Question: this is a 3 part question (DO NOT GOOGLE) I WANT A honest student answer. 6 Discuss how macroeconomic analysis, industry analysis, and companies' financial

this is a 3 part question (DO NOT GOOGLE) I WANT A honest student answer.

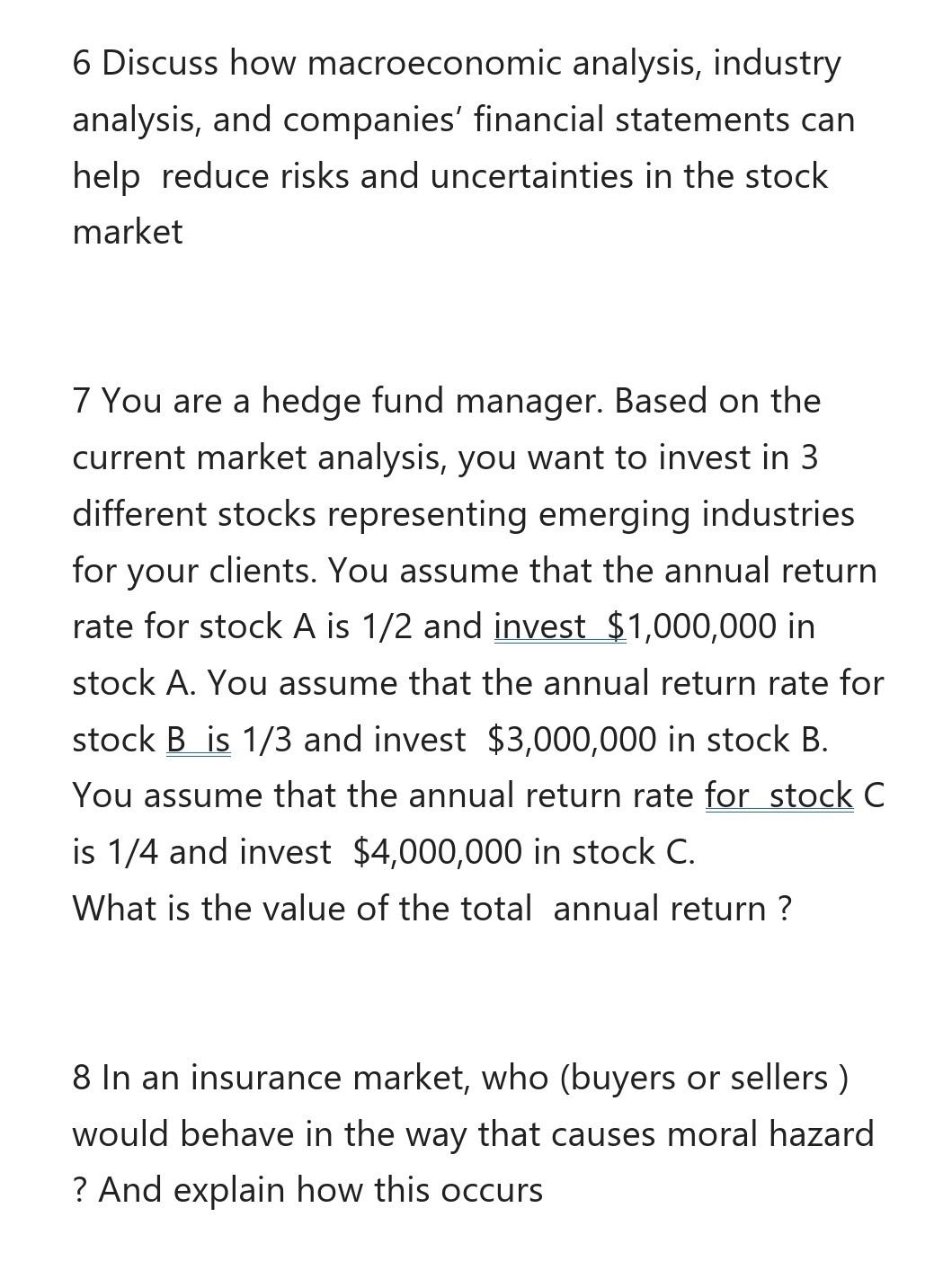

6 Discuss how macroeconomic analysis, industry analysis, and companies' financial statements can help reduce risks and uncertainties in the stock market 7 You are a hedge fund manager. Based on the current market analysis, you want to invest in 3 different stocks representing emerging industries for your clients. You assume that the annual return rate for stock A is 1/2 and invest $1,000,000 in stock A. You assume that the annual return rate for stock B is 1/3 and invest $3,000,000 in stock B. You assume that the annual return rate for stock C is 1/4 and invest $4,000,000 in stock C. What is the value of the total annual return ? 8 In an insurance market, who (buyers or sellers ) would behave in the way that causes moral hazard ? And explain how this occurs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock