Question: This individual problem set is due in Blackboard by 1 1 : 5 9 pm on Monday, October 2 3 , On the companion Excel

This individual problem set is due in Blackboard by :pm on Monday, October

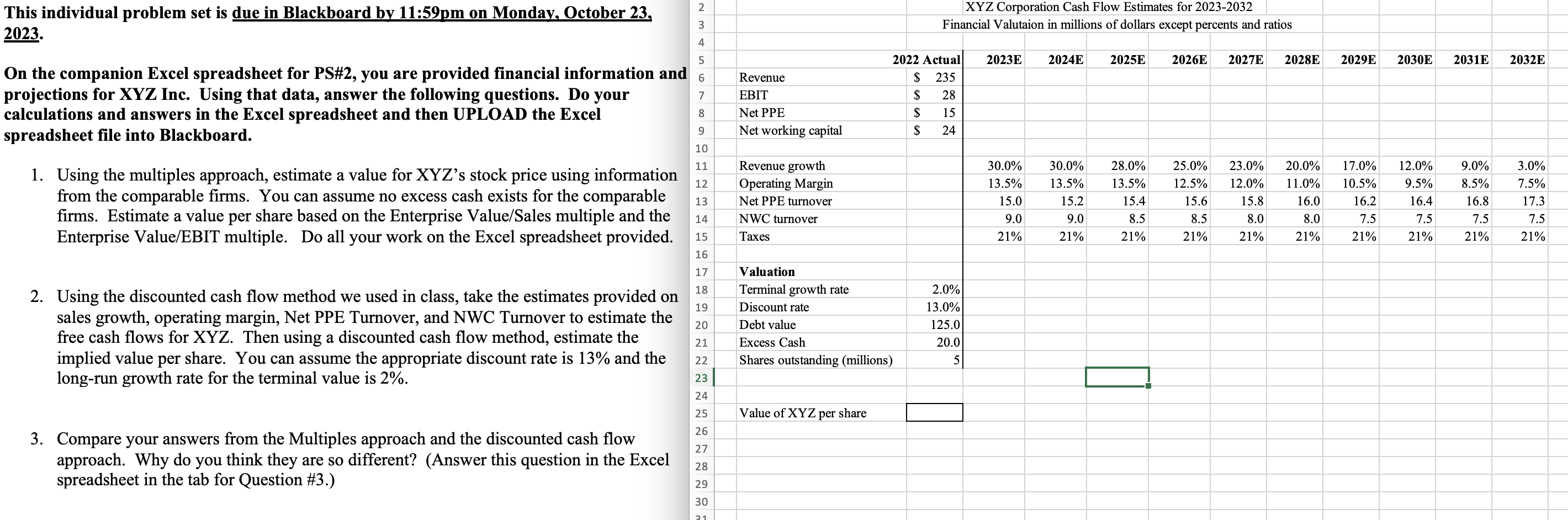

On the companion Excel spreadsheet for PS# you are provided financial information and

projections for XYZ Inc. Using that data, answer the following questions. Do your

calculations and answers in the Excel spreadsheet and then UPLOAD the Excel

spreadsheet file into Blackboard.

Using the multiples approach, estimate a value for XYZs stock price using information

from the comparable firms. You can assume no excess cash exists for the comparable

firms. Estimate a value per share based on the Enterprise ValueSales multiple and the

Enterprise ValueEBIT multiple. Do all your work on the Excel spreadsheet provided.

Using the discounted cash flow method we used in class, take the estimates provided on

sales growth, operating margin, Net PPE Turnover, and NWC Turnover to estimate the

free cash flows for XYZ Then using a discounted cash flow method, estimate the

implied value per share. You can assume the appropriate discount rate is and the

longrun growth rate for the terminal value is

Compare your answers from the Multiples approach and the discounted cash flow

approach. Why do you think they are so different? Answer this question in the Excel

spreadsheet in the tab for Question #

XYZ Corporation Cash Flow Estimates for

Financial Valutaion in millions of dollars except percents and ratios

d

Revenue

EBIT

Net PPE

Net working capital

Revenue growth

Operating Margin

Net PPE turnover

NWC turnover

Taxes

Valuation

Terminal growth rate

Discount rate

Debt value

Excess Cash

Shares outstanding millions

Value of XYZ per share

Actual

$

$

$

$

$

tableExcess CashShares outstanding millions

Value of per share

E

E

E

E

E

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock