Question: This is a case study two part question A homeowner with a 90% LTV mortgage on her residential home that is now up for renewal

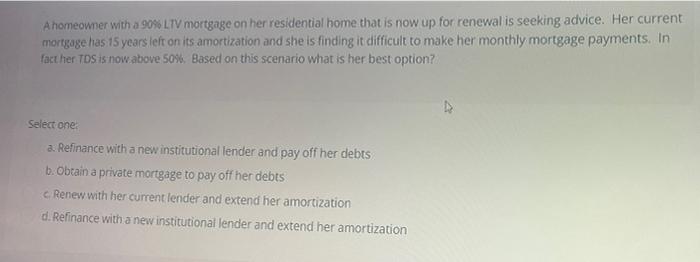

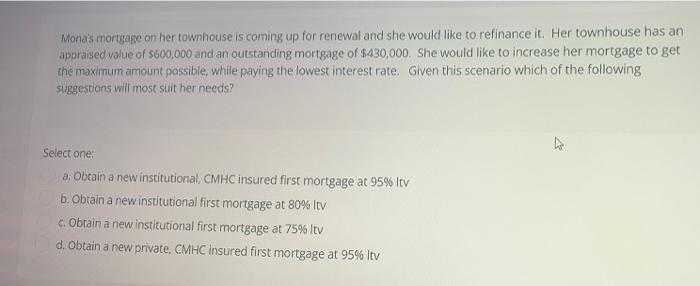

A homeowner with a 90% LTV mortgage on her residential home that is now up for renewal is seeking advice. Her current mortgage has 15 years left on its amortization and she is finding it difficult to make her monthly mortgage payments. In fact her TDS is now above 50% Based on this scenario what is her best option? Select one a. Refinance with a new institutional lender and pay off her debts b. Obtain a private mortgage to pay off her debts Renew with her current lender and extend her amortization d. Refinance with a new institutional lender and extend her amortization Mona's mortgage on her townhouse is coming up for renewal and she would like to refinance it. Her townhouse has an appraised value of $600,000 and an outstanding mortgage of $430,000. She would like to increase her mortgage to get the maximum amount possible, while paying the lowest interest rate. Given this scenario which of the following suggestions will most suit her needs? Select one: a. Obtain a new institutional CMHC insured first mortgage at 95% Itv b. Obtain a new institutional first mortgage at 80% Itv c. Obtain a new institutional first mortgage at 75% Itv d. Obtain a new private, CMHC insured first mortgage at 95% Itv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts