Question: This is a case analysis.. the case is The Boeing 7E7 can be found in Darden Business Publishing from the University of Virginia. Please answer

This is a case analysis.. the case is "The Boeing 7E7" can be found in Darden Business Publishing from the University of Virginia. Please answer just conceptual questions.

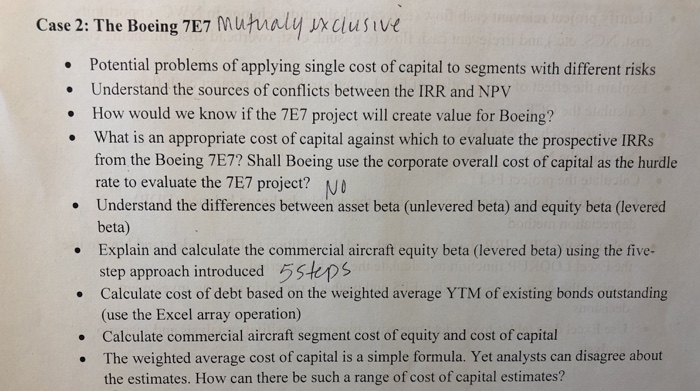

Case 2: The Boeing TE7 muhualy xcusive Potential problems of applying single cost of capital to segments with different risks Understand the sources of conflicts between the IRR and NPV How would we know if the 7E7 project will create value for Boeing? What is an appropriate cost of capital against which to evaluate the prospective IRRs from the Boeing 7E7? Shall Boeing use the corporate overall cost of capital as the hurdle rate to evaluate the 7E7 project? N Understand the differences between asset beta (unlevered beta) and equity beta (levered beta) Explain and calculate the commercial aircraft equity beta (levered beta) using the five- step approach introduced 5steps Calculate cost of debt based on the weighted average YTM of existing bonds outstanding (use the Excel array operation) Calculate commercial aircraft segment cost of equity and cost of capital The weighted average cost of capital is a simple formula. Yet analysts can disagree about the estimates. How can there be such a range of cost of capital estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts