Question: This is a case study (worth 20%). You are required to do your own work and to cite your references properly. The cases may be

This is a case study (worth 20%). You are required to do your own work and to cite your references properly. The cases may be fictional or they may be

based upon a real situation with some of the manes changed or removed but you can research the scenario for additional information insight.

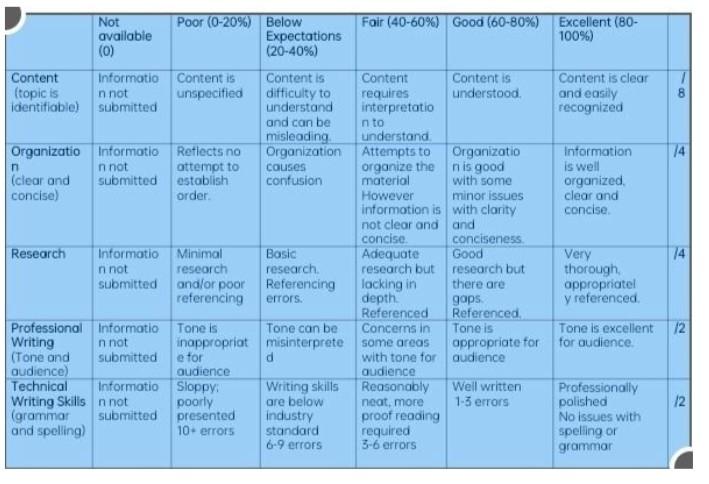

There is no set minimum or maximum number of pages required but if you follow the framework properly that will guide you in writing up the case. I have also attached the rubric for this assignment.

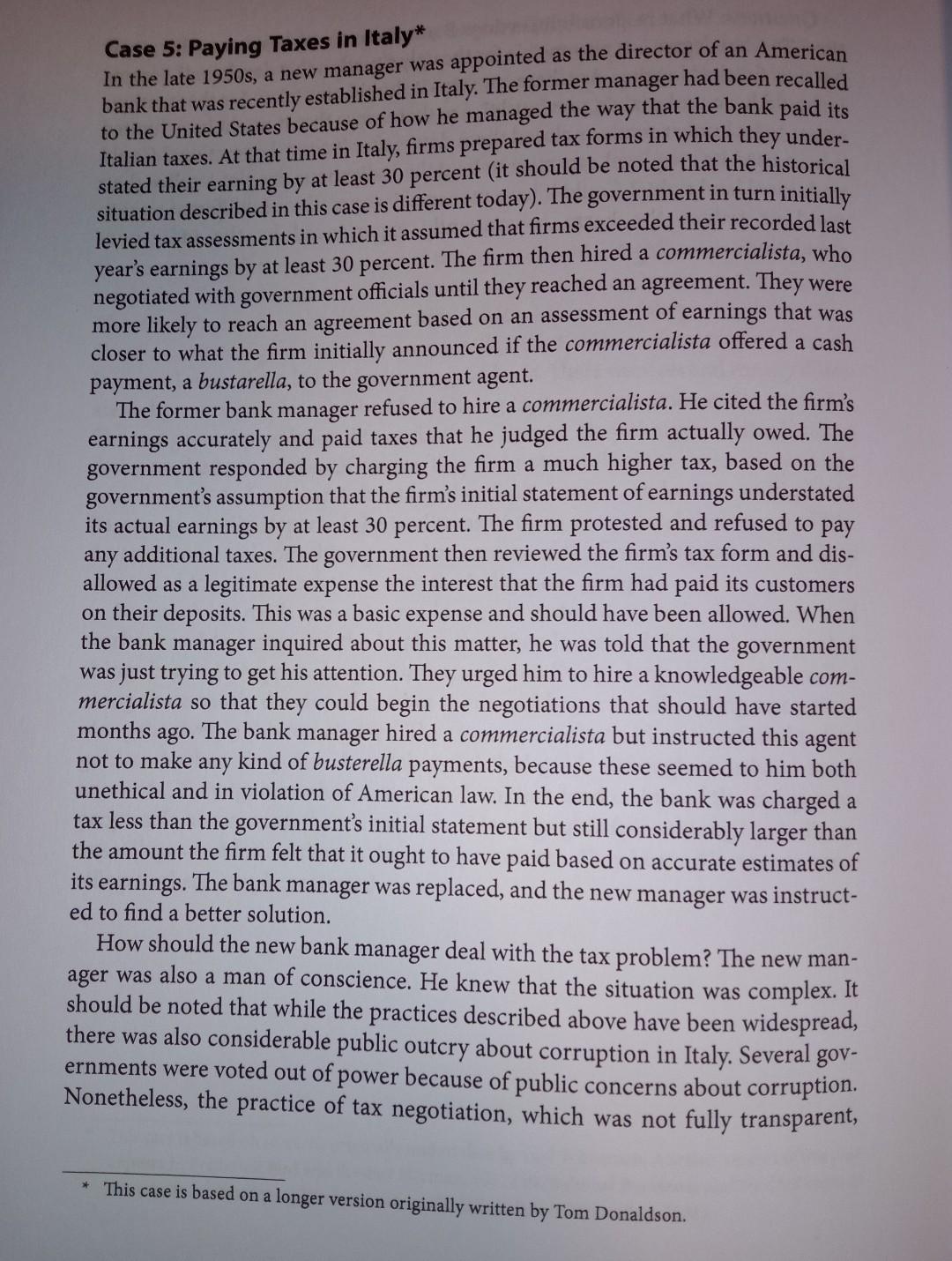

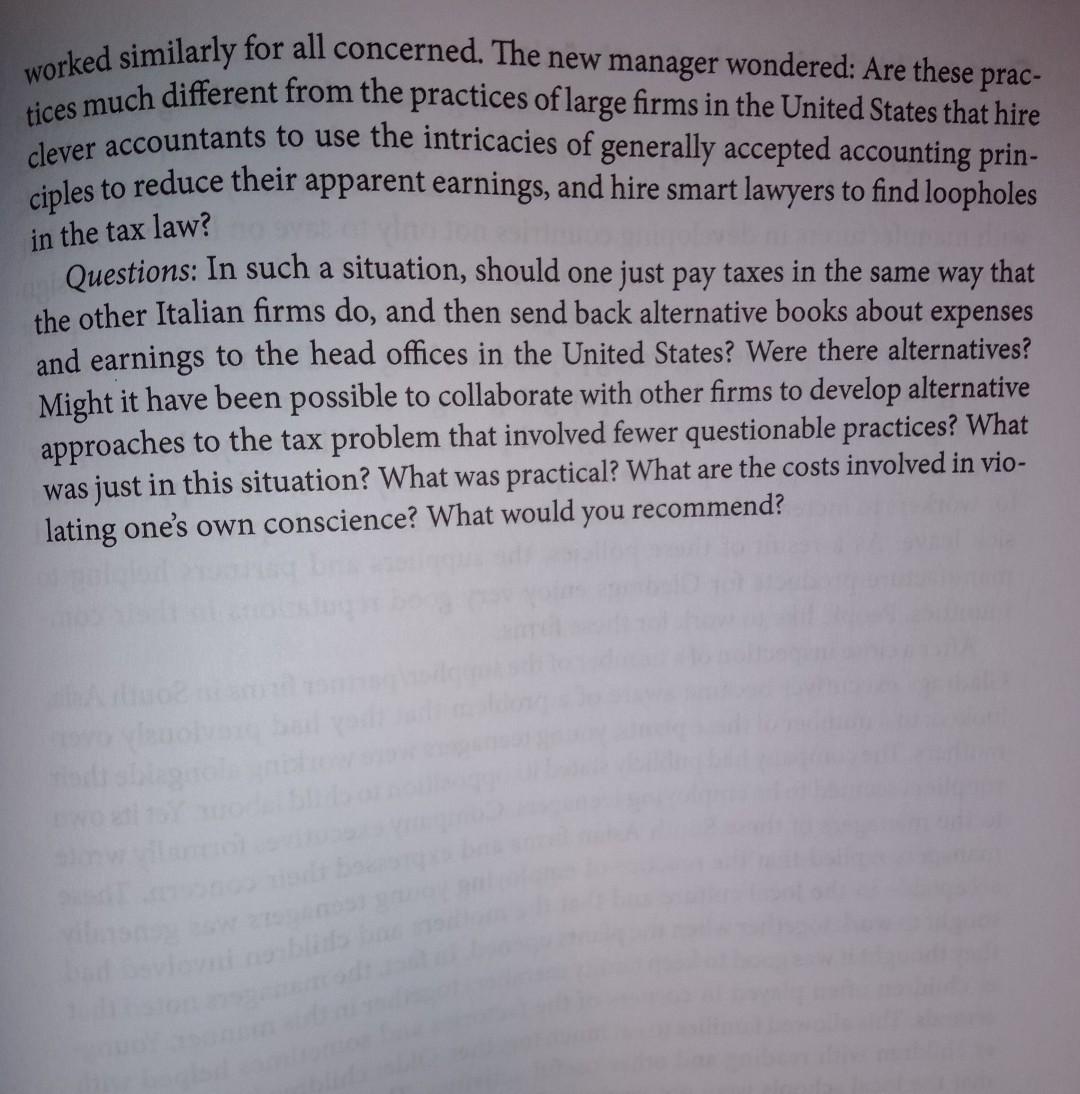

Case 5: Paying Taxes in Italy* In the late 1950s, a new manager was appointed as the director of an American bank that was recently established in Italy. The former manager had been recalled to the United States because of how he managed the way that the bank paid its Italian taxes. At that time in Italy, firms prepared tax forms in which they understated their earning by at least 30 percent (it should be noted that the historical situation described in this case is different today). The government in turn initially levied tax assessments in which it assumed that firms exceeded their recorded last year's earnings by at least 30 percent. The firm then hired a commercialista, who negotiated with government officials until they reached an agreement. They were more likely to reach an agreement based on an assessment of earnings that was closer to what the firm initially announced if the commercialista offered a cash payment, a bustarella, to the government agent. The former bank manager refused to hire a commercialista. He cited the firm's earnings accurately and paid taxes that he judged the firm actually owed. The government responded by charging the firm a much higher tax, based on the government's assumption that the firm's initial statement of earnings understated its actual earnings by at least 30 percent. The firm protested and refused to pay any additional taxes. The government then reviewed the firm's tax form and disallowed as a legitimate expense the interest that the firm had paid its customers on their deposits. This was a basic expense and should have been allowed. When the bank manager inquired about this matter, he was told that the government was just trying to get his attention. They urged him to hire a knowledgeable commercialista so that they could begin the negotiations that should have started months ago. The bank manager hired a commercialista but instructed this agent not to make any kind of busterella payments, because these seemed to him both unethical and in violation of American law. In the end, the bank was charged a tax less than the government's initial statement but still considerably larger than the amount the firm felt that it ought to have paid based on accurate estimates of its earnings. The bank manager was replaced, and the new manager was instructed to find a better solution. How should the new bank manager deal with the tax problem? The new manager was also a man of conscience. He knew that the situation was complex. It should be noted that while the practices described above have been widespread, there was also considerable public outcry about corruption in Italy. Several governments were voted out of power because of public concerns about corruption. Nonetheless, the practice of tax negotiation, which was not fully transparent, * This case is based on a longer version originally written by Tom Donaldson. worked similarly for all concerned. The new manager wondered: Are these practices much different from the practices of large firms in the United States that hire clever accountants to use the intricacies of generally accepted accounting principles to reduce their apparent earnings, and hire smart lawyers to find loopholes in the tax law? Questions: In such a situation, should one just pay taxes in the same way that the other Italian firms do, and then send back alternative books about expenses and earnings to the head offices in the United States? Were there alternatives? Might it have been possible to collaborate with other firms to develop alternative approaches to the tax problem that involved fewer questionable practices? What was just in this situation? What was practical? What are the costs involved in violating one's own conscience? What would you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts