Question: This chapter demonstrated that the requirement that new projects be accretive to firm EPS sometimes results in accepting negative-NPV projects and rejecting positive-NPV projects. However,

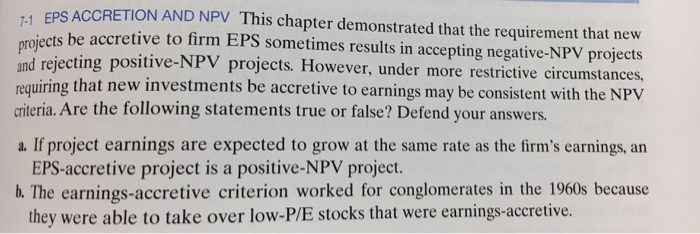

This chapter demonstrated that the requirement that new projects be accretive to firm EPS sometimes results in accepting negative-NPV projects and rejecting positive-NPV projects. However, under more restrictive circumstances, requiring that new investments be accretive to earnings may by consistent with the NPV criteria. Are the following statements true or false? Defend your answers. a. If project earnings are expected to grow at the same rate as the firm's earnings, an EPS-accretive project is a positive-NPV project. b. The earnings-accretive criterion worked for conglomerates in the 1960s because they were able to take over low-P/E stocks that were earnings-accretive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts