Question: This firm intends to embark on projects that require an initial sinking of 30million and are expected to provide in aggregate a 20% return with

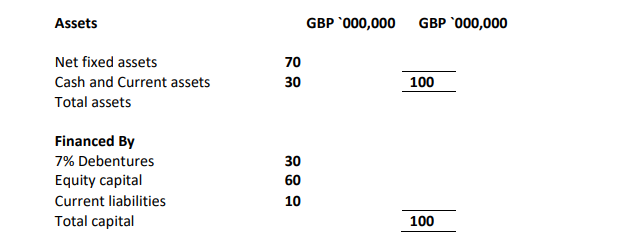

This firm intends to embark on projects that require an initial sinking of 30million and are expected to provide in aggregate a 20% return with a standard deviation of 30% over the planned investment horizon. These projects are to be financed wholly by the internally available funds and the debentures are to be redeemed at the end of the planned investment horizon. For this firm,

- Evaluate, stating your assumptions, the probability that the firm is financially better off by embarking on the intended projects; (40 marks)

- Assuming that it is only able to earn actual returns of 12% on its fixed assets and 15% on its projects, derive the projected balance sheet at the end of the planned investment horizon; (60 marks)

Assets GBP '000,000 GBP '000,000 Net fixed assets Cash and Current assets Total assets 70 30 100 Financed By 7% Debentures Equity capital Current liabilities Total capital 30 60 10 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts