Question: this is a 2 part question. thank you for the help Rhino Inc. hired you as a consultant to help them estimate their cost of

this is a 2 part question. thank you for the help

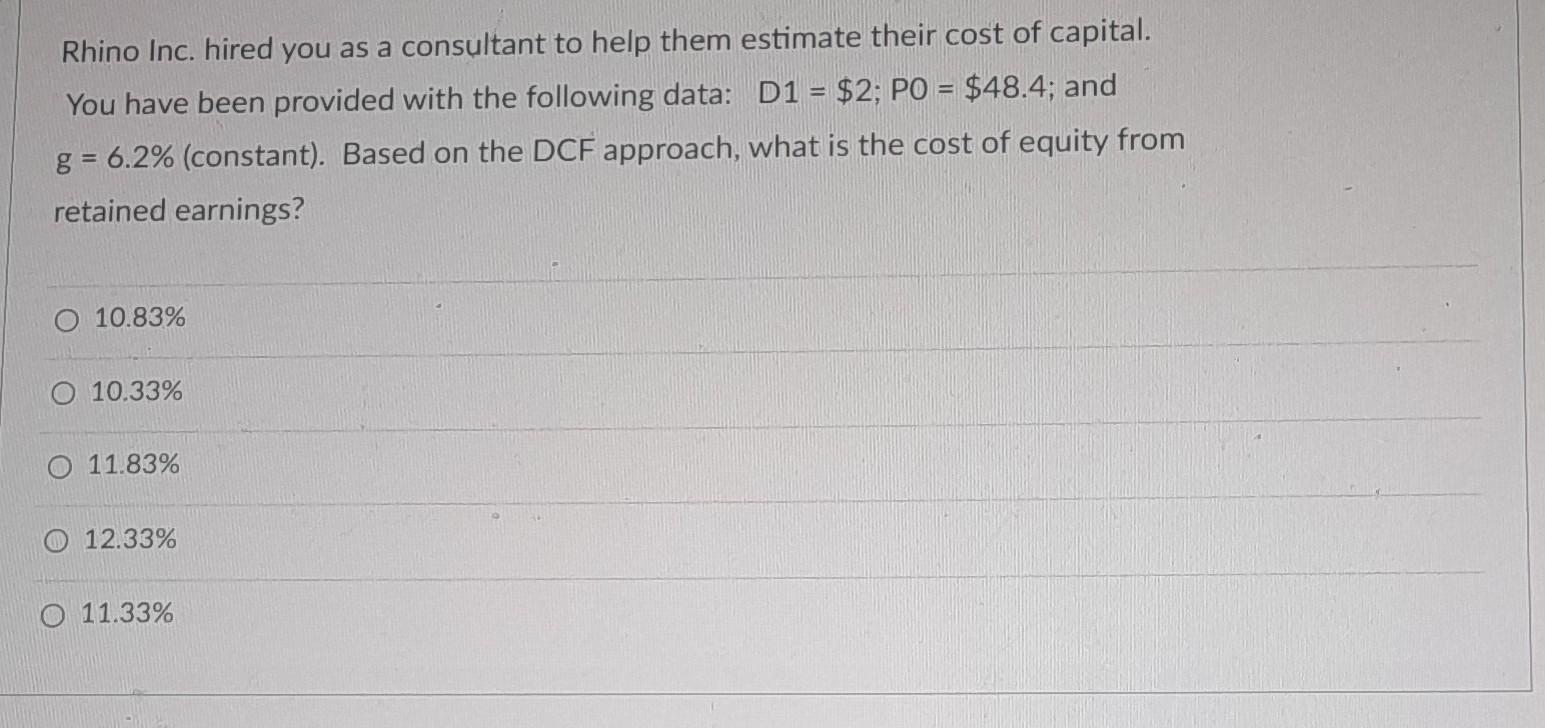

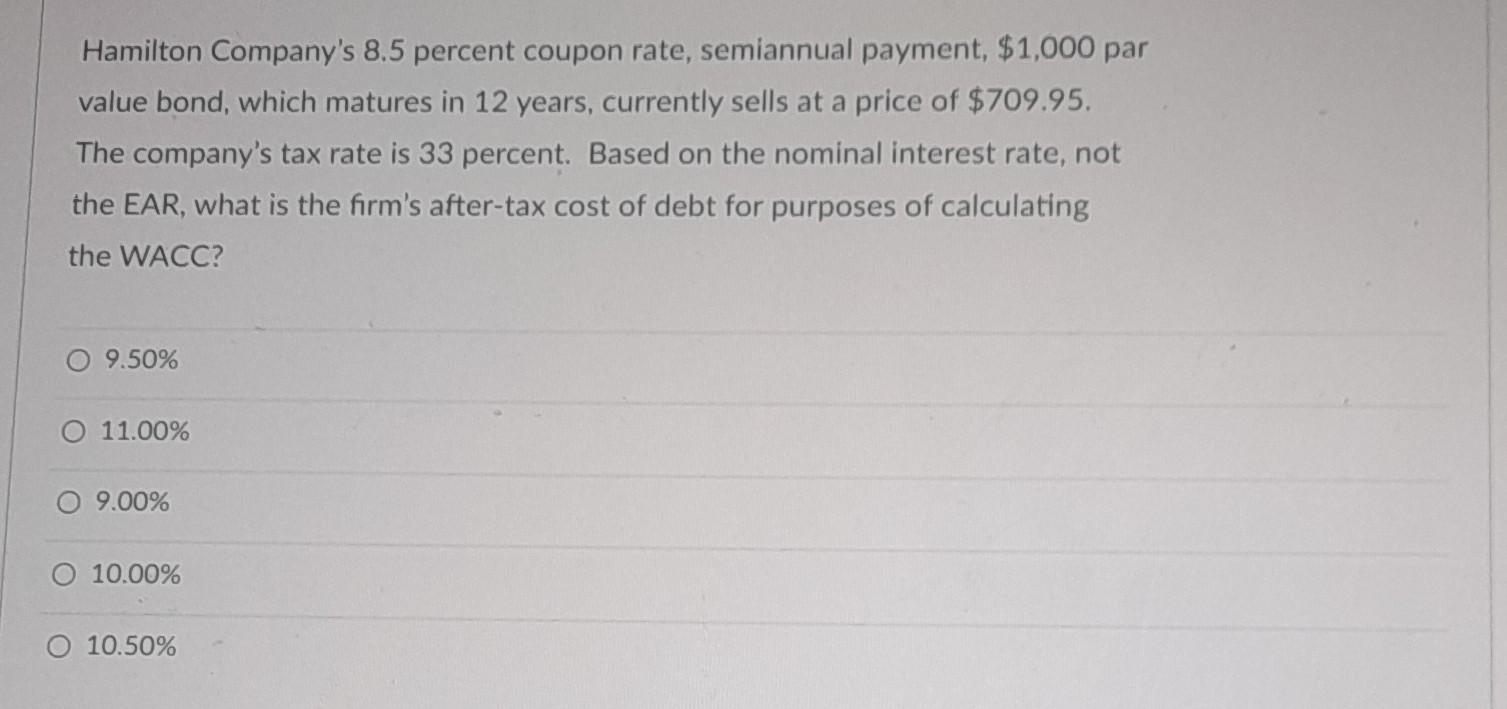

Rhino Inc. hired you as a consultant to help them estimate their cost of capital. You have been provided with the following data: D1=$2;P0=$48.4; and g=6.2% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? 10.83% 10.33% 11.83% 12.33% 11.33% Hamilton Company's 8.5 percent coupon rate, semiannual payment, $1,000 par value bond, which matures in 12 years, currently sells at a price of $709.95. The company's tax rate is 33 percent. Based on the nominal interest rate, not the EAR, what is the firm's after-tax cost of debt for purposes of calculating the WACC? 9.50% 11.00% 9.00% 10.00% 10.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts