Question: this is a 5 part question Problem 12-18 Relevant Cost Analysis in a Variety of Situations [LO12-2, L012-3, LO12-4] Andretti Company has a single product

![in a Variety of Situations [LO12-2, L012-3, LO12-4] Andretti Company has a](https://s3.amazonaws.com/si.experts.images/answers/2024/07/669f909a40f27_273669f9099b375f.jpg)

this is a 5 part question

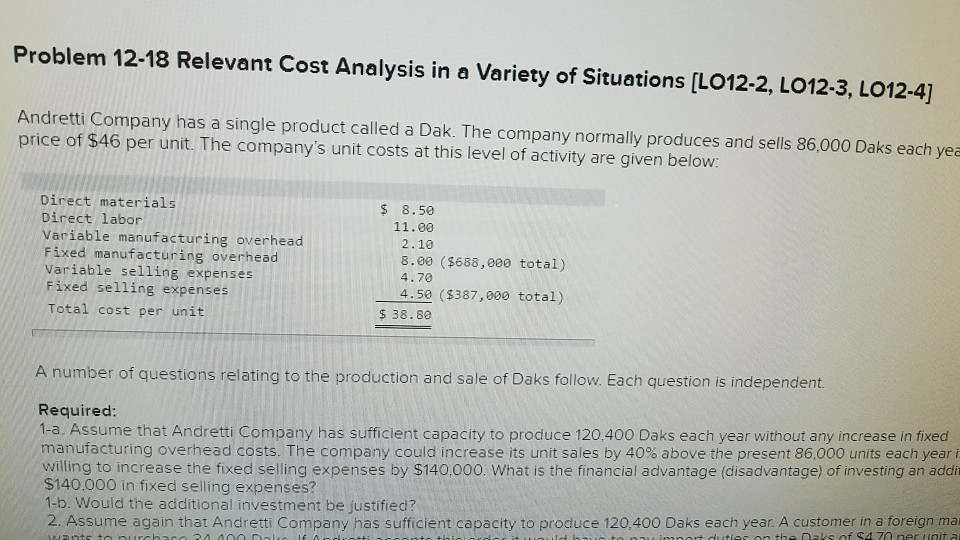

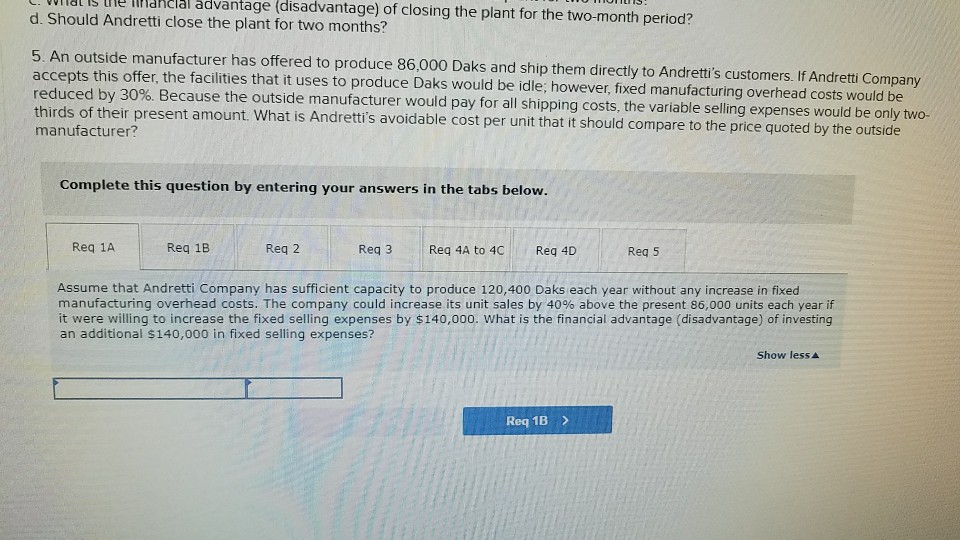

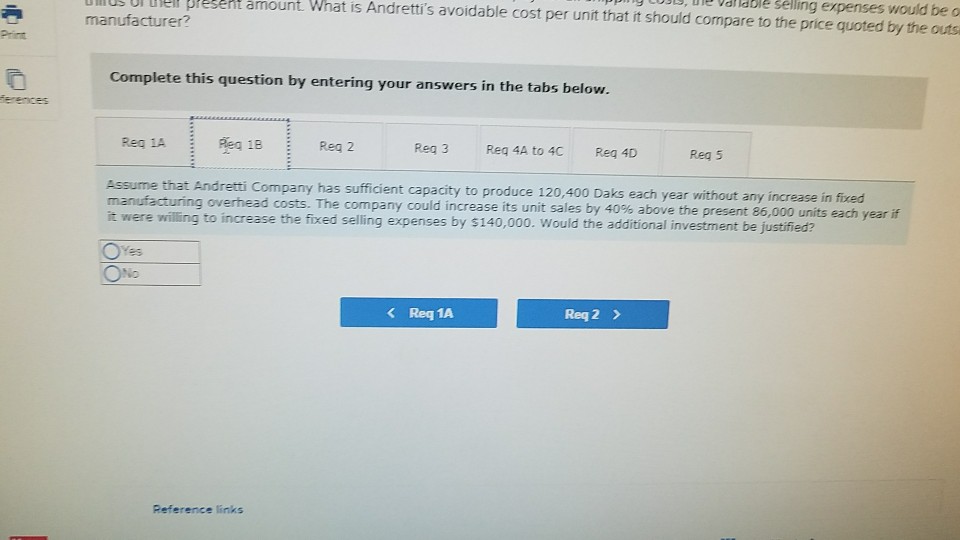

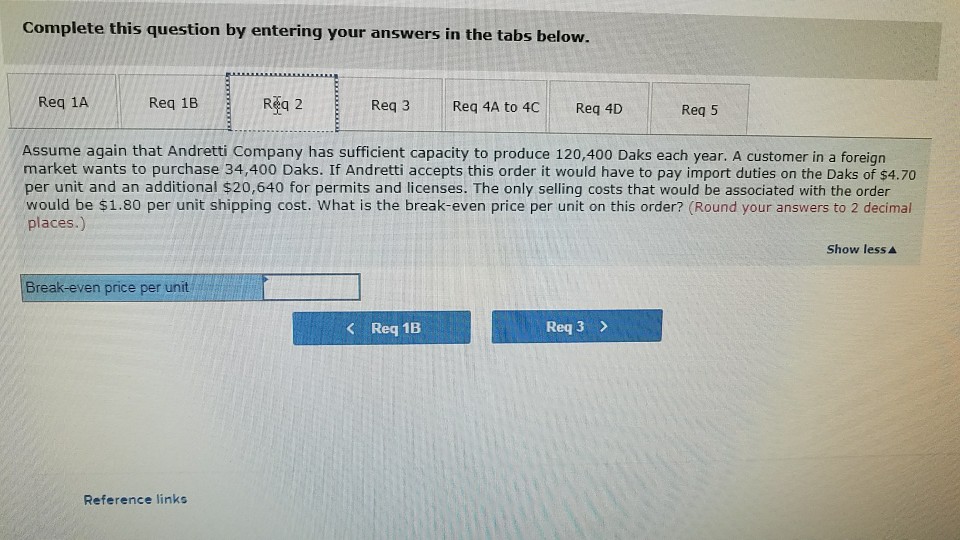

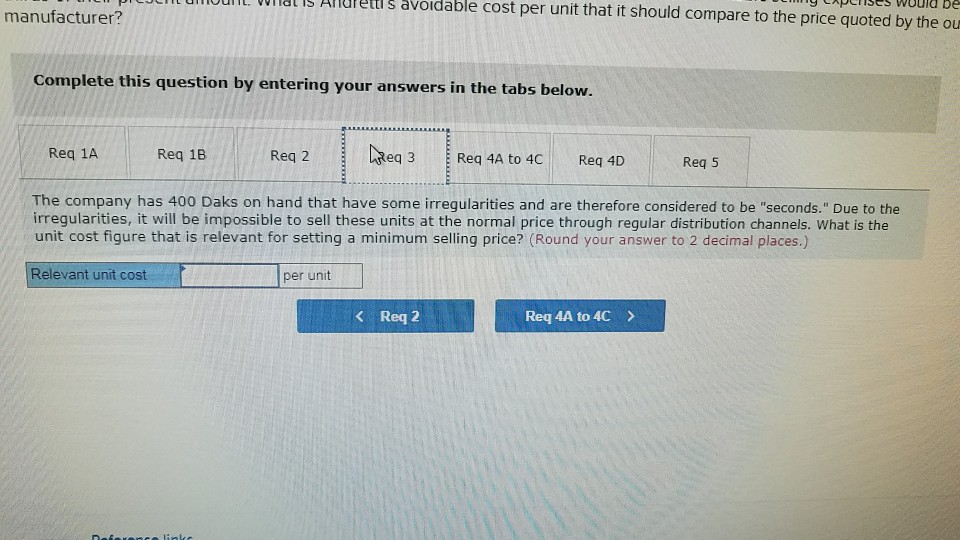

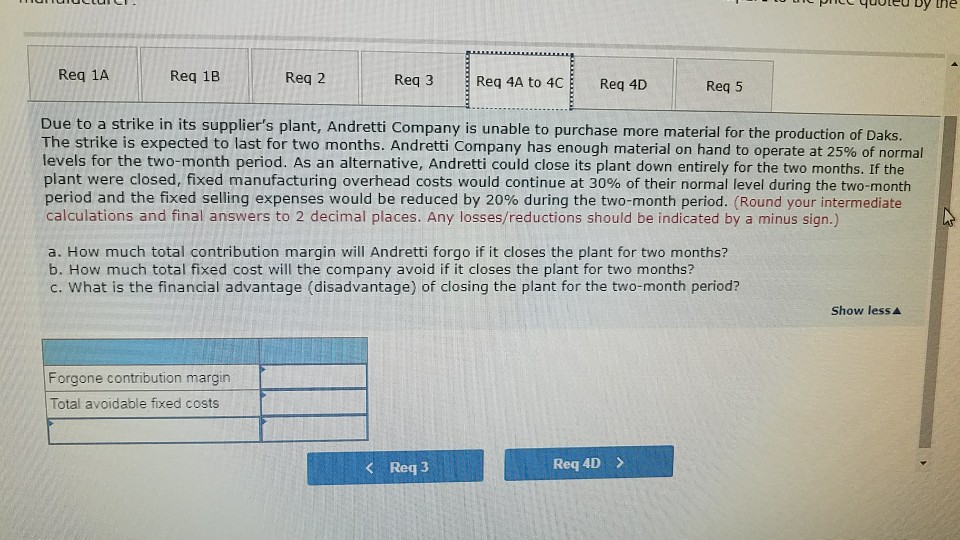

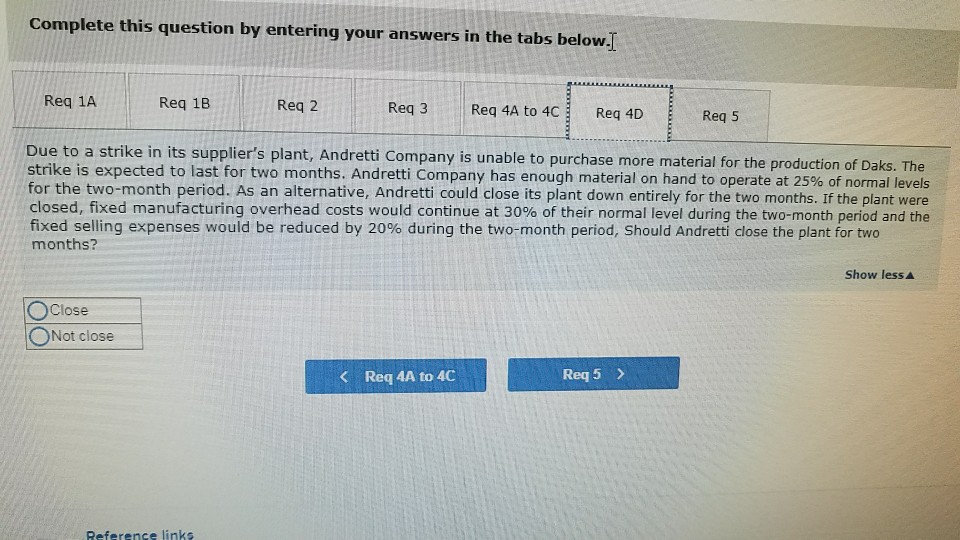

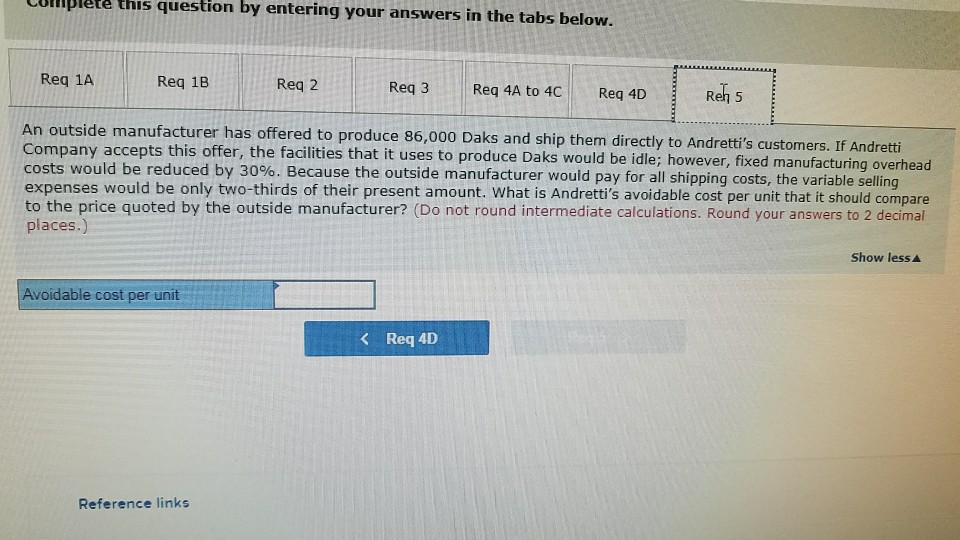

Problem 12-18 Relevant Cost Analysis in a Variety of Situations [LO12-2, L012-3, LO12-4] Andretti Company has a single product called a Dak. The company normally produces and sells 86,000 Daks each yea price of $46 per unit. The company's unit costs at this level of activity are given below Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 8.50 11.00 2.10 8.00 ($688,000 total) 4.70 4.5 $387,000 total) $ 38.80 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required 1-a. Assume that Andretti Company has sufficient capacity to produce 120,400 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 40% above the present 86,000 units each year wiling to increase the fixed selling expenses by $140.000. What is the financial advantage (disadvantage) of investing an addi $140,000 in fixed selling expenses? 1-b. Would the additional investment be justified? 2. Assume again that Andretti Company has sufficient capacity to produce 120.400 Daks each year. A customer in a foreign ma

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts