Question: THIS IS 1 PROBLEM ( INVESTMENT VALUATION COURSE ) Problems 1-10 are one problem; the info could come from an earlier problem; use Illustration 8.10

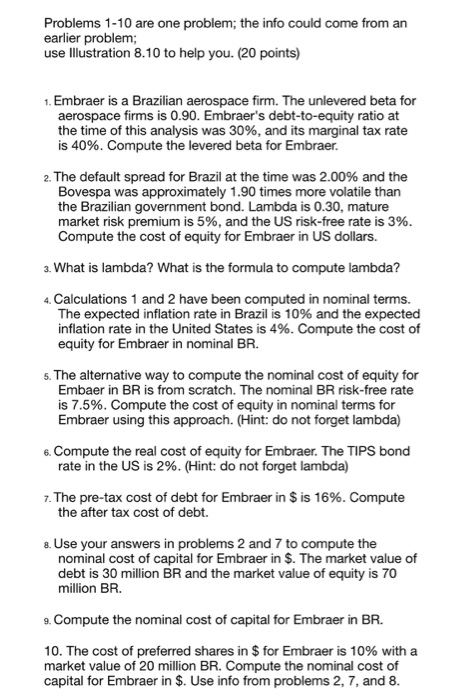

Problems 1-10 are one problem; the info could come from an earlier problem; use Illustration 8.10 to help you. (20 points) 1. Embraer is a Brazilian aerospace firm. The unlevered beta for aerospace firms is 0.90. Embraer's debt-to-equity ratio at the time of this analysis was 30%, and its marginal tax rate is 40%. Compute the levered beta for Embraer. 2. The default spread for Brazil at the time was 2.00% and the Bovespa was approximately 1.90 times more volatile than the Brazilian government bond. Lambda is 0.30, mature market risk premium is 5%, and the US risk-free rate is 3%. Compute the cost of equity for Embraer in US dollars. 3. What is lambda? What is the formula to compute lambda? 4. Calculations 1 and 2 have been computed in nominal terms. The expected inflation rate in Brazil is 10% and the expected inflation rate in the United States is 4%. Compute the cost of equity for Embraer in nominal BR. 6. The alternative way to compute the nominal cost of equity for Embaer in BR is from scratch. The nominal BR risk-free rate is 7.5%. Compute the cost of equity in nominal terms for Embraer using this approach. (Hint: do not forget lambda) 6. Compute the real cost of equity for Embraer. The TIPS bond rate in the US is 2%. (Hint: do not forget lambda) 7. The pre-tax cost of debt for Embraer in $ is 16%. Compute the after tax cost of debt. 8. Use your answers in problems 2 and 7 to compute the nominal cost of capital for Embraer in $. The market value of debt is 30 million BR and the market value of equity is 70 million BR. . Compute the nominal cost of capital for Embraer in BR. 10. The cost of preferred shares in $ for Embraer is 10% with a market value of 20 million BR. Compute the nominal cost of capital for Embraer in $. Use info from problems 2, 7, and 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts