Question: This case study is based on fictitious businesses. It is not intended to be interpreted as an accurate description of real events. Zybeth plc Zybeth

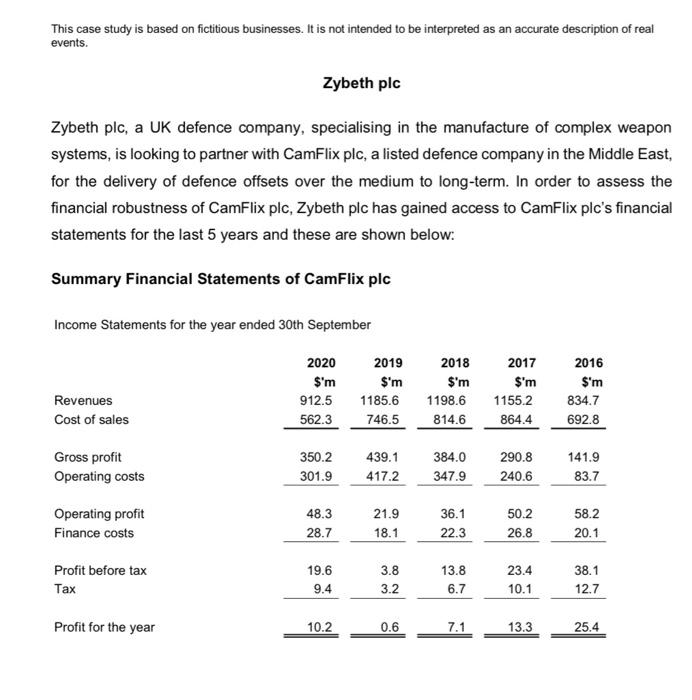

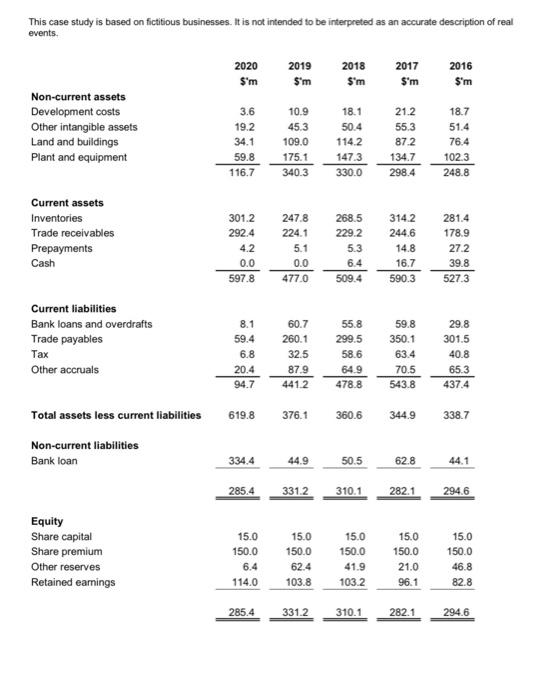

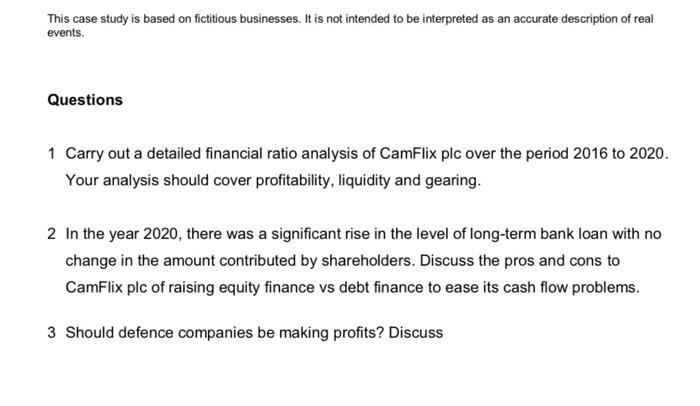

This case study is based on fictitious businesses. It is not intended to be interpreted as an accurate description of real events. Zybeth plc Zybeth plc, a UK defence company, specialising in the manufacture of complex weapor systems, is looking to partner with CamFlix plc, a listed defence company in the Middle East for the delivery of defence offsets over the medium to long-term. In order to assess the financial robustness of CamFlix plc, Zybeth plc has gained access to CamFlix plc's financia statements for the last 5 years and these are shown below: Summary Financial Statements of CamFlix plc Income Statements for the year ended 30 th September This case study is based on fictitious businesses. It is not intended to be interpreted as an accurate description of real events. Equity This case study is based on fictitious businesses. It is not intended to be interpreted as an accurate description of real events. Questions 1 Carry out a detailed financial ratio analysis of CamFlix plc over the period 2016 to 2020. Your analysis should cover profitability, liquidity and gearing. 2 In the year 2020 , there was a significant rise in the level of long-term bank loan with no change in the amount contributed by shareholders. Discuss the pros and cons to CamFlix plc of raising equity finance vs debt finance to ease its cash flow problems. 3 Should defence companies be making profits? Discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts