Question: This is a case study two part question Jackson Pockett is applying for a mortgage on his mother's house. Jackson, who has told you that

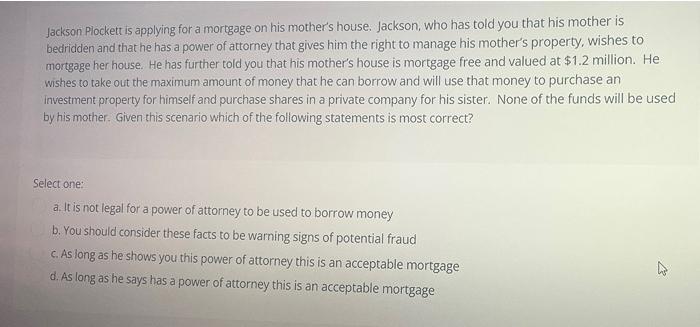

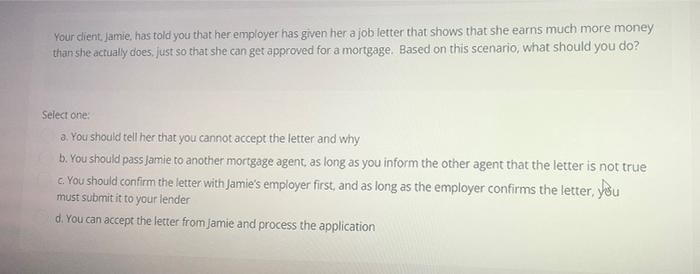

Jackson Pockett is applying for a mortgage on his mother's house. Jackson, who has told you that his mother is bedridden and that he has a power of attorney that gives him the right to manage his mother's property, wishes to mortgage her house. He has further told you that his mother's house is mortgage free and valued at $1.2 million. He wishes to take out the maximum amount of money that he can borrow and will use that money to purchase an investment property for himself and purchase shares in a private company for his sister. None of the funds will be used by his mother. Given this scenario which of the following statements is most correct? Select one: a. It is not legal for a power of attorney to be used to borrow money b. You should consider these facts to be warning signs of potential fraud C. As long as he shows you this power of attorney this is an acceptable mortgage d. As long as he says has a power of attorney this is an acceptable mortgage Your client. Jamie, has told you that her employer has given her a job letter that shows that she earns much more money than she actually does, just so that she can get approved for a mortgage. Based on this scenario, what should you do? Select one: a. You should tell her that you cannot accept the letter and why b. You should pass Jamie to another mortgage agent, as long as you inform the other agent that the letter is not true c. You should confirm the letter with Jamie's employer first, and as long as the employer confirms the letter, you must submit it to your lender d. You can accept the letter from Jamie and process the application

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts