Question: This Case study is about Blades Inc, and hypothetically you are the chief financial Analyst of this company and required to report to the CFO

This Case study is about "Blades Inc", and hypothetically you are the chief financial Analyst of this company and required to report to the CFO of the company, Ben Holt about the effect of fluctuations of Thai Bath (THB) on the company's transactions with Thailand.

Blades, Inc is the producer of "Speedos" and the company's main export of Speedos is to Thailand. Blades' primary customer in Thailand, a retailer called Entertainment Products, has committed itself to purchase a fixed number of Speedos annually for the next three (3) years at a fixed price denominated in THB. Also, Blades is using a Thai supplier for some of the components needed to manufacture Speedos.

However, as a result of the recent weak economy in Thailand, Ben Holt is worried that the worsening economy of Thailand could affect the value of the THB and consequently the export of Speedos to Thailand, even though its primary Thai customer is committed to Blades over the next three (3) years.

The CFO, Ben Holt, has asked you, the Blades' financial analyst, to provide him with detailed illustrations of how he can anticipate Blade's profit under the following two potential possibilities:

- Assuming THB might depreciate from $0.022 to $0.020 within the next 30 days.

- Assuming THB might appreciate from $0.022 to $0.025 within the next 30 days.

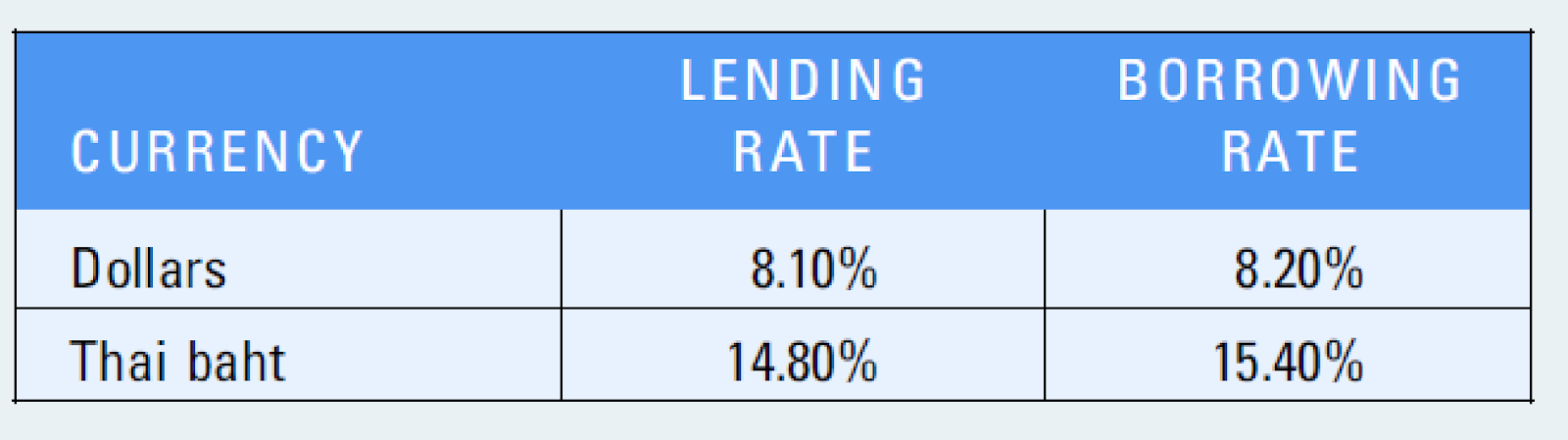

Show the speculative profit (in dollars) resulting from each scenario with complete formulas. Use both possibilities to illustrate speculation outcomes. Assume that Blades can borrow either $10 million or the baht equivalent of this amount. Furthermore, assume that the following short-term interest rates (annualized) are available to Blades in Table 1:

LENDING BORROWING CURRENCY RATE RATE Dollars 8.10% 8.20% Thai baht 14.80% 15.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts