Question: This exercise stresses the relationships between the information recorded in a periodic inventory system and the basic elements of an income statement. Each of the

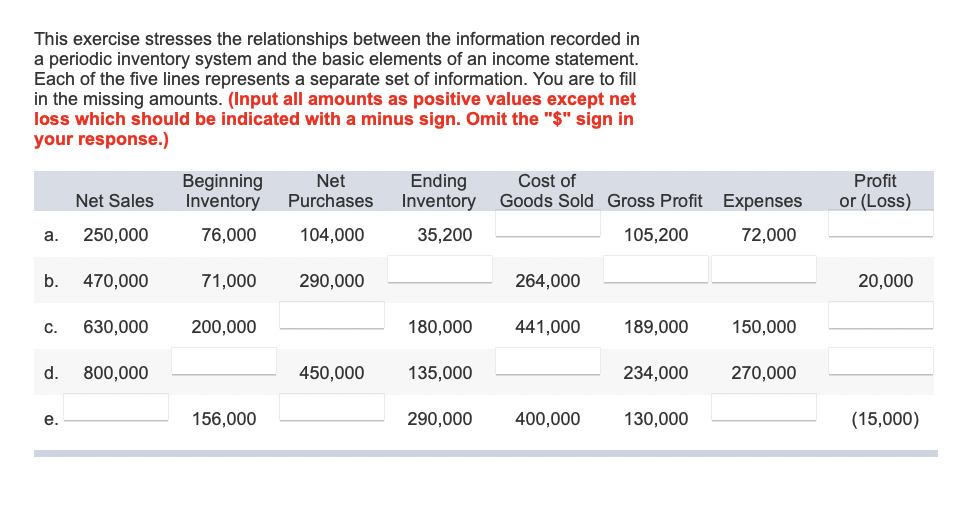

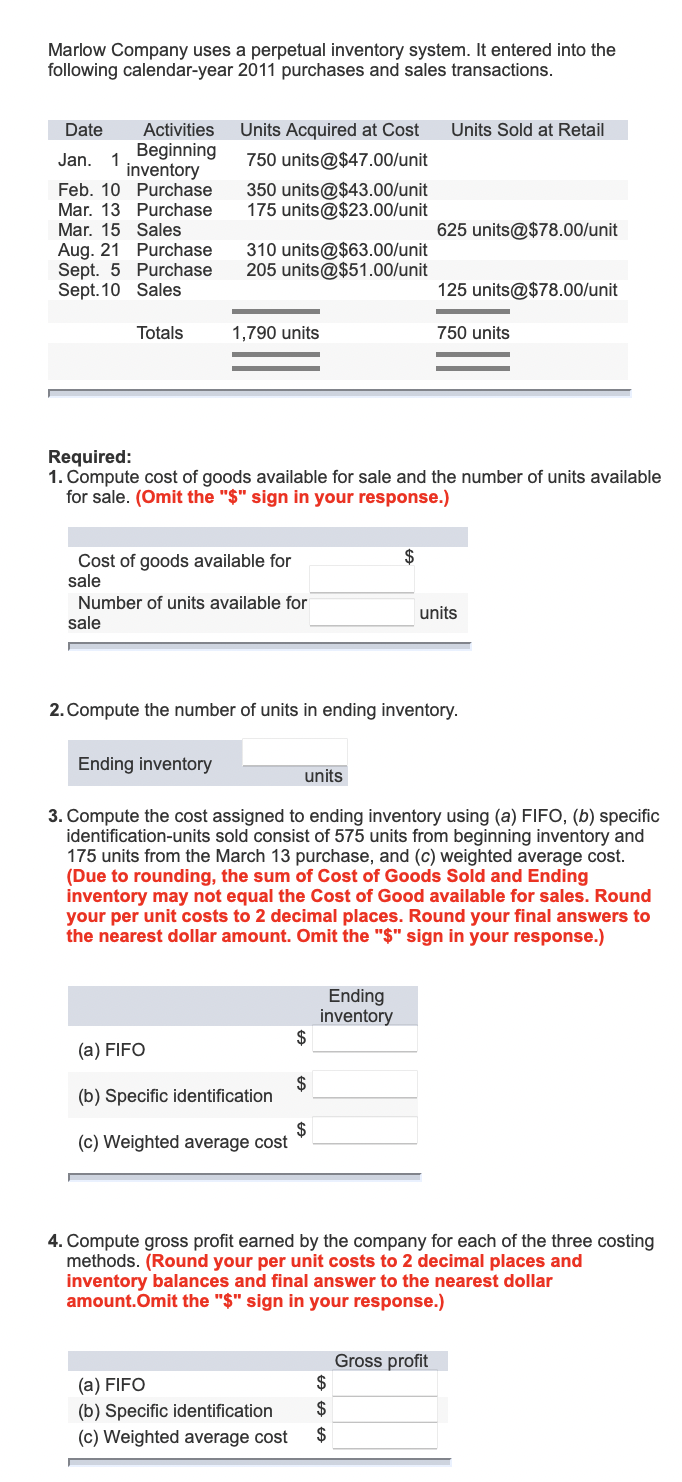

This exercise stresses the relationships between the information recorded in a periodic inventory system and the basic elements of an income statement. Each of the five lines represents a separate set of information. You are to fill in the missing amounts. (Input all amounts as positive values except net loss which should be indicated with a minus sign. Omit the "$" sign in your response.) Beginning Inventory Net Purchases Ending Inventory 35,200 Net Sales Cost of Goods Sold Gross Profit Expenses Profit or (Loss) a. 250,000 76,000 104,000 105,200 72,000 b. 470,000 71,000 290,000 264,000 20,000 c. 630,000 200,000 180,000 441,000 189,000 150,000 d. 800,000 450,000 135,000 234,000 270,000 e. 156,000 290,000 400,000 130,000 (15,000) Marlow Company uses a perpetual inventory system. It entered into the following calendar-year 2011 purchases and sales transactions. Date Activities Jan. 1 Beginning inventory Feb. 10 Purchase Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Units Acquired at Cost Units Sold at Retail 750 units@$47.00/unit 350 units @$43.00/unit 175 units @ $23.00/unit 625 units @ $78.00/unit 310 units @$63.00/unit 205 units @$51.00/unit 125 units@ $78.00/unit Totals 1,790 units 750 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. (Omit the "$" sign in your response.) $ Cost of goods available for sale Number of units available for sale units 2. Compute the number of units in ending inventory. Ending inventory units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) specific identification-units sold consist of 575 units from beginning inventory and 175 units from the March 13 purchase, and (c) weighted average cost. (Due to rounding, the sum of Cost of Goods Sold and Ending inventory may not equal the Cost of Good available for sales. Round your per unit costs to 2 decimal places. Round your final answers to the nearest dollar amount. Omit the "$" sign in your response.) Ending inventory $ (a) FIFO $ (b) Specific identification $ (c) Weighted average cost 4. Compute gross profit earned by the company for each of the three costing methods. (Round your per unit costs to 2 decimal places and inventory balances and final answer to the nearest dollar amount.Omit the "$" sign in your response.) Gross profit (a) FIFO (b) Specific identification (c) Weighted average cost $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts