Question: This capital budgeting problem is a bit more difficult to evaluate than it would seem because we have two projects with differing limelines . Here

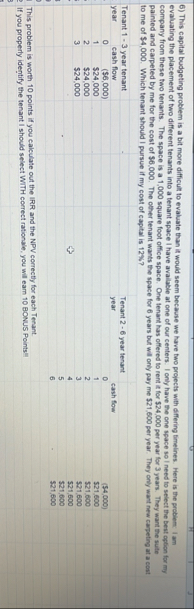

This capital budgeting problem is a bit more difficult to evaluate than it would seem because we have two projects with differing limelines Here is the probiem. I am evaluating the placement of two different tenants into a tenant space I have avalable at one of our centers. I only have the one space so I need to select the best ogtion for my company from these two tenants. The space is a square foot office space. One tenant has offered to rent it for $ per year for years. They want the suite painted and carpeted by me for the cost of $ The other tenant wants the space for years but wit only pay me $ per year They onty wart new carpeting at a cont to me of $ Which tenant should I pursue if my cost of capital is

This problem is worth points if you calculate out the IRR and the NPV correctly for each Tenant. If you properly identify the tenant I should select WITH correct rationale, you will earn BONUS Points"

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock