Question: this is 1 full question please answer Azoume that you are purchasing an investment and have decided to invest in a company in the digital

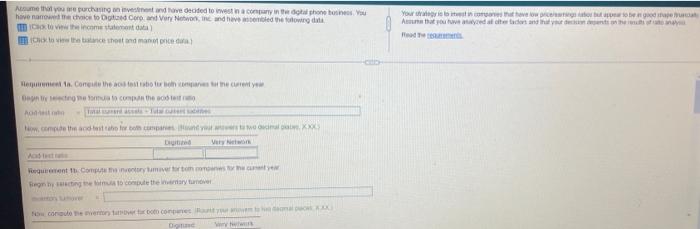

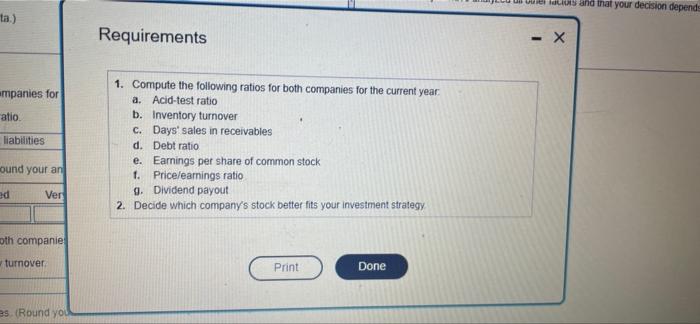

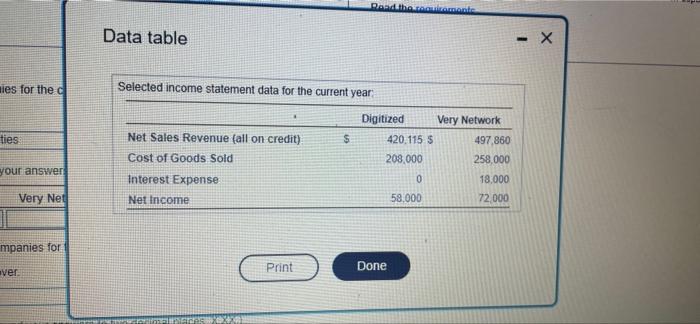

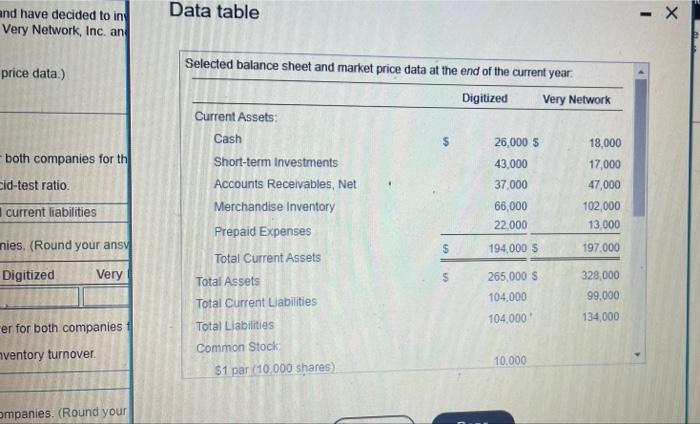

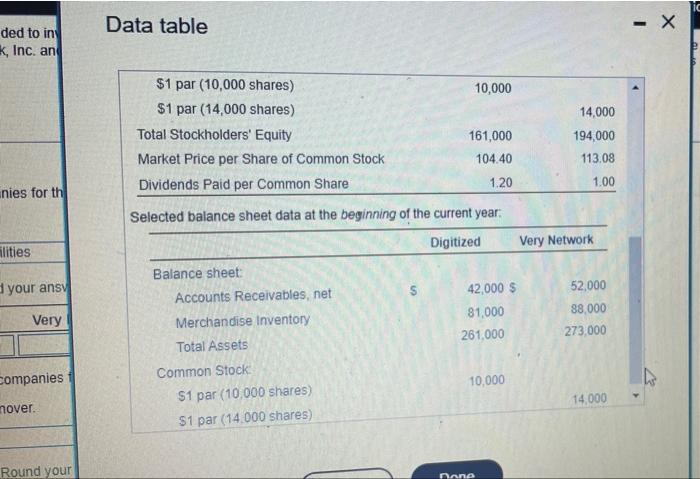

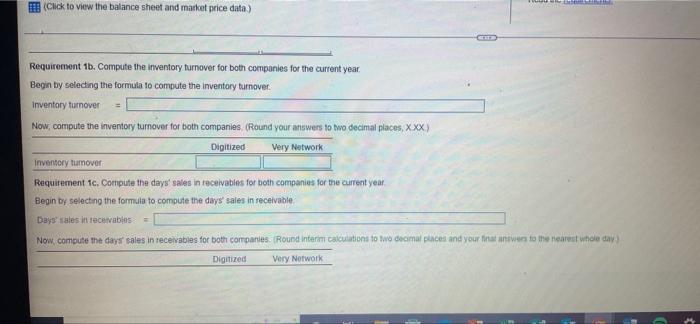

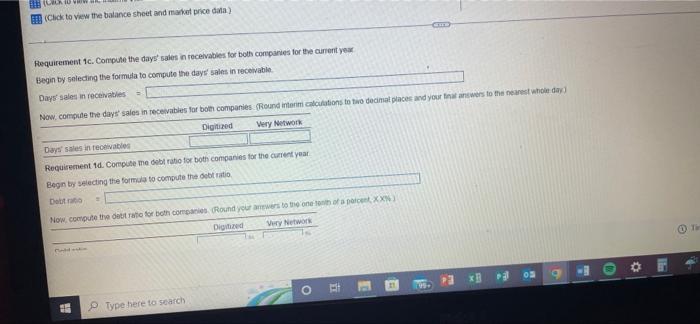

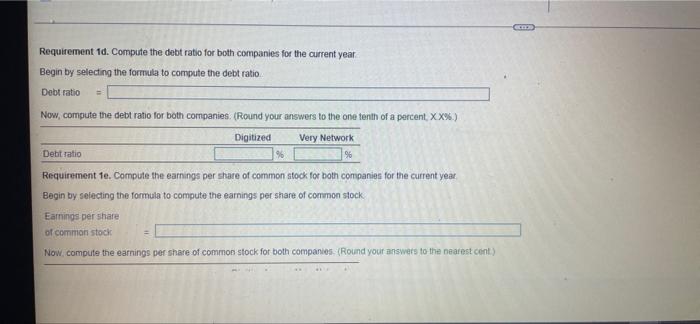

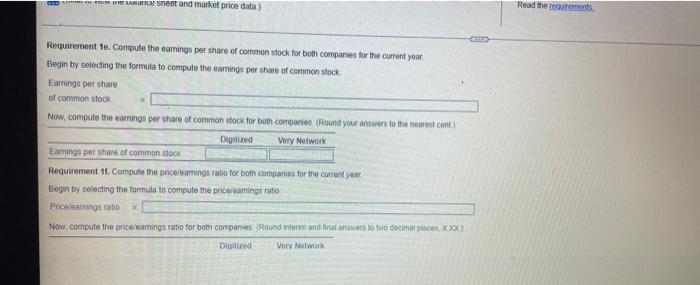

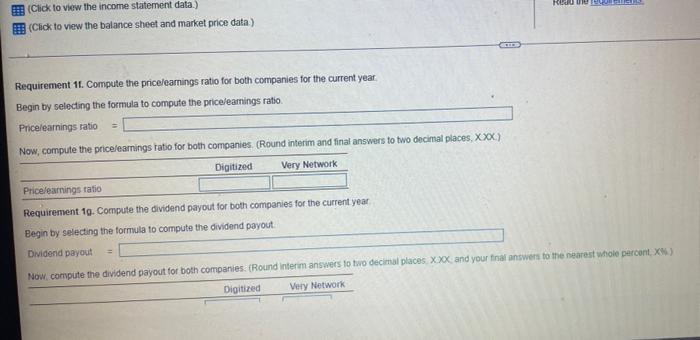

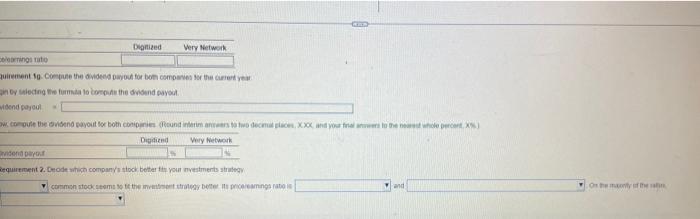

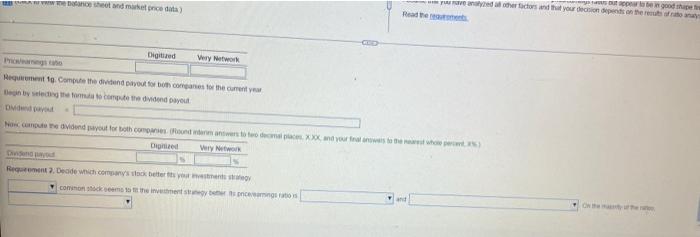

Azoume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitized Corp. and Very Network, Inc and have assembled the following data Co to view the income statement data) Co to view the balance sheet and manot price data) Requirement 1a. Compute the aos fest rabo for both companies for the current year Den ty selecting the formula to compute the acide A Total asels-Toll cater Now, compute the acd test rabo for both companies Hound your answers to two decimal plate XXX) Digitinee Very Network Ad Requirement 1b. Compute the inventory tumover for tom compenes for the year Regn by secting the formula to compute the inventary tumover Now compute the eventory tatover tar boto companies Digit Raut your avem to mal p Very Network Your strategy is to invest in compares that have low pricelesning ator but appear to b Assume that you have analyzed at citer tadans and that y Read The uns en god shape fundat anay ta.) mpanies for atio. liabilities ound your an ed Ver oth companie turnover. es. (Round you Requirements 1. Compute the following ratios for both companies for the current year: a. Acid-test ratio b. Inventory turnover c. d. e. 1. g. Dividend payout 2. Decide which company's stock better fits your investment strategy. Days' sales in receivables Debt ratio Earnings per share of common stock Price/earnings ratio Print Done nel lacions and that your decision depends - X ies for the c ties your answer Very Net mpanies for ver. Data table Selected income statement data for the current year: Net Sales Revenue (all on credit) Cost of Goods Sold Interest Expense Net Income SER Print Read the requirements $ Digitized 420,115 S 208,000 Done 0 58.000 Very Network 497,860 258,000 18,000 72,000 - X and have decided to in Very Network, Inc. and price data.) both companies for th cid-test ratio. I current liabilities nies. (Round your ansv Digitized Very er for both companies. nventory turnover. ompanies. (Round your Data table Selected balance sheet and market price data at the end of the current year. Digitized Very Network Current Assets: Cash Short-term Investments Accounts Receivables, Net Merchandise Inventory Prepaid Expenses Total Current Assets Total Assets Total Current Liabilities Total Liabilities Common Stock $1 par (10.000 shares) $ S 26,000 $ 43,000 37,000 66,000 22,000 194,000 $ 265,000 $ 104,000. 104.000 10,000 18,000 17,000 47,000 102,000 13,000 197,000 328,000 99,000 134,000 - ded to in k, Inc. and nies for th lities d your ansv Very Companies f mover. Round your Data table $1 par (10,000 shares) $1 par (14,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock Dividends Paid per Common Share Selected balance sheet data at the beginning of the current year: Digitized Balance sheet: Accounts Receivables, net Merchandise Inventory Total Assets Common Stock $1 par (10,000 shares) $1 par (14,000 shares) 6 10,000 161,000 104.40 1.20 42,000 $ 81,000 261,000 10,000 none 14,000 194,000 113.08 1.00 Very Network ET 52,000 88,000 273,000 14,000 - X (Click to view the balance sheet and market price data.) Requirement 1b. Compute the inventory turnover for both companies for the current year Begin by selecting the formula to compute the inventory turnover. Inventory turnover = Now, compute the inventory turnover for both companies (Round your answers to two decimal places, X.XX.) Digitized Very Network MINIM Inventory turnover Requirement 1c. Compute the days' sales in receivables for both companies for the current year. Begin by selecting the formula to compute the days' sales in receivable. Days' sales in receivables Now, compute the days sales in receivables for both companies (Round interim calculations to two decimal places and your final answers to the nearest whole day) Digitized Very Network (Click to view the balance sheet and market price data) Requirement 1c. Compute the days' sales in receivables for both companies for the current year Begin by selecting the formula to compute the days' sales in receivable. Days' sales in receivables Now, compute the days' sales in receivables for both companies (Round interim calculations to two decimal places and your final answers to the nearest whole day) Digitized Very Network Days' sales in receivables Requirement 1d. Compute the debt ratio for both companies for the current year Begin by selecting the formula to compute the debt ratio, Debt ratio = S W Now, compute the debt ratio for both companies (Round your arewers to the one tenth of a parcent, XX%) Digitized Very Network Type here to search O CD 10 1 05 6 m 12 The Requirement 1d. Compute the debt ratio for both companies for the current year Begin by selecting the formula to compute the debt ratio. Debt ratio Now, compute the debt ratio for both companies. (Round your answers to the one tenth of a percent, XX%.) Digitized Very Network Debt ratio % Requirement 1e. Compute the earnings per share of common stock for both companies for the current year Begin by selecting the formula to compute the earnings per share of common stock Earnings per share of common stock Now, compute the earnings per share of common stock for both companies. (Round your answers to the nearest cent) GED sneet and market price data) Requirement 1e. Compute the earnings per share of common stock for both companies for the current year Begin by selecting the formula to compute the earnings per share of common stock. Earnings per share of common stock Now, compute the earnings per share of common stock for both companies (Round your answers to the nearest cent) Digitized Very Network Earnings per share of common stock Requirement 11. Compute the price/earnings ratio for both companies for the current year Begin by selecting the formula to compute the price/eamings ratio Pricelearnings ratio Now, compute the price/eamings ratio for both companies (Round interam and final answers to two decimal places, XXX) Very Network Digitized Read the requirements (Click to view the income statement data.) (Click to view the balance sheet and market price data). Requirement 11. Compute the pricelearnings ratio for both companies for the current year Begin by selecting the formula to compute the price/earings ratio. Pricelearnings ratio = Now, compute the pricelearnings ratio for both companies. (Round interim and final answers to two decimal places, XXX) Digitized Very Network Price/earnings ratio Requirement 1g. Compute the dividend payout for both companies for the current year Begin by selecting the formula to compute the dividend payout Dividend payout STES Digitized Read the recom Now, compute the dividend payout for both companies. (Round interim answers to two decimal places, XXX and your final answers to the nearest whole percent, X%) Very Network Digitized Very Network Clearningstatio quirement 1g. Compute the dividend payout for both companies for the current year in by selecting the furmila to compute the dividend payout widend payoul WO ow, compute the dividend payout for both companies (Round interim answers to two decimal places, XXX, and your final answers to the newest whole percent X%) Very Network Digidiend vidend payout Requirement 2. Decide which company's stock better fits your investments strategy common stock seems to tie the investment strategy better its pricereamings rato i and On the many of the VAIN the balance sheet and market price data) Digitized Very Network Requirement 1g. Compute the dividend payout for both companies for the current year Begin by selecting the formula to compute the dividend payout Didend payo Digitized Now compute the dividend payout for both companies (Round der anwers to two decal places XXX, and your final arowers to the nearest whole percent) Very Network Dividend pay Requirement 2. Decide which company's stock better fits your vestments strategy yuave analyzed all other factors and that your decision depends on the results of nato anay but appear to be in good shape t Read the reatments common stock seems to the investment strategy better ts pricemings ratio is and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts