Question: This is a complete question. Don't send it back incomplete if you don't know how to solve. I also don't have the listed options to

This is a complete question. Don't send it back incomplete if you don't know how to solve.

I also don't have the listed options to post.

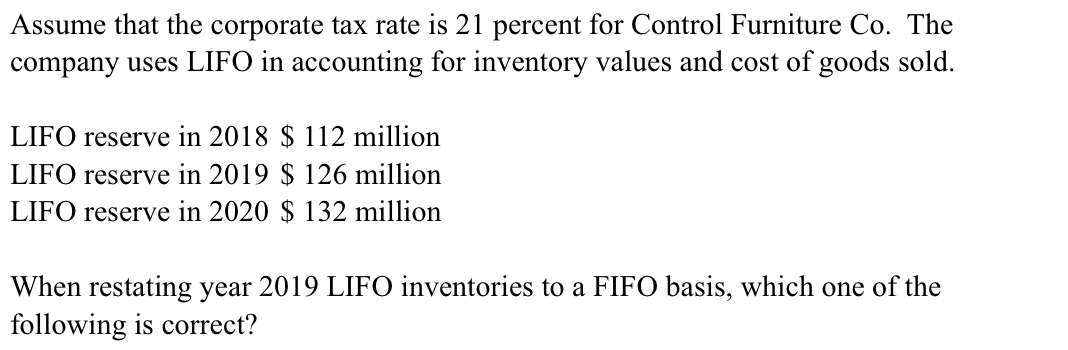

Assume that the corporate tax rate is 21 percent for Control Furniture Co. The company uses LIFO in accounting for inventory values and cost of goods sold. LIFO reserve in 2018 $ 112 million LIFO reserve in 2019 $ 126 million LIFO reserve in 2020 $ 132 million When restating year 2019 LIFO inventories to a FIFO basis, which one of the following is correct? Assume that the corporate tax rate is 21 percent for Control Furniture Co. The company uses LIFO in accounting for inventory values and cost of goods sold. LIFO reserve in 2018 $ 112 million LIFO reserve in 2019 $ 126 million LIFO reserve in 2020 $ 132 million When restating year 2019 LIFO inventories to a FIFO basis, which one of the following is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts