Question: this has 5 parts Required information Problem 9-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.]

![displayed below.] On October 29 , Lobo Company began operations by purchasing](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7b80a1e703_53766f7b809ac0a1.jpg)

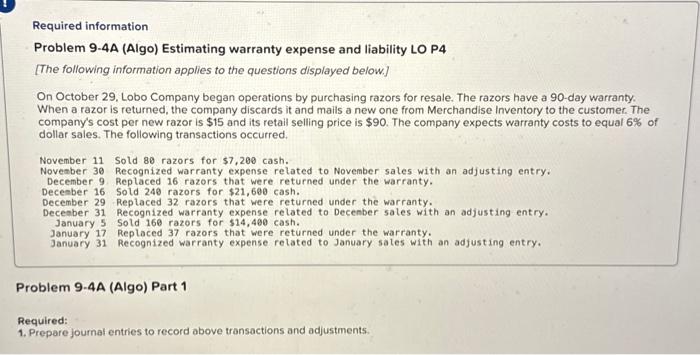

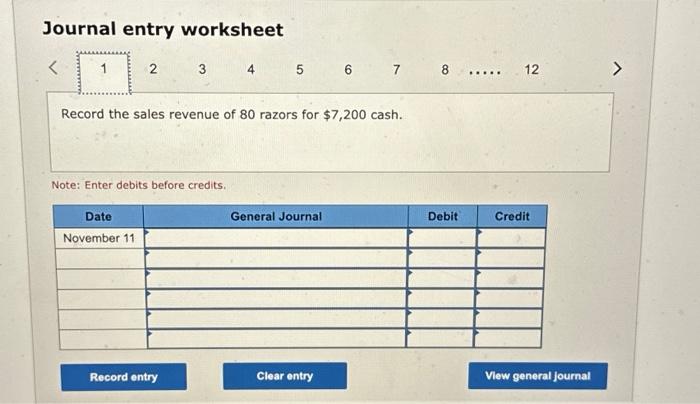

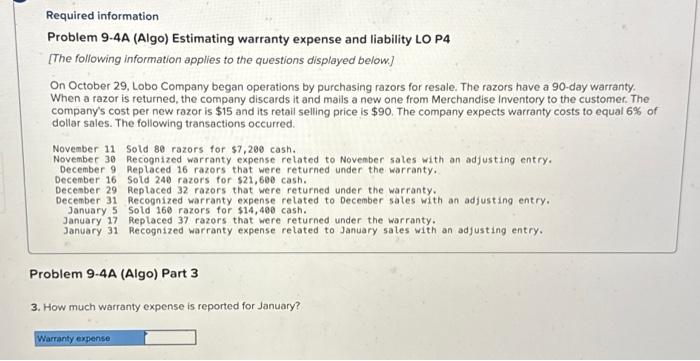

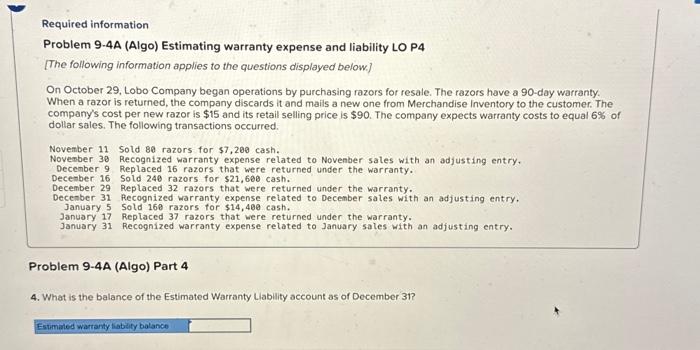

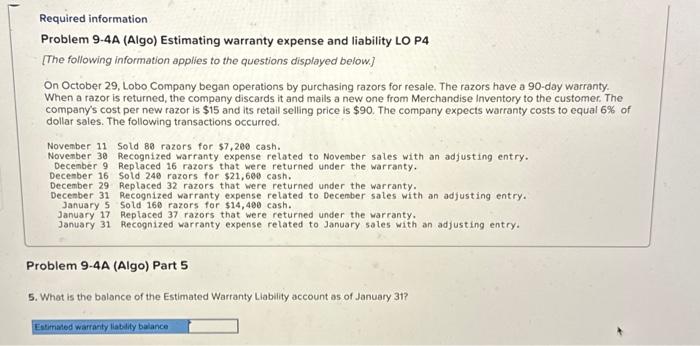

Required information Problem 9-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.] On October 29 , Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 6% of dollar sales. The following transactions occurred. November 11 Sold 80 razors for $7,200 cash. Novenber 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 16 razors that were returned under the warranty. Decenber 16 Sold 240 razors for $21,600 cash. December 29 Replaced 32 razors that were returned under the warranty. Deceaber 31 Recognized warranty expense related to Decenber sales with an adjusting entry. January 5 Sold 160 razors for $14,490 cash. January 17 Replaced 37 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 9-4A (Algo) Part 1 Required: Required: 1. Prepare journal entries to record above tronsactions and adjustments. Required information Problem 9.4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 6% of dollar sales. The following transactions occurred. November 11 Sold 80 razors for $7,200 cash. Novenber 39 Recognized warranty expense related to Novenber sales with an adjusting entry. Decenber 9 Replaced 16 razors that were returned under the warranty. Decenber 16 Sold 240 razors for $21,600 cash. December 29 Replaced 32 razors that were returned under the warranty. Decenber 31 Recognized warranty expense related to Decenber sales with an adjusting entry. January 5 Sold 160 razors for $14,400 cash. January 17 . Aeplaced 37 razors that were returned under the warranty. Problem 9-4A (Algo) Part 2 2. How much warranty expense is reported for November and for December? Required information Problem 9-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.] On October 29 , Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 6% of dollar sales. The following transactions occurred. Novenber 11 Sold 88 razors for $7,200 cash. Novenber 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 16 razors that were returned under the warranty. December 16 Sold 240 razors for $21,600 cash. Decenber 29 Replaced 32 razors that were returned under the warranty. Decenber 31 Recognized warranty expense related to Decenber sales with an adjusting entry. January 5 sold 160 razors for $14,490 cash. January 17 Replaced 37 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 9-4A (Algo) Part 5 5. What is the balance of the Estimated Warranty Llability account as of January 31 ? Problem 9-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 6% of dollar sales. The following transactions occurred. November 11 Sold 80 razors for $7,200 cash. November 30 Recognized warranty expense related to Novenber sales with an adjusting entry. December 9 Replaced 16 razors that were returned under the warranty. December 16 Sold 240 razors for $21,600 cash. Decenber 29 Replaced 32 razors that were returned under the warranty. December 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 Sold 160 razors for $14,400 cash. January 17 Replaced 37 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 9-4A (Algo) Part 3 3. How much warranty expense is reported for January? Required information Problem 9-4A (Algo) Estimating warranty expense and liability LO P4 [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 6% of dollar sales. The following transactions occurred. November 11 Sold 80 razors for $7,200 cash. Novesber 30 Recognized warranty expense related to Novenber sales with an adjusting entry. December 9 Replaced 16 razors that were returned under the warranty. Decenber 16 Sold 240 razors for $21,608 cash. December 29 Replaced 32 razors that were returned under the warranty. Decenber 31 Recognized warranty expense related to December sales with an adjusting entry. January 5 sotd 168 razors for $14,400 cash. January 17 Replaced 37 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry. Problem 9-4A (Algo) Part 4 4. What is the balance of the Estimated Warranty Llability account as of December 31 ? Journal entry worksheet Record the sales revenue of 80 razors for $7,200 cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts