Question: This exercise will help you better understand consumer income as it relates to gross income, disposable income, and discretionary income. Consumer spending accounts for two-thirds

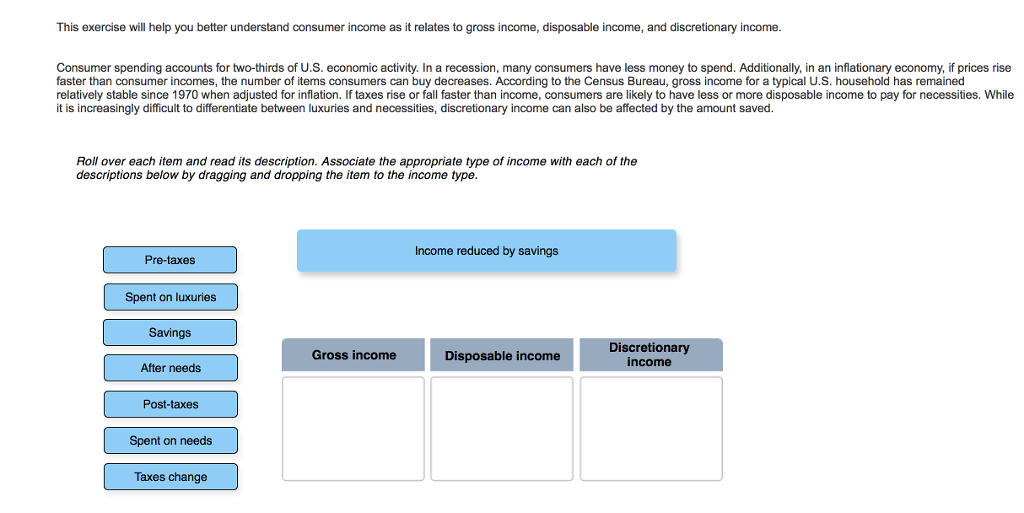

This exercise will help you better understand consumer income as it relates to gross income, disposable income, and discretionary income. Consumer spending accounts for two-thirds of U.S. economic activity. In a recession, many consumers have less money to spend. Additionally, in an inflationary economy, if prices rise faster than consumer incomes, the number of items consumers can buy decreases. According to the Census Bureau, gross income for a typical U.S. household has remained relatively stable since 1970 when adjusted for inflation. If taxes rise or fall faster than income, consumers are likely to have less or more disposable income to pay for necessities. While it is increasingly difficult to differentiate between luxuries and necessities, discretionary income can also be affected by the amount saved. Roll over each item and read its description. Associate the appropriate type of income with each of the descriptions below by dragging and dropping the item to the income type

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts