifer Amistad (Social Security numbor 341-65-6789). Alexander pays Jennifer \$200 per month in alimony under the divorce decree. Not included with the Smith's tax forms was interest from State of Florida bonds of $145.00. Alexander also received a Form W-2, Form 1099-INT, and Form 1099-DIV that you should have downloaded in Step 1 above. Copy B-To Be Filed With Employee's FEDErAL 1 ax return. This information is being furnished to the internal Revonue Service: CORRECTED (if checked) CORRECTED (f checked) Form 1099-DIV (keep for your records) wiring gowformtog9ON Depatmen of the Treasury - interal Aevenve Sorvce Standard Someone can claime You as a dependent Your spouse as a deperdent Deduction Spouse itemizes on a separate retum oryou were a duallatave aimen Age/Bilindness Your Wore bom beloce January 2, 1959 Are bind Spouse: Was bem betore Jasuan 2,1958 is blind Forn 1040(2022) \begin{tabular}{lll} \hline Tax and & 16 & Tax (see instructionsi. Creck if as \\ Credits & 17 & Amount from Schedule 2, line 3 \\ & 18 & Add linos 16 and 17 \end{tabular} 19 Child tax credit or credit for other dopendents from Schedule 8812 20 Amount from Schedule 3, line 8 21 Add lines 19 and 20 . 22. Subtract line 21 from line 18. If zero or less, enter -0 - 23 Other taxes, including sel-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23 . This is your total tax Payments 25 Federal income tax withhold from: \begin{tabular}{|l|l} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19 & \\ \hline 20 \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline 24 & \\ \hline \end{tabular} a Form(s) W-2 b Fom(s) 1099 c OAther forms (see instructions) d Add lines 25 a through 25c II you have a 262022 estimated tax paymerits and amount appled from 2021 return qualiting chlid. 27 Eamed income credit (EIC) atach Ser EC \( \lcm{28} \) Addit onal child tax credit trom Schedule 8812 29 American opportunity oredit from Form 8863 , line 8 . 30 Reserved for future use . 31 Amount from Schodule 3 , line 15 Third Party Do you want to alow another person to discuss this retum with the IRST See Designee instructions Here Part I Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony recelved b Date of ceiginal divorce or separation agreement (see instructions): 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 . Farm income or (loss). Attach Schedule F. 7 Unemployment compensation . 8 Other income: a Net operating loss b Gambling c Cancellation of debt d Forelgn earned income exclusion from Form 2555 e Income from Form 8853 I Income from Form 8889 g Alaska Permanent Fund dividends h Jury duty pay 1 Prizes and awards j Activity not engaged in for proft income k. Stock options . I Income from the rontal of personal property if you engaged in the rental for profit but wore not in the business of renting such property m Oympic and Paralympic modals and USOC prize money (see instructions) n Section 951(a inclution (seo instructions) o Section 951A(a) inclusion (90e instructions) p Section 4610 excess business loss adjustment q Tacable distributions from an ABLE account (seo instructions) r. Scholarship and fellowehlp grants not reported on Forn W-2 s. Nontaxable amount of Medicaid waiver poyments included on Form. t Pension of annuty from a nonqualifed defered compensation plan or a nongovemenental section 457 plan u Wages eamed while incarcerated x Other income. List type and amount: Soledive form 104a 2002. Part ill Adjustments to Income 11 Educator expenses 12 Certain business expensos of rosorvists, performing artists, and feo-basis government officials. Attach Form 2106 13 Health savings account deduction. Attach Form 8889 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax, Attach Schedule SE 16 Self-employed SEP, SIMPL.E, and qualified plans 17 Seli-employed bealth insurence deduction 18 Penaly on early withdrawal of savings 19 a Alimony paid \begin{tabular}{|l|} \hline 11 \\ \hline 12 \\ \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline 16 \\ \hline 17 \\ \hline 18 \\ \hline 19 a \\ \hline \end{tabular} b Apcipient's SSN c Date of original divorce or separation agreoment (see instructions): 20 IRA doduction. 21 Studont loan interest deduction 22 Reserved for future use 23 Archor MSA deduction 24 Other adjustments: a Jury duty pay (seo instructions) income reported on line ai from the rental of personal property engaged in for profit ... . . . 24b. o Nontaxable amount of the value of Olymple and Paralymplo medils and USOC prite money reported on line 8m d Peforeatation amortization and expenses . - Repayment of aupplomental unemployment benefis under the Trade 1 Contributions to section So1(c)(18yD) pension plans . 9 Contributions by certain chaplains to section 403(b) plans h Attomey fees and court costs for actions hvolving certain unlawful discrimination claima (see instructions) 1 Atorney fees and court oosts you paid in connection with an award from the IRS for information you provided that helped the IAS deteot tax law violations I Housing deduction from Form 2555 . k Excess deductions of section 67(0) expenses from Schedule K-1 (Form 1041). x other adjustments. Lit type and amount: 25 Total other adjustments. Add lines 24a through 242 26 . Add ines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 10405SP, line 10, or Form 1040-NR, line 10a d the box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts