Question: this assignment should be solved in excel as per instructions Unless otherwise directed, solve each problem below in its own worksheet and identify each sheet

this assignment should be solved in excel as per instructions

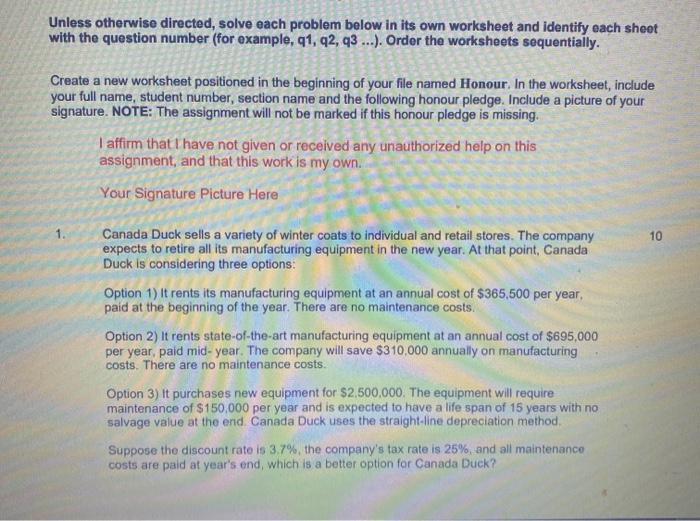

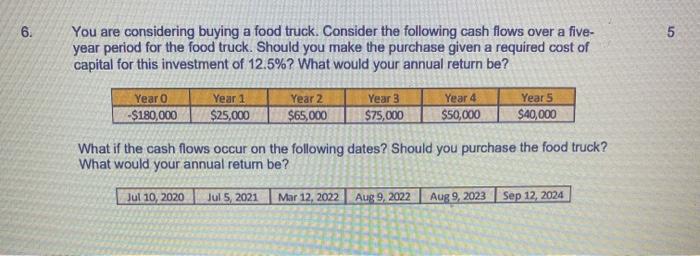

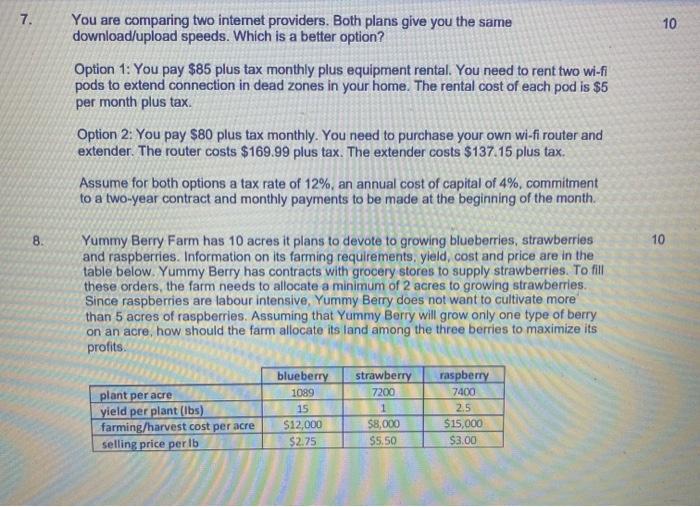

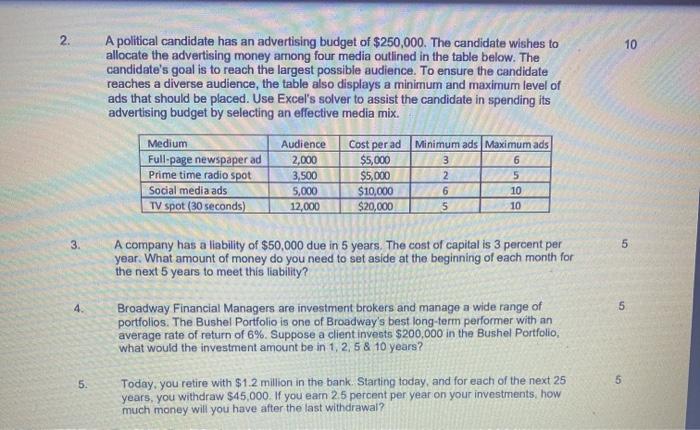

this assignment should be solved in excel as per instructionsUnless otherwise directed, solve each problem below in its own worksheet and identify each sheet with the question number (for example, 41, 42, 43 ...). Order the worksheets sequentially. Create a new worksheet positioned in the beginning of your file named Honour. In the worksheet, include your full name, student number, section name and the following honour pledge. Include a picture of your signature. NOTE: The assignment will not be marked if this honour pledge is missing. I affirm that I have not given or received any unauthorized help on this assignment, and that this work is my own Your Signature Picture Here 10 Canada Duck sells a variety of winter coats to individual and retail stores. The company expects to retire all its manufacturing equipment in the new year. At that point, Canada Duck is considering three options: Option 1) It rents its manufacturing equipment at an annual cost of $365,500 per year, paid at the beginning of the year. There are no maintenance costs. Option 2) It rents state-of-the-art manufacturing equipment at an annual cost of $695,000 per year, paid mid-year. The company will save $310,000 annually on manufacturing costs. There are no maintenance costs. Option 3) It purchases new equipment for $2.500,000. The equipment will require maintenance of $150,000 per year and is expected to have a life span of 15 years with no salvage value at the end Canada Duck uses the straight-line depreciation method. Suppose the discount rate is 37%, the company's tax rate is 25%, and all maintenance costs are paid at year's end, which is a better option for Canada Duck? 6. 5 You are considering buying a food truck. Consider the following cash flows over a five- year period for the food truck. Should you make the purchase given a required cost of capital for this investment of 12.5%? What would your annual return be? Year o -$180,000 Year 1 $25,000 Year 2 $65,000 Year 3 $75,000 Year 4 $50,000 Year 5 $40,000 What if the cash flows occur on the following dates? Should you purchase the food truck? What would your annual return be? Jul 10, 2020 Jul 5, 2021 Mar 12, 2022 Aug 9, 2022 Aug 9, 2023 Sep 12, 2024 7. 10 You are comparing two internet providers. Both plans give you the same download/upload speeds. Which is a better option? Option 1: You pay $85 plus tax monthly plus equipment rental. You need to rent two wi-fi pods to extend connection in dead zones in your home. The rental cost of each pod is $5 per month plus tax. Option 2: You pay $80 plus tax monthly. You need to purchase your own wi-fi router and extender. The router costs $169.99 plus tax. The extender costs $137.15 plus tax. Assume for both options a tax rate of 12%, an annual cost of capital of 4%, commitment to a two-year contract and monthly payments to be made at the beginning of the month. 8 10 Yummy Berry Farm has 10 acres it plans to devote to growing blueberries, strawberries and raspberries. Information on its farming requirements, yield, cost and price are in the table below. Yummy Berry has contracts with grocery stores to supply strawberries. To fill these orders, the farm needs to allocate a minimum of 2 acres to growing strawberries. Since raspberries are labour intensive, Yummy Berry does not want to cultivate more than 5 acres of raspberries. Assuming that Yummy Berry will grow only one type of berry on an acre, how should the farm allocate its land among the three berries to maximize its profits. blueberry strawberry raspberry plant per acre 1089 7200 7400 yield per plant (lbs) 15 2.5 farming/harvest cost per acre $12,000 $8,000 $15,000 selling price per lb $2.75 $5.50 $3.00 1 2. 10 A political candidate has an advertising budget of $250,000. The candidate wishes to allocate the advertising money among four media outlined in the table below. The candidate's goal is to reach the largest possible audience. To ensure the candidate reaches a diverse audience, the table also displays a minimum and maximum level of ads that should be placed. Use Excel's solver to assist the candidate in spending its advertising budget by selecting an effective media mix. Medium Full page newspaper ad Prime time radio spot Social media ads TV spot (30 seconds) Audience 2,000 3,500 5,000 12,000 Cost per ad Minimum ads Maximum ads $5,000 3 6 $5,000 2 5 $10,000 6 10 $20,000 5 10 5 A company has a liability of $50,000 due in 5 years. The cost of capital is 3 percent per year. What amount of money do you need to set aside at the beginning of each month for the next 5 years to meet this liability? 4. 5 Broadway Financial Managers are investment brokers and manage a wide range of portfolios. The Bushel Portfolio is one of Broadway's best long-term performer with an average rate of return of 6%. Suppose a client invests $200,000 in the Bushel Portfolio what would the investment amount be in 1, 2,5 & 10 years? 5. 5 Today, you retire with $1.2 million in the bank. Starting today, and for each of the next 25 years, you withdraw $45,000. If you earn 25 percent per year on your investments, how much money will you have after the last withdrawal? Unless otherwise directed, solve each problem below in its own worksheet and identify each sheet with the question number (for example, 41, 42, 43 ...). Order the worksheets sequentially. Create a new worksheet positioned in the beginning of your file named Honour. In the worksheet, include your full name, student number, section name and the following honour pledge. Include a picture of your signature. NOTE: The assignment will not be marked if this honour pledge is missing. I affirm that I have not given or received any unauthorized help on this assignment, and that this work is my own Your Signature Picture Here 10 Canada Duck sells a variety of winter coats to individual and retail stores. The company expects to retire all its manufacturing equipment in the new year. At that point, Canada Duck is considering three options: Option 1) It rents its manufacturing equipment at an annual cost of $365,500 per year, paid at the beginning of the year. There are no maintenance costs. Option 2) It rents state-of-the-art manufacturing equipment at an annual cost of $695,000 per year, paid mid-year. The company will save $310,000 annually on manufacturing costs. There are no maintenance costs. Option 3) It purchases new equipment for $2.500,000. The equipment will require maintenance of $150,000 per year and is expected to have a life span of 15 years with no salvage value at the end Canada Duck uses the straight-line depreciation method. Suppose the discount rate is 37%, the company's tax rate is 25%, and all maintenance costs are paid at year's end, which is a better option for Canada Duck? 6. 5 You are considering buying a food truck. Consider the following cash flows over a five- year period for the food truck. Should you make the purchase given a required cost of capital for this investment of 12.5%? What would your annual return be? Year o -$180,000 Year 1 $25,000 Year 2 $65,000 Year 3 $75,000 Year 4 $50,000 Year 5 $40,000 What if the cash flows occur on the following dates? Should you purchase the food truck? What would your annual return be? Jul 10, 2020 Jul 5, 2021 Mar 12, 2022 Aug 9, 2022 Aug 9, 2023 Sep 12, 2024 7. 10 You are comparing two internet providers. Both plans give you the same download/upload speeds. Which is a better option? Option 1: You pay $85 plus tax monthly plus equipment rental. You need to rent two wi-fi pods to extend connection in dead zones in your home. The rental cost of each pod is $5 per month plus tax. Option 2: You pay $80 plus tax monthly. You need to purchase your own wi-fi router and extender. The router costs $169.99 plus tax. The extender costs $137.15 plus tax. Assume for both options a tax rate of 12%, an annual cost of capital of 4%, commitment to a two-year contract and monthly payments to be made at the beginning of the month. 8 10 Yummy Berry Farm has 10 acres it plans to devote to growing blueberries, strawberries and raspberries. Information on its farming requirements, yield, cost and price are in the table below. Yummy Berry has contracts with grocery stores to supply strawberries. To fill these orders, the farm needs to allocate a minimum of 2 acres to growing strawberries. Since raspberries are labour intensive, Yummy Berry does not want to cultivate more than 5 acres of raspberries. Assuming that Yummy Berry will grow only one type of berry on an acre, how should the farm allocate its land among the three berries to maximize its profits. blueberry strawberry raspberry plant per acre 1089 7200 7400 yield per plant (lbs) 15 2.5 farming/harvest cost per acre $12,000 $8,000 $15,000 selling price per lb $2.75 $5.50 $3.00 1 2. 10 A political candidate has an advertising budget of $250,000. The candidate wishes to allocate the advertising money among four media outlined in the table below. The candidate's goal is to reach the largest possible audience. To ensure the candidate reaches a diverse audience, the table also displays a minimum and maximum level of ads that should be placed. Use Excel's solver to assist the candidate in spending its advertising budget by selecting an effective media mix. Medium Full page newspaper ad Prime time radio spot Social media ads TV spot (30 seconds) Audience 2,000 3,500 5,000 12,000 Cost per ad Minimum ads Maximum ads $5,000 3 6 $5,000 2 5 $10,000 6 10 $20,000 5 10 5 A company has a liability of $50,000 due in 5 years. The cost of capital is 3 percent per year. What amount of money do you need to set aside at the beginning of each month for the next 5 years to meet this liability? 4. 5 Broadway Financial Managers are investment brokers and manage a wide range of portfolios. The Bushel Portfolio is one of Broadway's best long-term performer with an average rate of return of 6%. Suppose a client invests $200,000 in the Bushel Portfolio what would the investment amount be in 1, 2,5 & 10 years? 5. 5 Today, you retire with $1.2 million in the bank. Starting today, and for each of the next 25 years, you withdraw $45,000. If you earn 25 percent per year on your investments, how much money will you have after the last withdrawal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts