Question: This exercise will explore the relationship between risk and reward for a stock and a call option written on the same stock. We are in

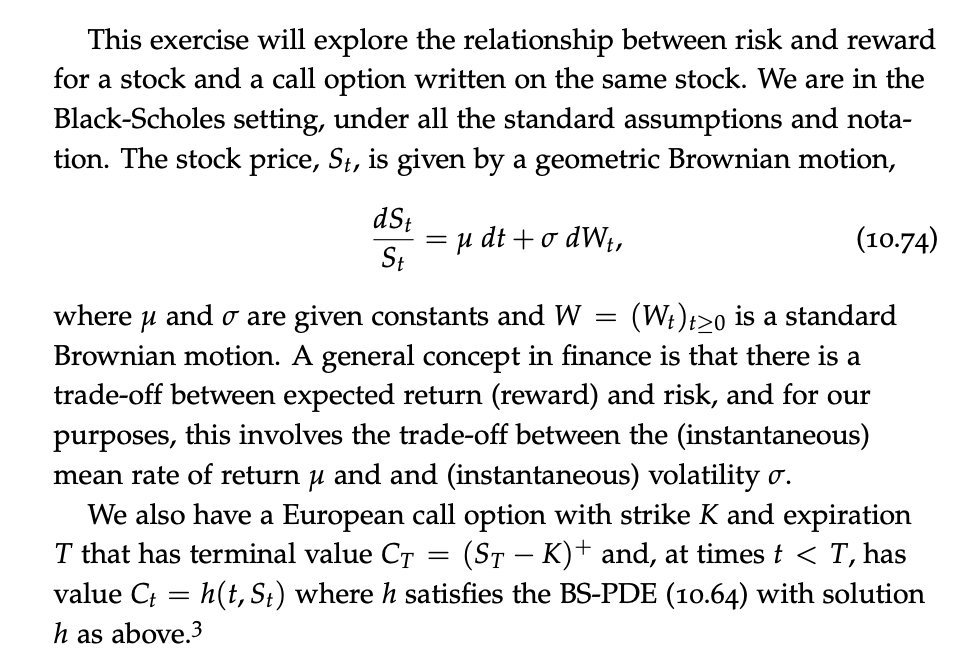

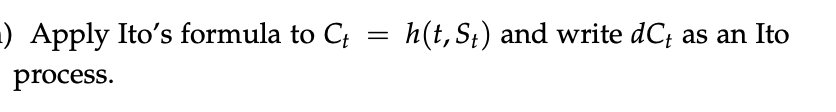

This exercise will explore the relationship between risk and reward for a stock and a call option written on the same stock. We are in the Black-Scholes setting, under all the standard assumptions and nota- tion. The stock price, St, is given by a geometric Brownian motion, dSt St = Eu dt to dW7, (10.74) where u and o are given constants and W = (W+)7>0 is a standard Brownian motion. A general concept in finance is that there is a trade-off between expected return (reward) and risk, and for our purposes, this involves the trade-off between the (instantaneous) mean rate of return u and and (instantaneous) volatility o. We also have a European call option with strike K and expiration T that has terminal value CT (ST K)+ and, at times t 0 is a standard Brownian motion. A general concept in finance is that there is a trade-off between expected return (reward) and risk, and for our purposes, this involves the trade-off between the (instantaneous) mean rate of return u and and (instantaneous) volatility o. We also have a European call option with strike K and expiration T that has terminal value CT (ST K)+ and, at times t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts