Question: This exercise should help you to understand the formulas (and the intuition behind them) I discussed in class. Suppose that the 1-year interest rate is

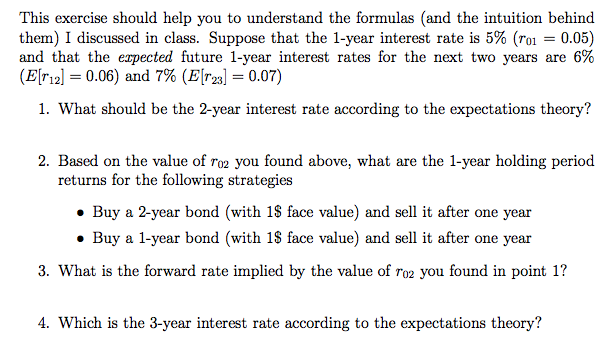

This exercise should help you to understand the formulas (and the intuition behind them) I discussed in class. Suppose that the 1-year interest rate is 5% (r01 0.05) and that the expected future 1-year interest rates for the next two years are 6% (Erial 0.06) and 7% (E[r23] 0.07) 1. What should be the 2-year interest rate according to the expectations theory? 2. Based on the value of ro2 you found above, what are the 1-year holding period returns for the following strategies . Buy a 2-year bond (with 1S face value) and sell it after one year Buy a 1-year bond (with 1S face value) and sell it after one year 3. What is the forward rate implied by the value of ro2 you found in point 1? 4. Which is the 3-year interest rate according to the expectations theory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts