Question: this assignment was given in a income tax accouting class. PRACTICE SET ACCT 324 - Fall 2022 2021 Individual Income Tax Return Please complete the

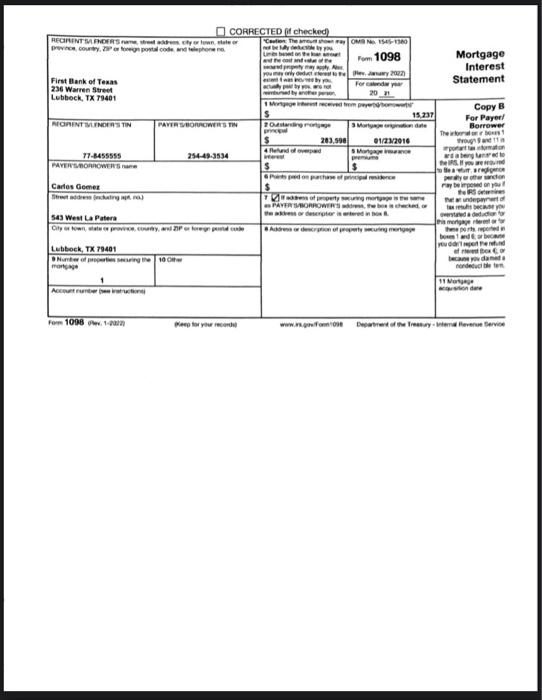

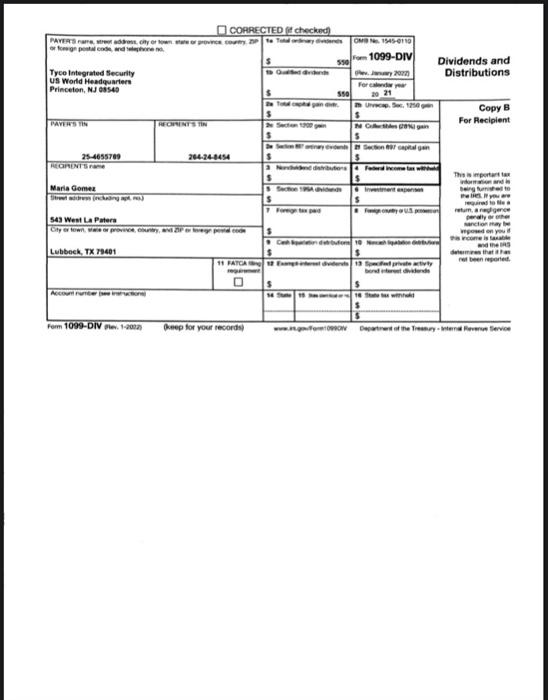

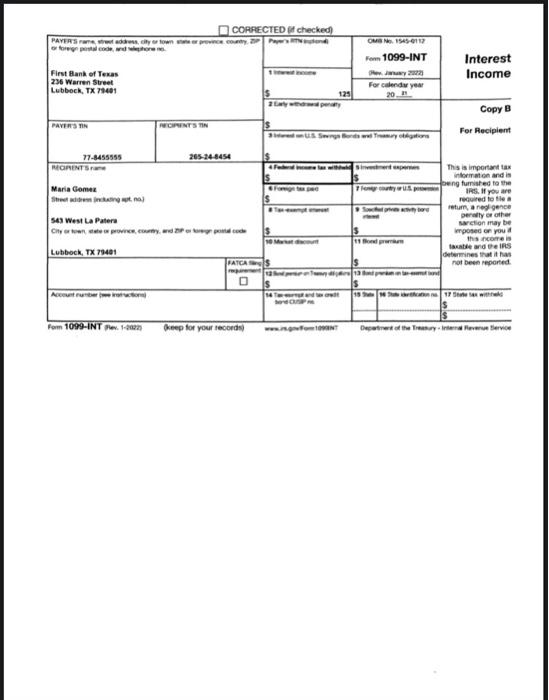

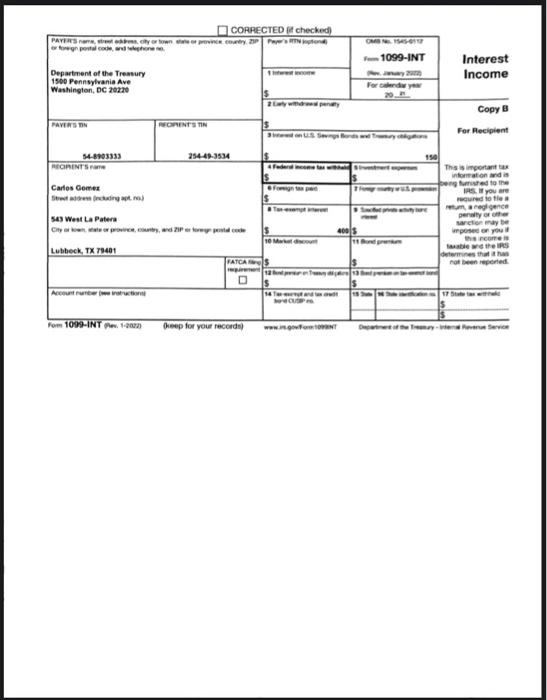

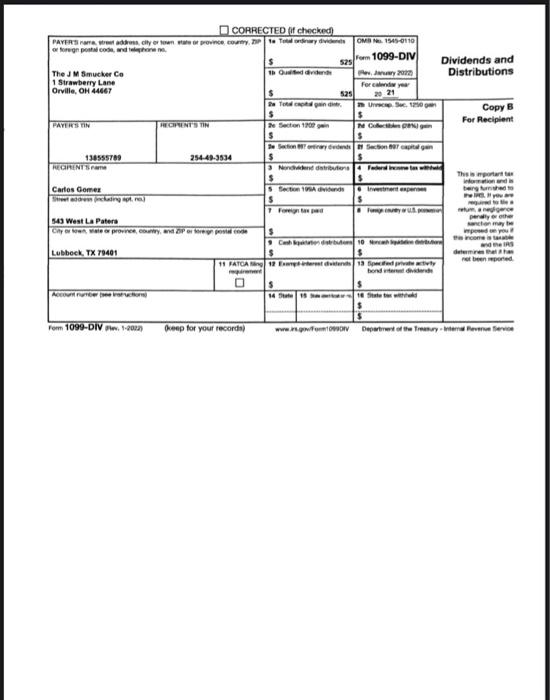

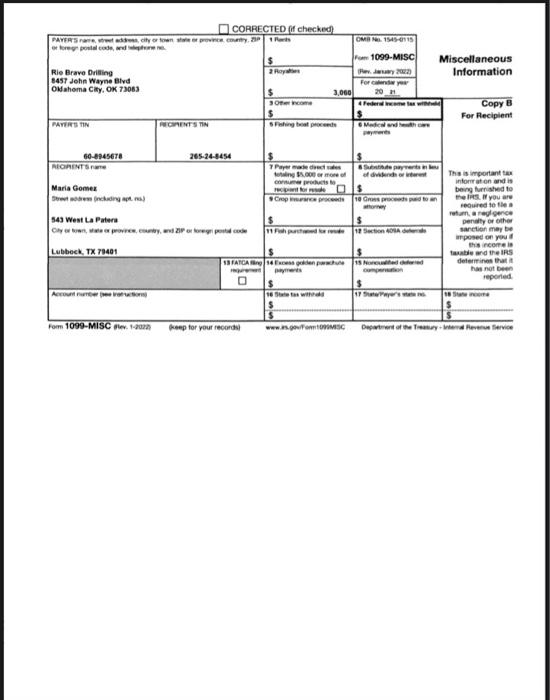

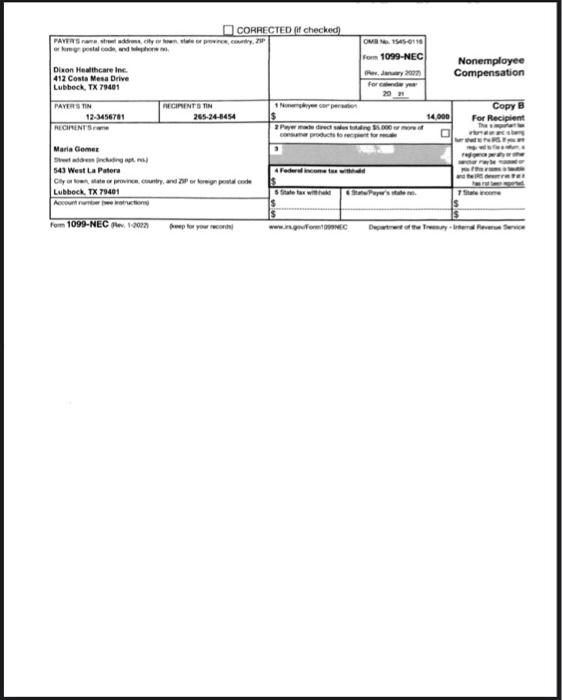

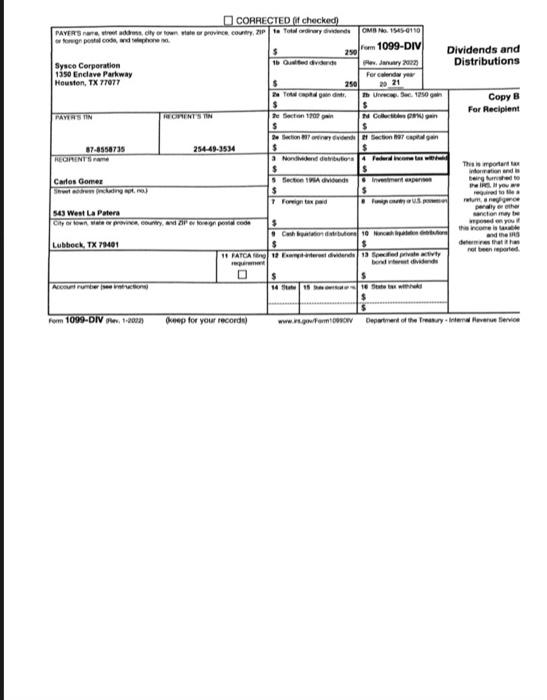

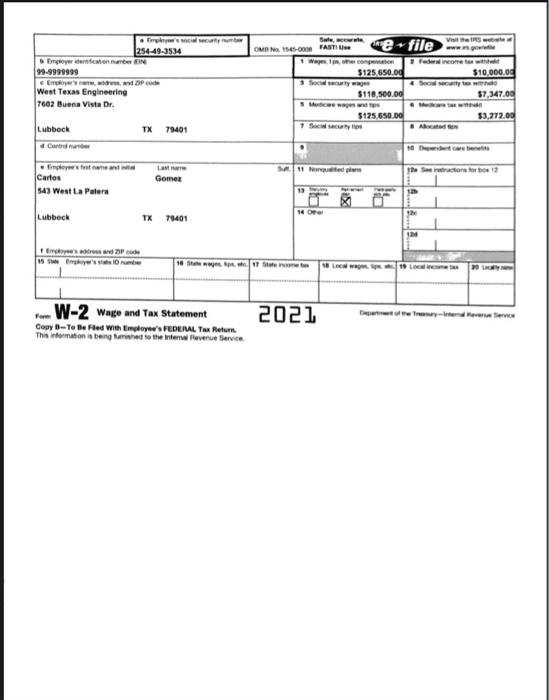

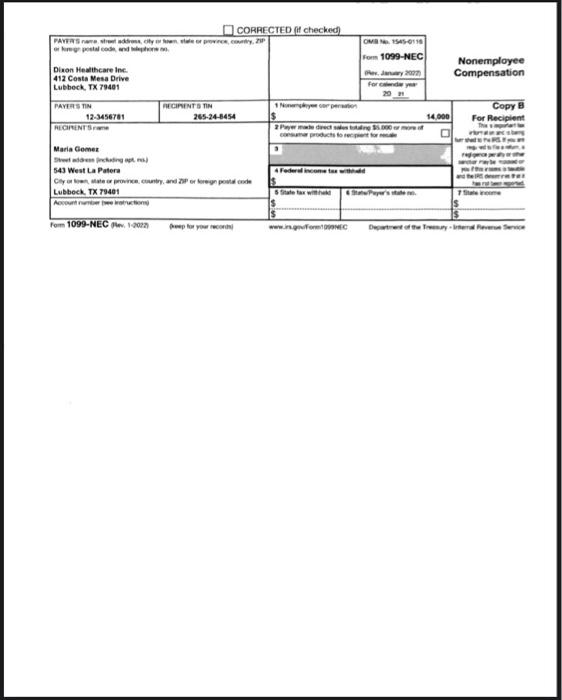

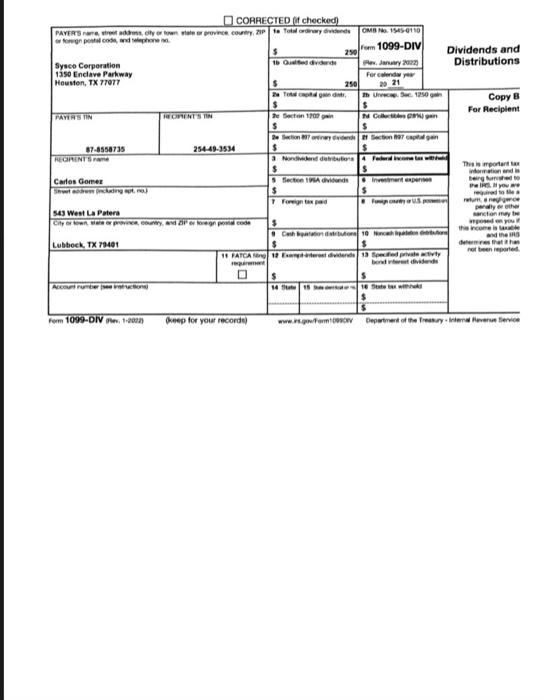

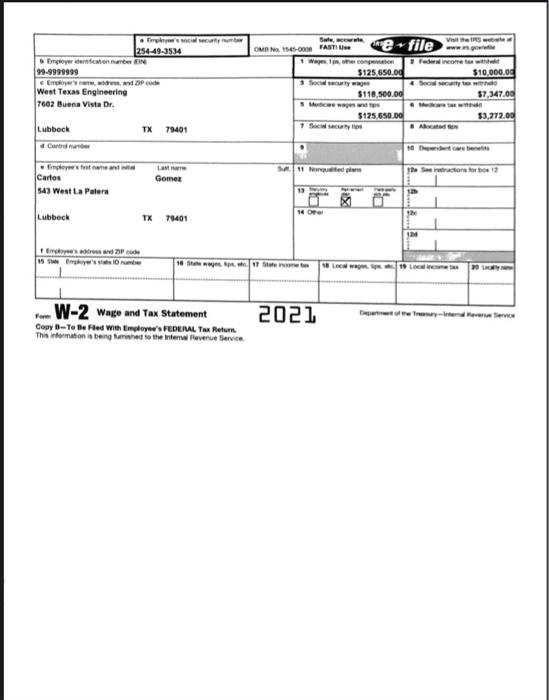

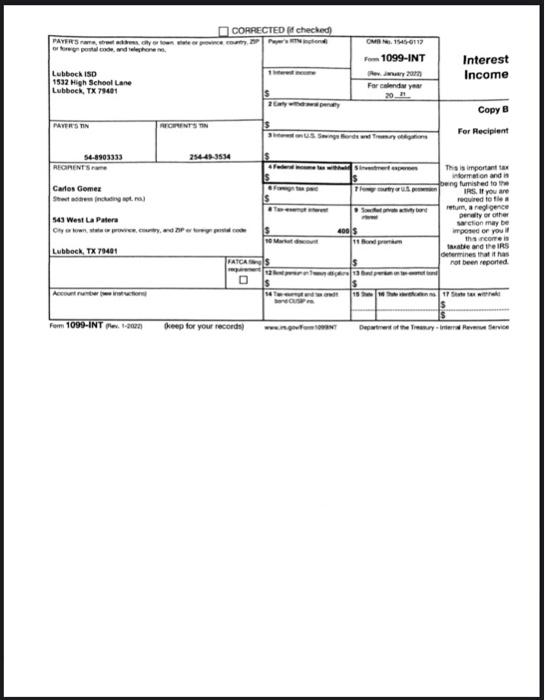

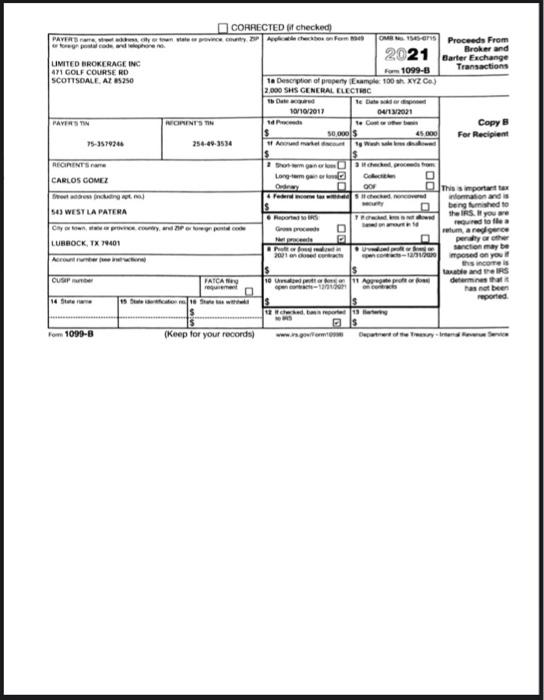

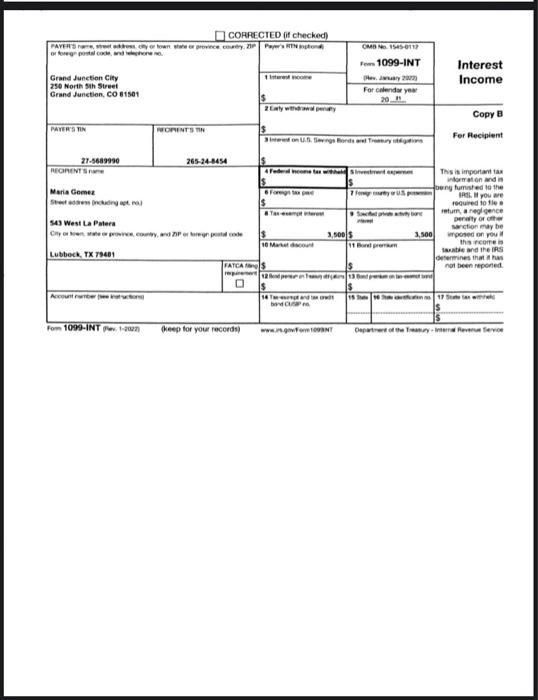

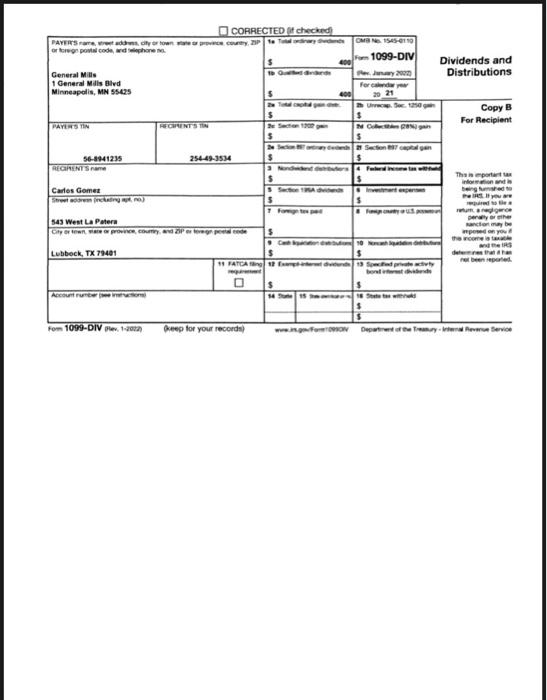

PRACTICE SET ACCT 324 - Fall 2022 2021 Individual Income Tax Return Please complete the 2021 federal income tax return for Carlos and Maria Gomez. Ignore the requirement to attach the forma(s) W-2 to the front page of Form 1040. If any required information is missing, use reasonable assumptions to provide it. Carlos and Maria live in Lubbock, Texas. They have two children: Luis (age 14) and Amanda (age 12). Both children lived with their parents during 2021, who provided all of their support. The Gomezes provided the following information: Their current mailing address is 543 West La Patera, Lubbock. TX 79401 Luis' social security number is 589-24-8432 Amanda's social security number is 599-74-8733 Carlos is a civil engineer. Maria is self-employed as a part-time bookkeeper. Carlos received a W-2 from his employer WTE. Maria received a Form 1099-NEC for her bookkeeping services performed for her largest client, Dixon Healthcare. Maria received an additional $4,000 from clients who were not required to issue a Form 1099-NEC. During the year, Maria paid the following bukiness-related expenses: $400 of the meals were purchased and consumed with clients in restaurants and the remainder were pre-packaged meals she purchased and consumed with clients at their offices. Maria drove 324 miles to and from her clients' offices. Maria started her bookkeeping service in 2016, and she uses the cash method of accounting. She is the only person performing services in the business, and she did not make any payments that would have required her to file a Form 1099. Carlos and Maria paid $10,000 for health insurance for the family. On January 3, 2021, the Gomezes sold their prior principal residence located at 45 East Entrada Trail, Lubbock, TX 79401. They purchased that resident in 2011 and lived there full-time until its sale. They originally purchased the home for $310,000. The Gomez family never claimed any tax depreciation on the home, nor were they allowed to do so. The sales price of the home was $495,000. They paid a real estate commission of $29,700. Title insurance and their share of closing costs totaled $4,300. Carlos and Maria purchased (and moved into) their current residence at 543 West La Patera, Lubbock, TX 79401 on January 29,2021 . Their new residence is 3,600 square feet, and it was purchased for $500,000($470,000 was allocated to the home itself and $30,000 to the lot on which it sits). The purchase-money mortgage, secured by the residence, was in the original principal amount of $300,000. Maria uses a 2020 room exclusively for her office. Expenses relating to the West La Patera home were as follows: Additional unreimbursed expenses paid during the year were: Carlos' W-2, Maria's Form 1099-NEC and other documents received from third parties are provided to you. With respect to that information, both the Grand Junction City bond and the Lubbock ISD bond were issued in 2013. The royalties paid by Rio Bravo were attributable to extracted oil and gas. The Gomezes did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year. As Texas residents, the Gomezes had no state income tax liability. They paid these federal estimated taxes on the dates indicated: If the Gomezes overpaid their income taxes, they would like as much as $3,000 applied to their 2022 estimated tax and any remainder directly deposited to their checking account at First Bank of Texas (routing no.111908060, account no. 0034567). For the purpose of this project, you may ignore alternative minimum tax. Note that this is a 2021 return subject to the applicable tax law and rate schedules. The forms and schedules required to prepare the Gomezes' return may be obtained on the IRS website (www irs.sow), and learning to navigate that webwite is one of the goals of this project. This Practice Set is worth 20% of your course grade, and it will be scored based on your effort and the accuracy and completeness of the forms and schedules required and prepared. You may work with your classmates-in fact, this is highly encouraged-however, you must turn in your own, individually prepared, return. The due date for this project is Tuesday. November 22 , and it should be "filed" in class on that date. Foen 1008 ari.1-2017 Pleep the rou iteistive) ] COARECIED (E' checiked) CORPECTED (t checked) COPRECTED (E checked) CORRECTED (if checked) CORRECTED (if checked) Q CORRECTED (ff checked) COAAECTED (f checked) Fon CHG wage and Tax Statement Copy B-Te Be Faed with Erepoper's FeDERM. Tax Reters. This information it being farmhed to the intervid Fevenue Service: Q CORRECTED (ff checked) COAAECTED (f checked) Fon CHG wage and Tax Statement Copy B-Te Be Faed with Erepoper's FeDERM. Tax Reters. This information it being farmhed to the intervid Fevenue Service: COHRECTED (f checked) CORRECTED (if checked) COARECIED at checked? PRACTICE SET ACCT 324 - Fall 2022 2021 Individual Income Tax Return Please complete the 2021 federal income tax return for Carlos and Maria Gomez. Ignore the requirement to attach the forma(s) W-2 to the front page of Form 1040. If any required information is missing, use reasonable assumptions to provide it. Carlos and Maria live in Lubbock, Texas. They have two children: Luis (age 14) and Amanda (age 12). Both children lived with their parents during 2021, who provided all of their support. The Gomezes provided the following information: Their current mailing address is 543 West La Patera, Lubbock. TX 79401 Luis' social security number is 589-24-8432 Amanda's social security number is 599-74-8733 Carlos is a civil engineer. Maria is self-employed as a part-time bookkeeper. Carlos received a W-2 from his employer WTE. Maria received a Form 1099-NEC for her bookkeeping services performed for her largest client, Dixon Healthcare. Maria received an additional $4,000 from clients who were not required to issue a Form 1099-NEC. During the year, Maria paid the following bukiness-related expenses: $400 of the meals were purchased and consumed with clients in restaurants and the remainder were pre-packaged meals she purchased and consumed with clients at their offices. Maria drove 324 miles to and from her clients' offices. Maria started her bookkeeping service in 2016, and she uses the cash method of accounting. She is the only person performing services in the business, and she did not make any payments that would have required her to file a Form 1099. Carlos and Maria paid $10,000 for health insurance for the family. On January 3, 2021, the Gomezes sold their prior principal residence located at 45 East Entrada Trail, Lubbock, TX 79401. They purchased that resident in 2011 and lived there full-time until its sale. They originally purchased the home for $310,000. The Gomez family never claimed any tax depreciation on the home, nor were they allowed to do so. The sales price of the home was $495,000. They paid a real estate commission of $29,700. Title insurance and their share of closing costs totaled $4,300. Carlos and Maria purchased (and moved into) their current residence at 543 West La Patera, Lubbock, TX 79401 on January 29,2021 . Their new residence is 3,600 square feet, and it was purchased for $500,000($470,000 was allocated to the home itself and $30,000 to the lot on which it sits). The purchase-money mortgage, secured by the residence, was in the original principal amount of $300,000. Maria uses a 2020 room exclusively for her office. Expenses relating to the West La Patera home were as follows: Additional unreimbursed expenses paid during the year were: Carlos' W-2, Maria's Form 1099-NEC and other documents received from third parties are provided to you. With respect to that information, both the Grand Junction City bond and the Lubbock ISD bond were issued in 2013. The royalties paid by Rio Bravo were attributable to extracted oil and gas. The Gomezes did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year. As Texas residents, the Gomezes had no state income tax liability. They paid these federal estimated taxes on the dates indicated: If the Gomezes overpaid their income taxes, they would like as much as $3,000 applied to their 2022 estimated tax and any remainder directly deposited to their checking account at First Bank of Texas (routing no.111908060, account no. 0034567). For the purpose of this project, you may ignore alternative minimum tax. Note that this is a 2021 return subject to the applicable tax law and rate schedules. The forms and schedules required to prepare the Gomezes' return may be obtained on the IRS website (www irs.sow), and learning to navigate that webwite is one of the goals of this project. This Practice Set is worth 20% of your course grade, and it will be scored based on your effort and the accuracy and completeness of the forms and schedules required and prepared. You may work with your classmates-in fact, this is highly encouraged-however, you must turn in your own, individually prepared, return. The due date for this project is Tuesday. November 22 , and it should be "filed" in class on that date. Foen 1008 ari.1-2017 Pleep the rou iteistive) ] COARECIED (E' checiked) CORPECTED (t checked) COPRECTED (E checked) CORRECTED (if checked) CORRECTED (if checked) Q CORRECTED (ff checked) COAAECTED (f checked) Fon CHG wage and Tax Statement Copy B-Te Be Faed with Erepoper's FeDERM. Tax Reters. This information it being farmhed to the intervid Fevenue Service: Q CORRECTED (ff checked) COAAECTED (f checked) Fon CHG wage and Tax Statement Copy B-Te Be Faed with Erepoper's FeDERM. Tax Reters. This information it being farmhed to the intervid Fevenue Service: COHRECTED (f checked) CORRECTED (if checked) COARECIED at checked

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts