Question: This Excel exercise is designed to find the present value of future cash flows. Assume there are two projects X & Y with cash flows

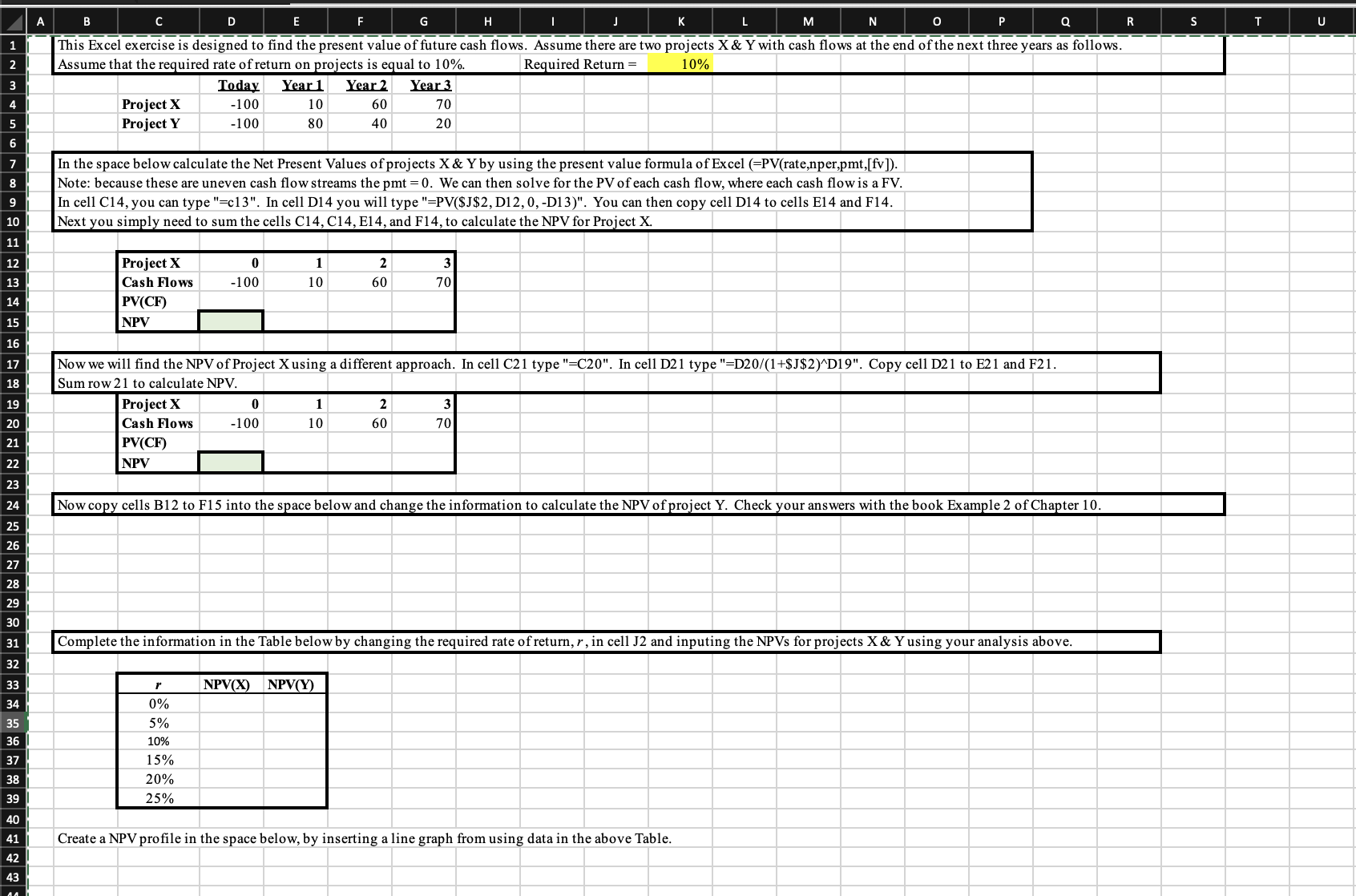

This Excel exercise is designed to find the present value of future cash flows. Assume there are two projects X & Y with cash flows at the end of the next three years as follows.

Assume that the required rate of return on projects is equal to Required Return

Today Year Year Year

Project X

Project Y

In the space below calculate the Net Present Values of projects X & Y by using the present value formula of Excel PVratenper,pmtfv

Note: because these are uneven cash flow streams the pmt We can then solve for the PV of each cash flow, where each cash flow is a FV

In cell C you can type c In cell D you will type PV$J$ DD You can then copy cell D to cells E and F

Next you simply need to sum the cells C C E and F to calculate the NPV for Project X

Project X

Cash Flows

PVCF

NPV

Now we will find the NPV of Project X using a different approach. In cell C type C In cell D type D$J$D Copy cell D to E and F

Sum row to calculate NPV

Project X

Cash Flows

PVCF

NPV

Now copy cells B to F into the space below and change the information to calculate the NPV of project Y Check your answers with the book Example of Chapter

Complete the information in the Table below by changing the required rate of return, r in cell J and inputing the NPVs for projects X & Y using your analysis above.

r NPVX NPVY

Create a NPV profile in the space below, by inserting a line graph from using data in the above Table.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock