Question: This is a case study question for review. Is someone able to answer all components a,b, and c for me? The following table gives monthly

This is a case study question for review. Is someone able to answer all components a,b, and c for me?

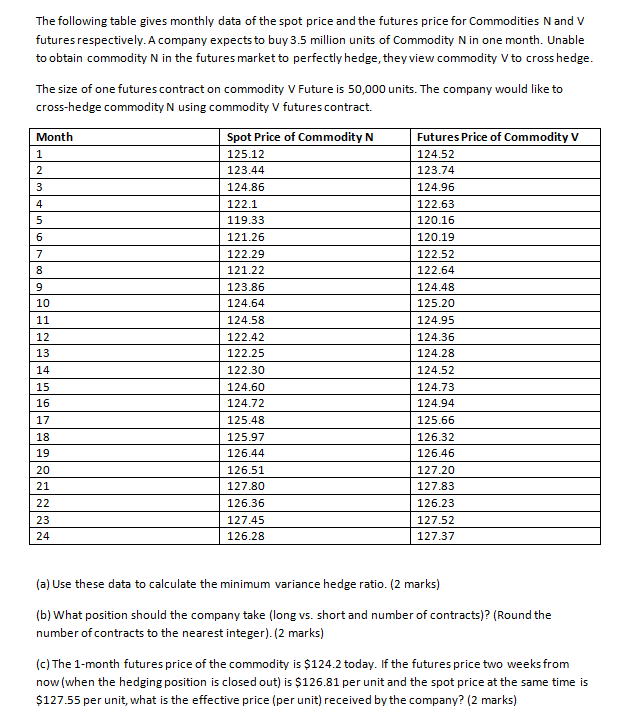

The following table gives monthly data of the spot price and the futures price for Commodities N and V futures respectively. A company expects to buy 3.5 million units of Commodity N in one month. Unable to obtain commodity N in the futures market to perfectly hedge, they view commodity V to cross hedge. The size of one futures contract on commodity V Future is 50,000 units. The company would like to cross-hedge commodity N using commodity V futures contract. Month 1 3 5 8 Spot Price of Commodity 125.12 123.44 124.86 | 122.1 119.33 121.26 122.29 121.22 123.86 124.64 124.58 122.42 122.25 122.30 124.60 124.72 125.48 125.97 126.44 126.51 127.80 126.36 12745 Futures Price of Commodity V 124.52 123.74 124.96 122.63 120.16 120.19 122.52 122.64 124.48 125.20 124.95 124.36 124.28 124.52 124.73 124.94 125.66 126.32 126.46 127.20 127.83 126.23 127.52 127.37 13 14 15 16 17 18 126.28 (a) Use these data to calculate the minimum variance hedge ratio. (2 marks) (b) What position should the company take (long vs. short and number of contracts)? (Round the number of contracts to the nearest integer). (2 marks) (c) The 1-month futures price of the commodity is $124.2 today. If the futures price two weeks from now (when the hedging position is closed out) is $126.81 per unit and the spot price at the same time is $127.55 per unit, what is the effective price (per unit) received by the company? (2 marks) The following table gives monthly data of the spot price and the futures price for Commodities N and V futures respectively. A company expects to buy 3.5 million units of Commodity N in one month. Unable to obtain commodity N in the futures market to perfectly hedge, they view commodity V to cross hedge. The size of one futures contract on commodity V Future is 50,000 units. The company would like to cross-hedge commodity N using commodity V futures contract. Month 1 3 5 8 Spot Price of Commodity 125.12 123.44 124.86 | 122.1 119.33 121.26 122.29 121.22 123.86 124.64 124.58 122.42 122.25 122.30 124.60 124.72 125.48 125.97 126.44 126.51 127.80 126.36 12745 Futures Price of Commodity V 124.52 123.74 124.96 122.63 120.16 120.19 122.52 122.64 124.48 125.20 124.95 124.36 124.28 124.52 124.73 124.94 125.66 126.32 126.46 127.20 127.83 126.23 127.52 127.37 13 14 15 16 17 18 126.28 (a) Use these data to calculate the minimum variance hedge ratio. (2 marks) (b) What position should the company take (long vs. short and number of contracts)? (Round the number of contracts to the nearest integer). (2 marks) (c) The 1-month futures price of the commodity is $124.2 today. If the futures price two weeks from now (when the hedging position is closed out) is $126.81 per unit and the spot price at the same time is $127.55 per unit, what is the effective price (per unit) received by the company? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts