Question: this in my task sheet of my assignment Stage 2 General Mathematics Assessment Type 2: Mathematical Investigation Topic 4: Financial Models Paying a Mortgage Introduction

this in my task sheet of my assignment

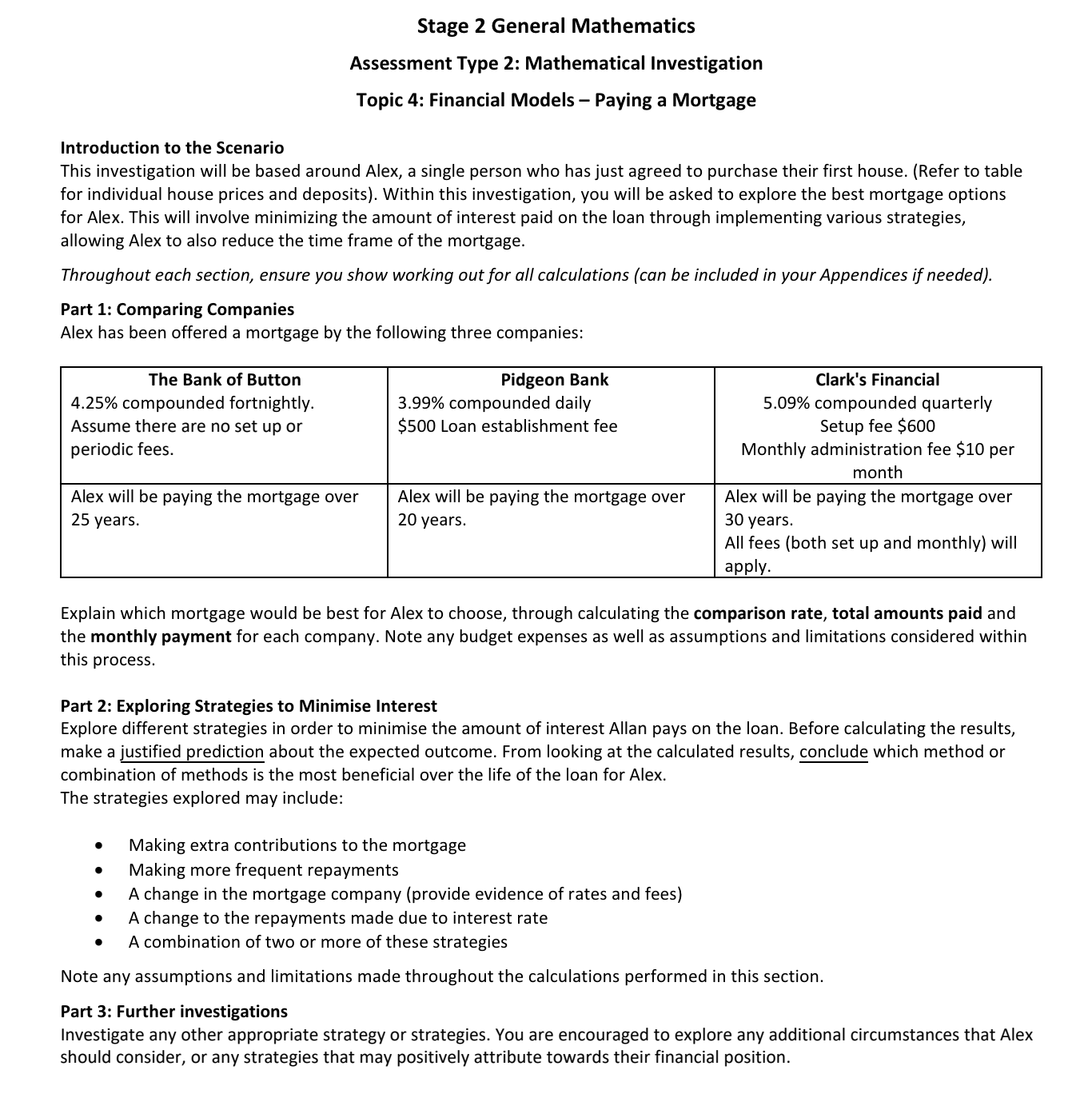

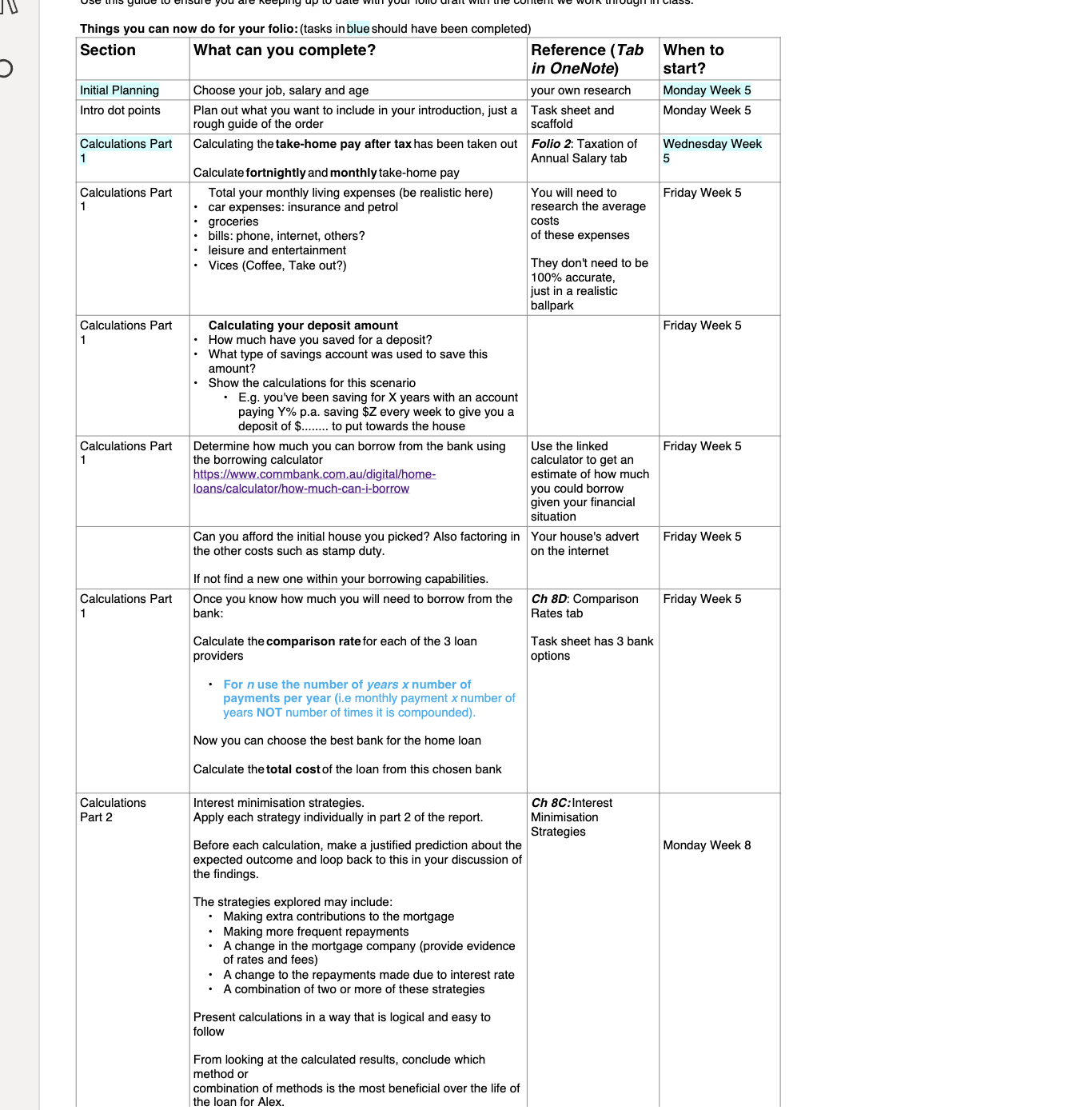

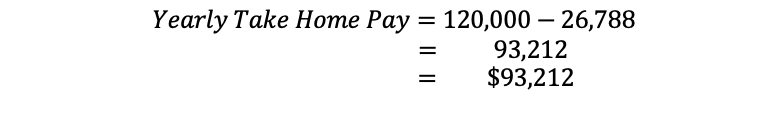

Stage 2 General Mathematics Assessment Type 2: Mathematical Investigation Topic 4: Financial Models Paying a Mortgage Introduction to the Scenario This investigation will be based around Alex, a single person who has just agreed to purchase their first house. (Refer to table for individual house prices and deposits). Within this investigation, you will be asked to explore the best mortgage options for Alex. This will involve minimizing the amount of interest paid on the loan through implementing various strategies, allowing Alex to also reduce the time frame of the mortgage. Throughout each section, ensure you show working out for all calculations (can be included in your Appendices if needed). Part 1: Comparing Companies Alex has been offered a mortgage by the following three companies: The Bank of Button Pidgeon Bank Clark's Financial 4.25% compounded fortnightly. 3.99% compounded daily 5.09% compounded quarterly Assume there are no set up or $500 Loan establishment fee Setup fee $600 periodic fees. Monthly administration fee 510 per month Alex will be paying the mortgage over Alex will be paying the mortgage over Alex will be paying the mortgage over 25 years. 20 years. 30 years. All fees (both set up and monthly) will apply. Explain which mortgage would be best for Alex to choose, through calculating the comparison rate, total amounts paid and the monthly payment for each company. Note any budget expenses as well as assumptions and limitations considered within this process. Part 2: Exploring Strategies to Minimise Interest Explore different strategies in order to minimise the amount of interest Allan pays on the loan. Before calculating the results, make a justified prediction about the expected outcome. From looking at the calculated results, conclude which method or combination of methods is the most beneficial over the life of the loan for Alex. The strategies explored may include: * Making extra contributions to the mortgage Making more frequent repayments e Achange in the mortgage company (provide evidence of rates and fees) e Achange to the repayments made due to interest rate * A combination of two or more of these strategies Note any assumptions and limitations made throughout the calculations performed in this section. Part 3: Further investigations Investigate any other appropriate strategy or strategies. You are encouraged to explore any additional circumstances that Alex should consider, or any strategies that may positively attribute towards their financial position. Things you can now do for your folio: (tasks in blue should have been completed) Section What can you complete? Reference (Tab When to in OneNote start? Initial Planning Choose your job, salary and age your own research Monday Week 5 Intro dot points Plan out what you want to include in your introduction, just a Task sheet and Monday Week 5 rough guide of the order scaffold Calculations Part Calculating the take-home pay after tax has been taken out Folio 2: Taxation of Wednesday Week Annual Salary tab Calculate fortnightly and monthly take-home pay Calculations Part Total your monthly living expenses (be realistic here) You will need to Friday Week 5 car expenses: insurance and petro research the average groceries costs bills: phone, internet, others? of these expenses . leisure and entertainment Vices (Coffee, Take out?) They don't need to be 100% accurate, just in a realistic ballpark Calculations Part Calculating your deposit amount Friday Week 5 How much have you saved for a deposit? What type of savings account was used to save this amount? Show the calculations for this scenario E.g. you've been saving for X years with an account paying Y% p.a. saving $2 every week to give you a deposit of $....... to put towards the house Calculations Part Determine how much you can borrow from the bank using Use the linked Friday Week 5 the borrowing calculator calculator to get an https://www.commbank.com.au/digital/home- estimate of how much loans/calculator/how-much-can-i-borrow you could borrow given your financial situation Can you afford the initial house you picked? Also factoring in Your house's advert Friday Week 5 the other costs such as stamp duty on the internet if not find a new one within your borrowing capabilities. Calculations Part Once you know how much you will need to borrow from the Ch 8D: Comparison Friday Week 5 bank: Rates tab Calculate the comparison rate for each of the 3 loan Task sheet has 3 bank providers options . For n use the number of years x number of payments per year (i.e monthly payment x number of years NOT number of times it is compounded). Now you can choose the best bank for the home loan Calculate the total cost of the loan from this chosen bank Calculations Interest minimisation strategies. Ch 8C:Interest Part 2 Apply each strategy individually in part 2 of the report. Minimisation Strategies Before each calculation, make a justified prediction about the Monday Week 8 expected outcome and loop back to this in your discussion of the findings. The strategies explored may include: . Making extra contributions to the mortgage . Making more frequent repayments A change in the mortgage company (provide evidence of rates and fees) A change to the repayments made due to interest rate A combination of two or more of these strategies Present calculations in a way that is logical and easy to follow From looking at the calculated results, conclude which method or combination of methods is the most beneficial over the life of the loan for Alex.\f\f\f\f\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts