Question: This discussion involves students performing ratio analysis to measure the market's (public's) expectations of both company return and risk. This involves demonstrating knowledge from Chapter

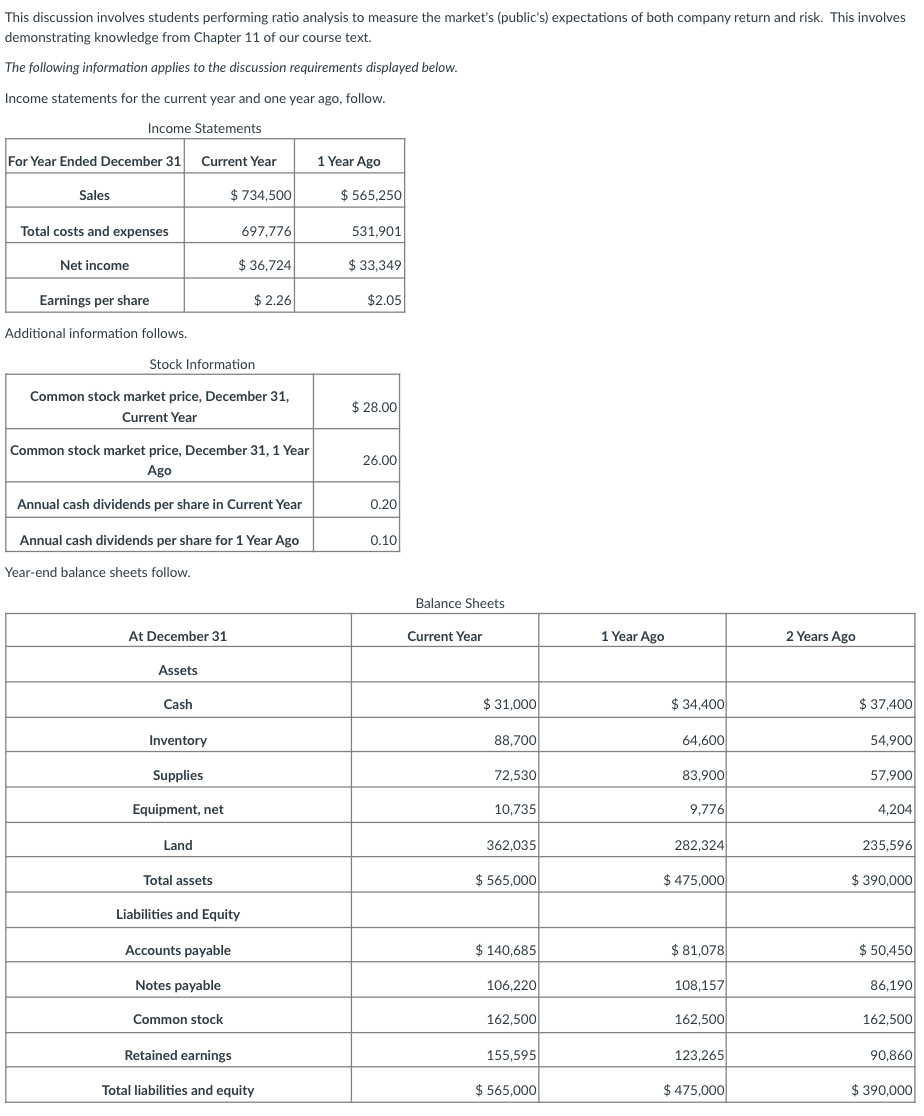

This discussion involves students performing ratio analysis to measure the market's (public's) expectations of both company return and risk. This involves demonstrating knowledge from Chapter 11 of our course text. The following information applies to the discussion requirements displayed below. Income statements for the current year and one year ago, follow. Additional information follows. Year-end balance sheets follow. Post a reply to this discussion including all requirements below. For any ratio calculations, show your calculation; for example, 6,517/(156+187)=38.0 times. Round all final answers to two decimal points (e.g., 78.27 or 9.12%). This information should be included in one post reply; only your first post reply will be graded (i.e., you cannot edit your initial post or add to it later). 1. Price-earnings ratio: Calculate price-earnings ratio for Current Year and 1 Year Ago. Assuming a competitor has a price-earnings ratio of 7 , does the company have higher or lower expectations for further growth versus the competitor? 2. Dividend yield: Calculate dividend yield for Current Year and 1 Year Ago. Indicate if the company's stock would be considered a growth stock or income stock. 3. Reflection: Review the ratio results and express what they collectively suggest about the market's (public's) expectations for the company. This discussion involves students performing ratio analysis to measure the market's (public's) expectations of both company return and risk. This involves demonstrating knowledge from Chapter 11 of our course text. The following information applies to the discussion requirements displayed below. Income statements for the current year and one year ago, follow. Additional information follows. Year-end balance sheets follow. Post a reply to this discussion including all requirements below. For any ratio calculations, show your calculation; for example, 6,517/(156+187)=38.0 times. Round all final answers to two decimal points (e.g., 78.27 or 9.12%). This information should be included in one post reply; only your first post reply will be graded (i.e., you cannot edit your initial post or add to it later). 1. Price-earnings ratio: Calculate price-earnings ratio for Current Year and 1 Year Ago. Assuming a competitor has a price-earnings ratio of 7 , does the company have higher or lower expectations for further growth versus the competitor? 2. Dividend yield: Calculate dividend yield for Current Year and 1 Year Ago. Indicate if the company's stock would be considered a growth stock or income stock. 3. Reflection: Review the ratio results and express what they collectively suggest about the market's (public's) expectations for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts