Question: This is a case we worked on during the Annual AICPA Accounting and Tax Conference in Washington DC a few years ago. It is a

This is a case we worked on during the Annual AICPA Accounting and Tax Conference in Washington DC a few years ago. It is a fairly complicated case that took my team a while to figure out. I believe it is a great way to practice your debits and credits. It was a 100-minute session with top KPMG European partners acting as workshop leaders.

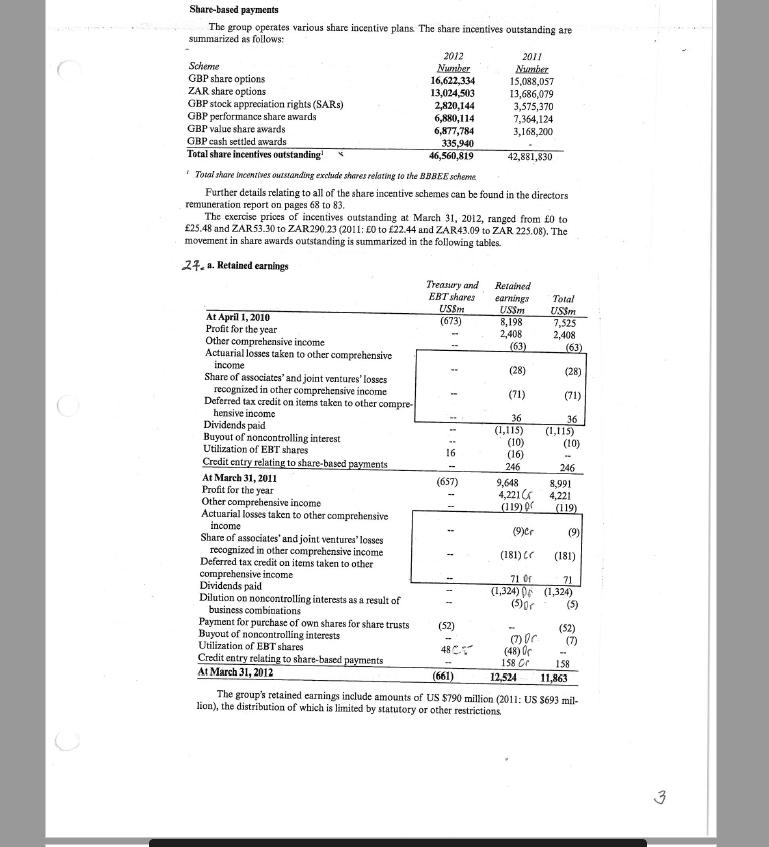

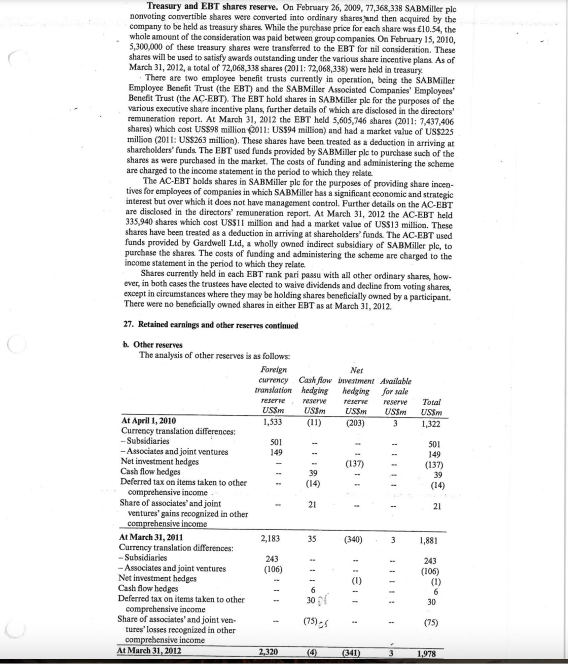

Required - Make all journal entries indicated for FY 2012 using pages 3 and 4. Observe that positive R/E and Reserve numbers are credits and negative numbers are debits to R/E and Reserves. Your analyses must show the accounts that are Credited and Debited against the DRs and CRs made in the R/E account and in the OCI Reserve accounts.

This is a critical analysis and thinking case that requires you to analyze incomplete information and synthesize a solution drawing upon mostly Intermediate Accounting knowledge and information gained from the IFRS text. The MSWord file email attachment should be one page (the last page completed).

:

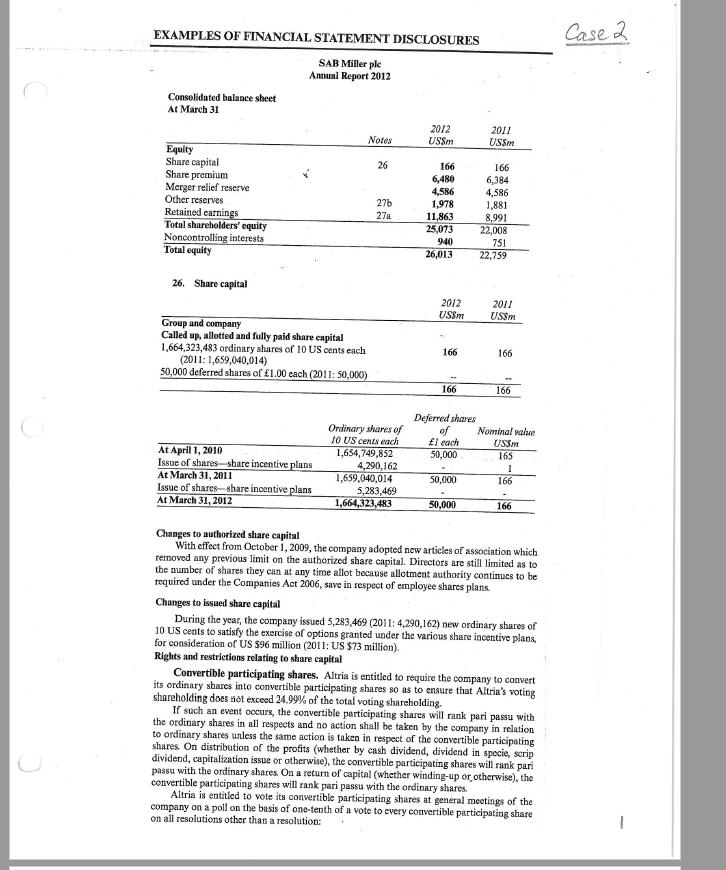

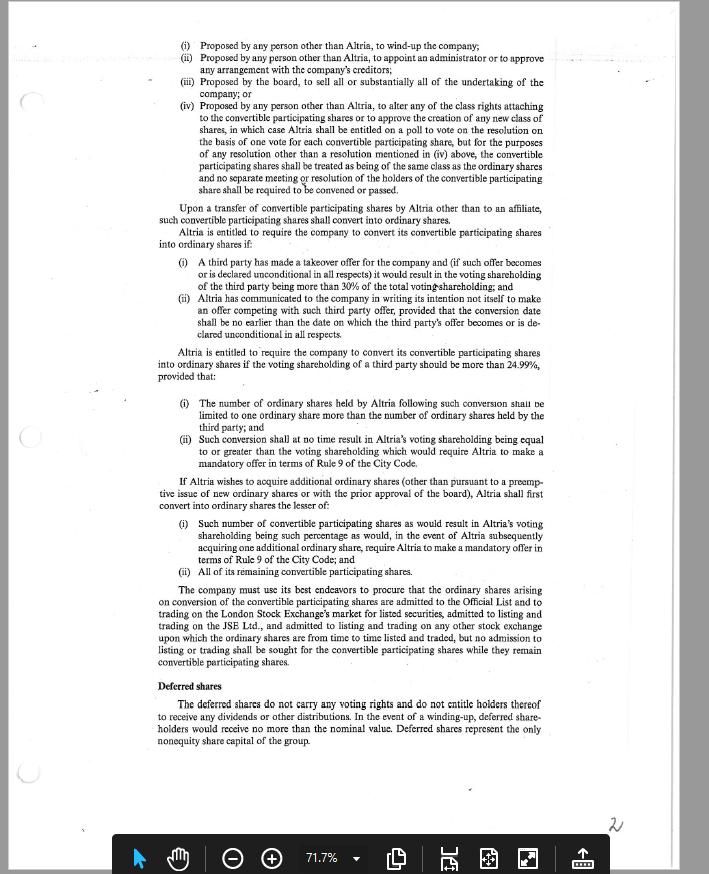

EXAMPLES OF FINANCIAL STATEMENT DISCLOSURES SAB Miller ple Annual Report 2012 Consolidated balance sheet At March 31 Equity Share capital Share premium Merger relief reserve Other reserves Retained earnings Total shareholders' equity Noncontrolling interests Total equity 26. Share capital Group and company Called up, allotted and fully paid share capital 1,664,323,483 ordinary shares of 10 US cents each (2011: 1,659,040,014) 50,000 deferred shares of 1.00 each (2011: 50,000) At April 1, 2010 Issue of shares-share incentive plans Notes At March 31, 2011 Issue of shares-share incentive plans At March 31, 2012 26 276 27a Ordinary shares of 10 US cents each 1,654,749,852 4,290,162 1,659,040,014 5,283,469 1,664,323,483 2012 USSM 166 6,480 4,586 1,978 11,863 25,073 940 26,013 2012 US$m 166 166 Deferred shares of 1 each 50,000 50,000 50,000 2011 US$m 166 6,384 4,586 1,881 8,991 22,008 751 22,759 2011 USSM 166 166 Nominal value US$m 165 1 166 166 Changes to authorized share capital With effect from October 1, 2009, the company adopted new articles of association which removed any previous limit on the authorized share capital. Directors are still limited as to the number of shares they can at any time allot because allotment authority continues to be required under the Companies Act 2006, save in respect of employee shares plans. Changes to issued share capital During the year, the company issued 5,283,469 (2011: 4,290,162) new ordinary shares of 10 US cents to satisfy the exercise of options granted under the various share incentive plans, for consideration of US $96 million (2011: US $73 million). Rights and restrictions relating to share capital Convertible participating shares. Altria is entitled to require the company to convert its ordinary shares into convertible participating shares so as to ensure that Altria's voting shareholding does not exceed 24.99% of the total voting shareholding. If such an event occurs, the convertible participating shares will rank pari passu with the ordinary shares in all respects and no action shall be taken by the company in relation to ordinary shares unless the same action is taken in respect of the convertible participating shares. On distribution of the profits (whether by cash dividend, dividend in specie, scrip dividend, capitalization issue or otherwise), the convertible participating shares will rank pari passu with the ordinary shares. On a return of capital (whether winding-up or otherwise), the convertible participating shares will rank pari passu with the ordinary shares. Altria is entitled to vote its convertible participating shares at general meetings of the company on a poll on the basis of one-tenth of a vote to every convertible participating share on all resolutions other than a resolution: Case 2

Step by Step Solution

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Journal Entries for FY 2012 Page 3 Date Account Debit Credit 20120331 Convertible Participating Shares 1664321413 Share Capital 20120331 Issue of SharesShare Purchase Plan 52434800 Share Capital 20120... View full answer

Get step-by-step solutions from verified subject matter experts