Question: This is a custom problem I think this is based on chapter 21, #31. the excel format is a mess in copy and paste Smith

This is a custom problem I think this is based on chapter 21, #31. the excel format is a mess in copy and paste

This is a custom problem I think this is based on chapter 21, #31. the excel format is a mess in copy and paste

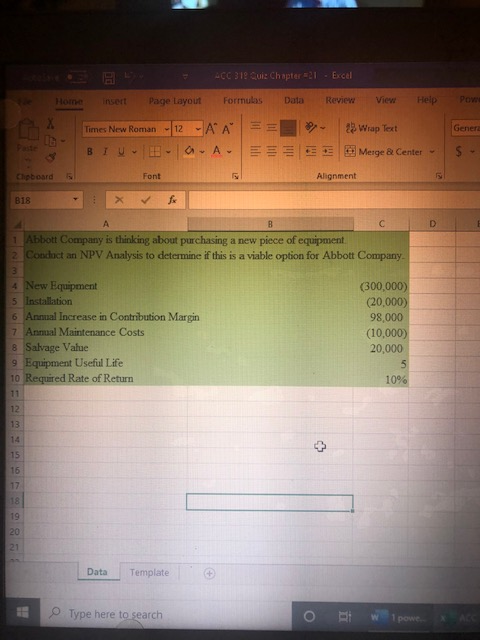

| Smith Company is thinking about purchasing a new piece of equipment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Conduct an NPV Analysis to determine if this is a viable option for Smith Company. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| data: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Equipment | (300,000) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Installation | (20,000) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Increase in Contribution Margin | 98,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Maintenance Costs | (10,000) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Salvage Value | 20,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equipment Useful Life | 5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Required Rate of Return template:

| 10% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

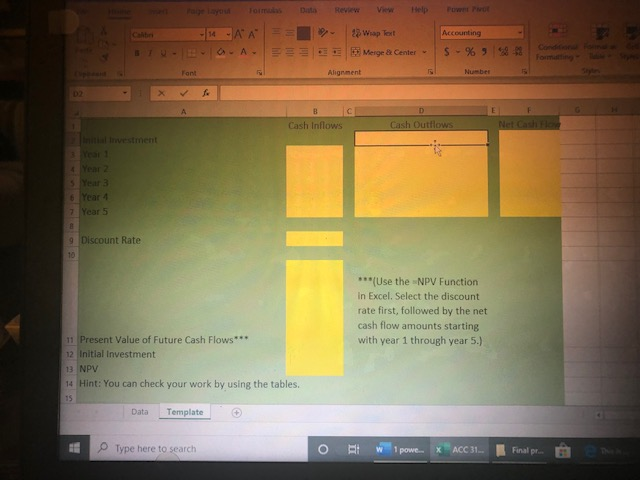

- BL A CC 31 Cui: Chapter 21 - Excel Home insert Page Layout Formulas Data Review View H elp Powe E Genera - EE 23 Wrap Text Mergea Center Times New Roman 12AA BIU -a. A. Font - x for Clipboard Alignment B18 Abbott Company is thinking about purchasing a new piece of equipment 2 Concoct an NPV Analysis to determine if this is a viable option for Abbott Company 4 New Equipment 5 Installation 6 Annual Increase in Contribution Margin 7 Annual Maintenance Costs 8 Salvage Value 9 Equipment Useful Life 10 Required Rate of Return (300,000) (20,000) 98,000 (10,000) 20,000 10% Data Template Type here to search o w I power x Ace Cabiri Accounting AA = A Wap Test Mero Center S C BU Formatting Font Alignment Number Cash Inflows Cash Outflows Net Cash Fle 4 Year 2 5 Year 3 6 Year 4 7 Year 5 9 Discount Rate ***Use the NPV Function In Excel. Select the discount rate first, followed by the net cash flow amounts starting with year 1 through year 5.) 11 Present Value of Future Cash Flows*** 12 Initial Investment 13 NPV 14 Hint: You can check your work by using the tables. Data Template Type here to search O t w pow. * ACC 31. Final pe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts