Question: This exercise utilizes two balance sheets, one for the Federal Reserve and one for BHZ Bank, a representative member of the banking system. Given the

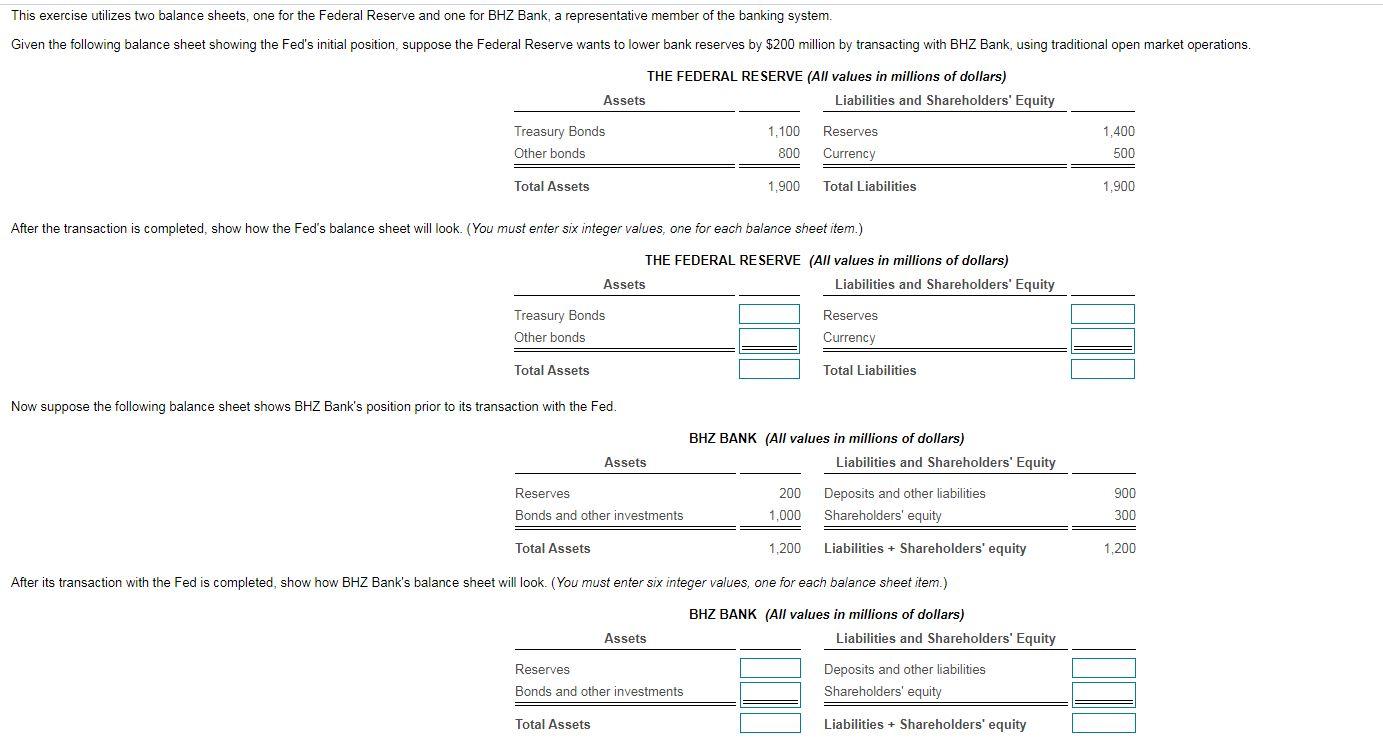

This exercise utilizes two balance sheets, one for the Federal Reserve and one for BHZ Bank, a representative member of the banking system. Given the following balance sheet showing the Fed's initial position, suppose the Federal Reserve wants to lower bank reserves by $200 million by transacting with BHZ Bank, using traditional open market operations. THE FEDERAL RESERVE (All values in millions of dollars) Assets Liabilities and Shareholders' Equity Treasury Bonds Other bonds 1,100 800 Reserves Currency 1,400 500 Total Assets 1,900 Total Liabilities 1,900 After the transaction is completed, show how the Fed's balance sheet will look. (You must enter six integer values, one for each balance sheet item.) THE FEDERAL RESERVE (All values in millions of dollars) Assets Liabilities and Shareholders' Equity Treasury Bonds Other bonds Reserves Currency Total Assets Total Liabilities Now suppose the following balance sheet shows BHZ Bank's position prior to its transaction with the Fed. BHZ BANK (All values in millions of dollars) Liabilities Shareholders' Equity Asse Reserves Bonds and other investments 200 1,000 Deposits and other liabilities Shareholders' equity 900 300 Total Assets 1,200 Liabilities + Shareholders' equity 1,200 After its transaction with the Fed is completed, show how BHZ Bank's balance sheet will look. (You must enter six integer values, one for each balance sheet item.) BHZ BANK (All values in millions of dollars) Liabilities and Shareholders' Equity Assets Reserves Bonds and other investments Deposits and other liabilities Shareholders' equity Total Assets Liabilities + Shareholders' equity This exercise utilizes two balance sheets, one for the Federal Reserve and one for BHZ Bank, a representative member of the banking system. Given the following balance sheet showing the Fed's initial position, suppose the Federal Reserve wants to lower bank reserves by $200 million by transacting with BHZ Bank, using traditional open market operations. THE FEDERAL RESERVE (All values in millions of dollars) Assets Liabilities and Shareholders' Equity Treasury Bonds Other bonds 1,100 800 Reserves Currency 1,400 500 Total Assets 1,900 Total Liabilities 1,900 After the transaction is completed, show how the Fed's balance sheet will look. (You must enter six integer values, one for each balance sheet item.) THE FEDERAL RESERVE (All values in millions of dollars) Assets Liabilities and Shareholders' Equity Treasury Bonds Other bonds Reserves Currency Total Assets Total Liabilities Now suppose the following balance sheet shows BHZ Bank's position prior to its transaction with the Fed. BHZ BANK (All values in millions of dollars) Liabilities Shareholders' Equity Asse Reserves Bonds and other investments 200 1,000 Deposits and other liabilities Shareholders' equity 900 300 Total Assets 1,200 Liabilities + Shareholders' equity 1,200 After its transaction with the Fed is completed, show how BHZ Bank's balance sheet will look. (You must enter six integer values, one for each balance sheet item.) BHZ BANK (All values in millions of dollars) Liabilities and Shareholders' Equity Assets Reserves Bonds and other investments Deposits and other liabilities Shareholders' equity Total Assets Liabilities + Shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts