Question: This company is considering distributing its $150 in cash either in the form of a dividend or by buying back (and retiring) its stock. If

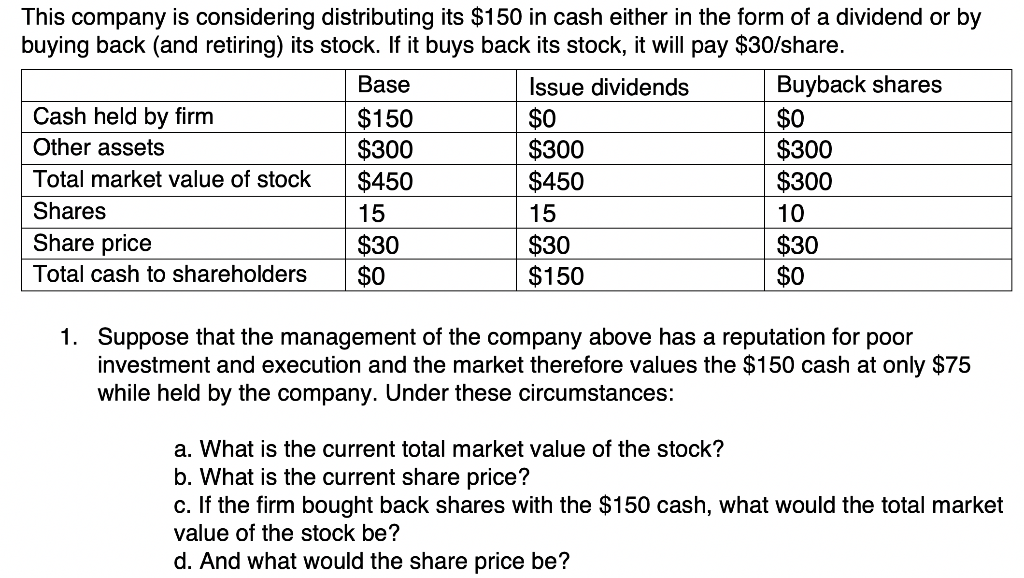

This company is considering distributing its $150 in cash either in the form of a dividend or by buying back (and retiring) its stock. If it buys back its stock, it will pay $30/share.

|

| Base | Issue dividends | Buyback shares |

| Cash held by firm | $150 | $0 | $0 |

| Other assets | $300 | $300 | $300 |

| Total market value of stock | $450 | $450 | $300 |

| Shares | 15 | 15 | 10 |

| Share price | $30 | $30 | $30 |

| Total cash to shareholders | $0 | $150 | $0 |

- Suppose that the management of the company above has a reputation for poor investment and execution and the market therefore values the $150 cash at only $75 while held by the company. Under these circumstances:

a. What is the current total market value of the stock?

b. What is the current share price?

c. If the firm bought back shares with the $150 cash, what would the total market value of the stock be?

d. And what would the share price be?

$0 $0 This company is considering distributing its $150 in cash either in the form of a dividend or by buying back (and retiring) its stock. If it buys back its stock, it will pay $30/share. Base Issue dividends Buyback shares Cash held by firm $150 Other assets $300 $300 $300 | Total market value of stock $450 $450 $300 Shares 15 15 10 Share price $30 $30 Total cash to shareholders $150 $0 $30 $0 1. Suppose that the management of the company above has a reputation for poor investment and execution and the market therefore values the $150 cash at only $75 while held by the company. Under these circumstances: a. What is the current total market value of the stock? b. What is the current share price? c. If the firm bought back shares with the $150 cash, what would the total market value of the stock be? d. And what would the share price be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts