Question: This is a 3 part question, please answer in the format given Required information [The following information applies to the questions displayed below] Shahia Company

![Required information [The following information applies to the questions displayed below] Shahia](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb3df1c4435_42566fb3df1618e6.jpg)

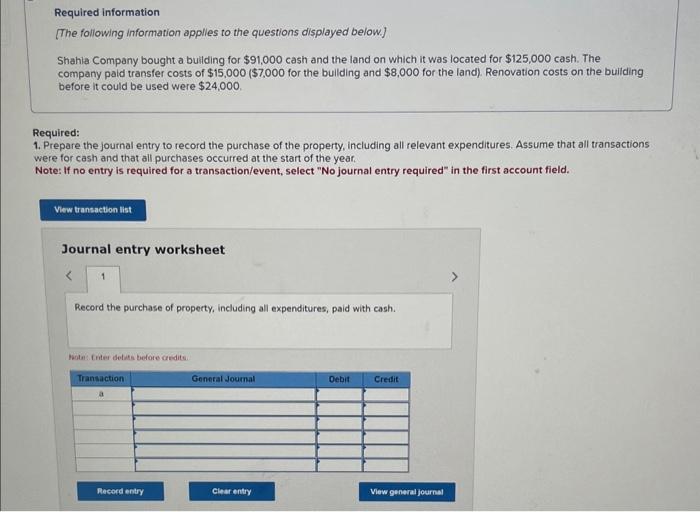

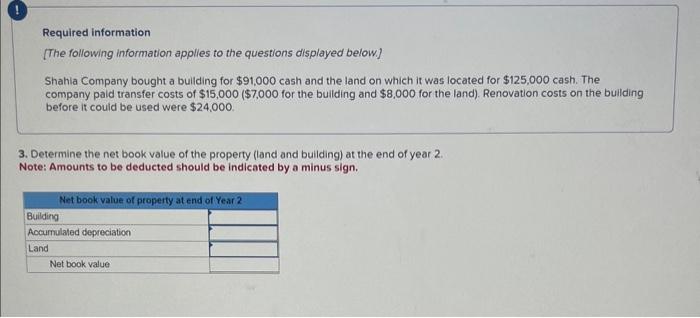

Required information [The following information applies to the questions displayed below] Shahia Company bought a building for $91,000 cash and the land on which it was located for $125,000 cash. The company paid transfer costs of $15,000 ( $7,000 for the building and $8,000 for the land). Renovation costs on the building before it could be used were $24,000. Required: 1. Prepare the journal entry to record the purchase of the property, including all relevant expenditures. Assume that all transactions were for cash and that all purchases occurred at the start of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the purchase of property, including all expenditures, paid with cash. Wathi friter dehits before ardite Required information [The following information applies to the questions displayed below.] Shahia Company bought a bullding for $91,000 cash and the land on which it was located for $125,000 cash. The company paid transfer costs of $15,000 ( $7,000 for the building and $8,000 for the land). Renovation costs on the building before it could be used were $24,000. 2. Compute straight-line depreciation at the end of one year, assuming an estimated 10-year useful life and a $17,000 estimated residual value. Required information [The following information applies to the questions displayed below.] Shahia Company bought a building for $91,000 cash and the land on which it was located for $125,000 cash. The company paid transfer costs of $15,000 ( $7,000 for the building and $8,000 for the land). Renovation costs on the building before it could be used were $24,000. 3. Determine the net book value of the property (land and buliding) at the end of year 2 . Note: Amounts to be deducted should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts