Question: This is a cost accounting problem, please show all work. New equipment purchase, income taxes. Ella's Bakery plans to purchase a new oven for its

This is a cost accounting problem, please show all work.

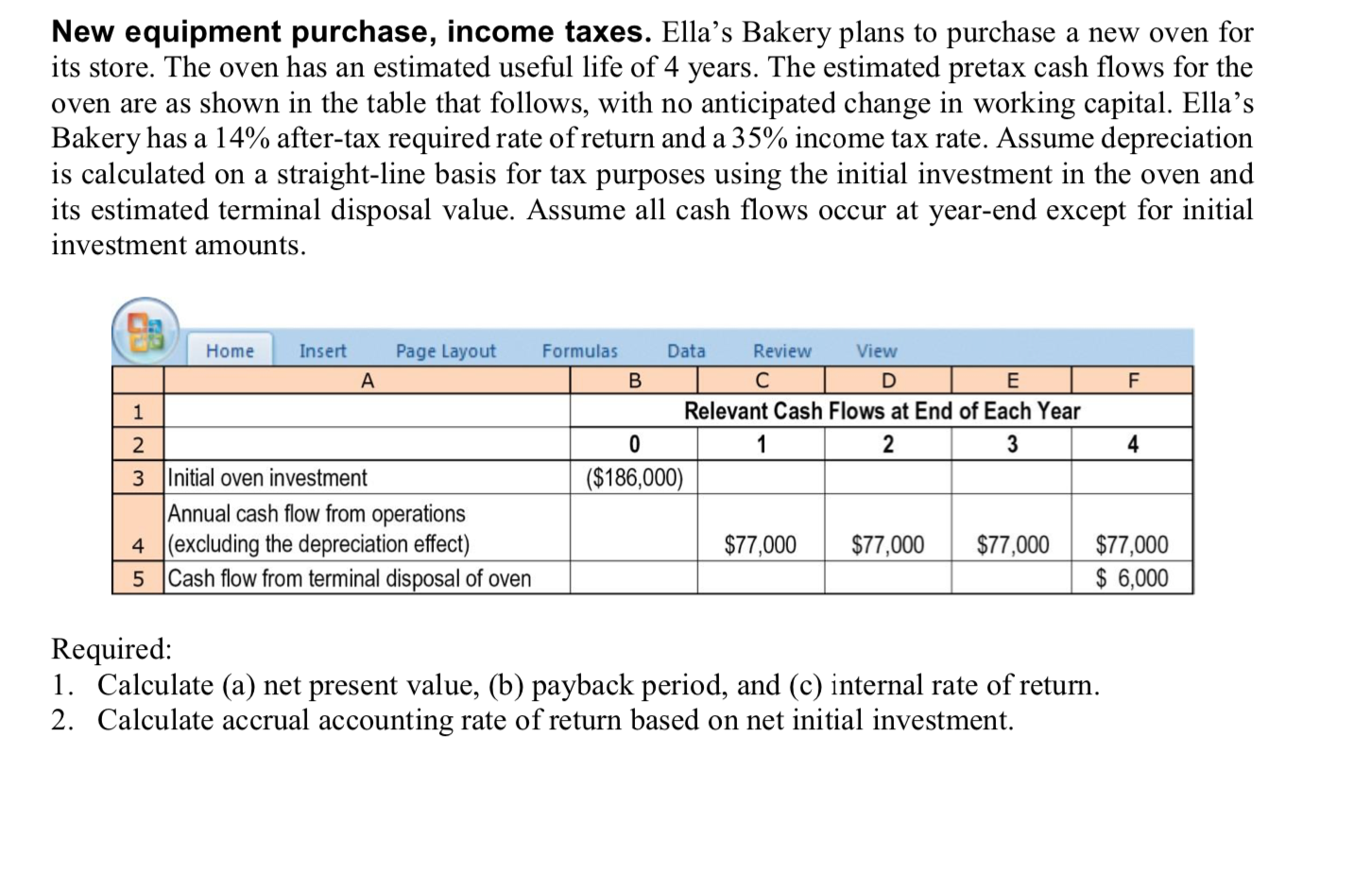

New equipment purchase, income taxes. Ella's Bakery plans to purchase a new oven for its store. The oven has an estimated useful life of 4 years. The estimated pretax cash flows for the oven are as shown in the table that follows, with no anticipated change in working capital. Ella's Bakery has a 14% after-tax required rate of return and a 35% income tax rate. Assume depreciation is calculated on a straight-line basis for tax purposes using the initial investment in the oven and its estimated terminal disposal value. Assume all cash flows occur at year-end except for initial investment amounts. Home Insert Page Layout . B F Formulas Data Review View C D E Relevant Cash Flows at End of Each Year 0 1 2 3 / ($186,000) 4 2 3 Initial oven investment |Annual cash flow from operations 4 l(excluding the depreciation effect) 5 Cash flow from terminal disposal of oven $77,000 $77,000 $77,000 $77,000 $ 6,000 Required: 1. Calculate (a) net present value, (b) payback period, and (c) internal rate of return. 2. Calculate accrual accounting rate of return based on net initial investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts