Question: This is a Case Study Estate Planning Case Studies SAMANTHA AND SAM SPARTAN Fact tom. 1 Samantha and Sam Spartan are both 35 and have

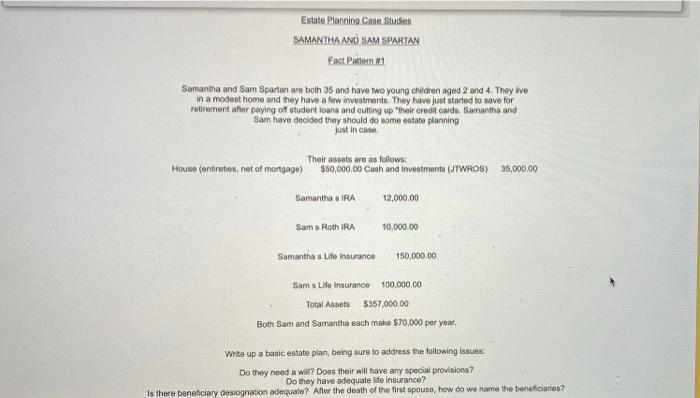

Estate Planning Case Studies SAMANTHA AND SAM SPARTAN Fact tom. 1 Samantha and Sam Spartan are both 35 and have two young children aged 2 and 4. They ive in a modest home and they have a few investments. They have just started to save for retirement after paying off student loans and cutting up their credit cards. Samantha and Sam have decided they should do some estate planning just in case House (ontiratios, net of mortgage) Their assets are as follows: $50,000.00 Cash and Investment (JTWROS) 35,000.00 Samantha SIRA 12,000.00 Sam s Roth IRA 10.000.00 Samantha Life Insurance 150,000.00 Soms Life Insurance 100,000.00 Total Assets $357.000.00 Both Sam and Samantha each make $70,000 per year, Write up a basic estate plan, being sure to address the following issues: Do they need a will? Does their will have any special provisions? Do they have adequate life insurance? Is there beneficiary desiognation adequate? After the death of the first opouto, how do we are the beneficiaries? Estate Planning Case Studies SAMANTHA AND SAM SPARTAN Fact tom. 1 Samantha and Sam Spartan are both 35 and have two young children aged 2 and 4. They ive in a modest home and they have a few investments. They have just started to save for retirement after paying off student loans and cutting up their credit cards. Samantha and Sam have decided they should do some estate planning just in case House (ontiratios, net of mortgage) Their assets are as follows: $50,000.00 Cash and Investment (JTWROS) 35,000.00 Samantha SIRA 12,000.00 Sam s Roth IRA 10.000.00 Samantha Life Insurance 150,000.00 Soms Life Insurance 100,000.00 Total Assets $357.000.00 Both Sam and Samantha each make $70,000 per year, Write up a basic estate plan, being sure to address the following issues: Do they need a will? Does their will have any special provisions? Do they have adequate life insurance? Is there beneficiary desiognation adequate? After the death of the first opouto, how do we are the beneficiaries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts