Question: This course - Topic 1 - Question 14 Not yet answered In 1998 Fischer Corp issued bonds with an 8 percent coupon rate and a

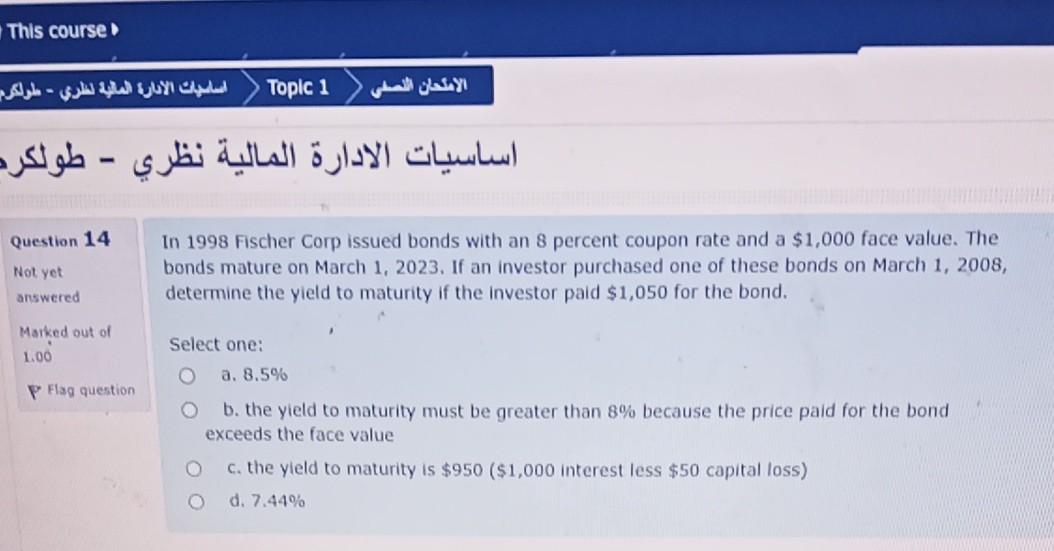

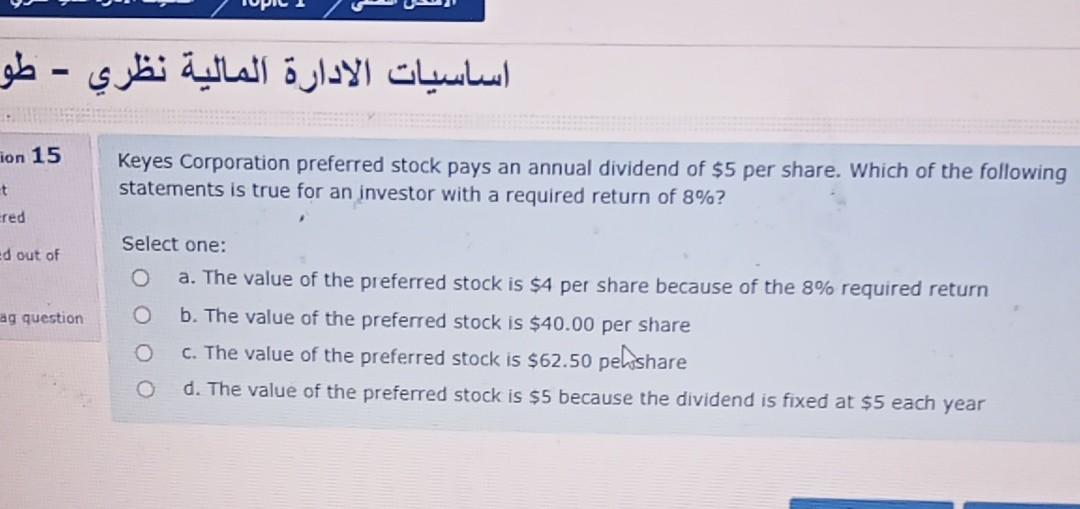

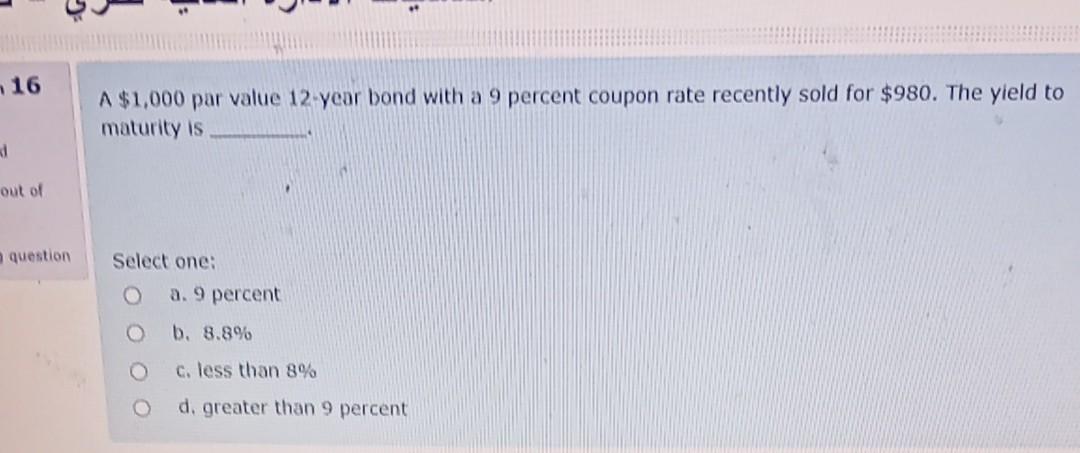

This course - Topic 1 - Question 14 Not yet answered In 1998 Fischer Corp issued bonds with an 8 percent coupon rate and a $1,000 face value. The bonds mature on March 1, 2023. If an investor purchased one of these bonds on March 1, 2008, determine the yield to maturity if the investor paid $1,050 for the bond. Marked out of 1.00 Select one: a. 8.5% P Flag question b. the yield to maturity must be greater than 8% because the price paid for the bond exceeds the face value c. the yield to maturity is $950 ($1,000 interest less $50 capital loss) d. 7.44% - ion 15 Keyes Corporation preferred stock pays an annual dividend of $5 per share. Which of the following statements is true for an investor with a required return of 8%? t -red ed out of ag question Select one: o a. The value of the preferred stock is $4 per share because of the 8% required return O b. The value of the preferred stock is $40.00 per share O C. The value of the preferred stock is $62.50 pehshare d. The value of the preferred stock is $5 because the dividend is fixed at $5 each year 16 A $1,000 par value 12 year bond with a 9 percent coupon rate recently sold for $980. The yield to maturity is 1 out of question Select one: a. 9 percent b. 8.8% c. less than 8% d greater than 9 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts