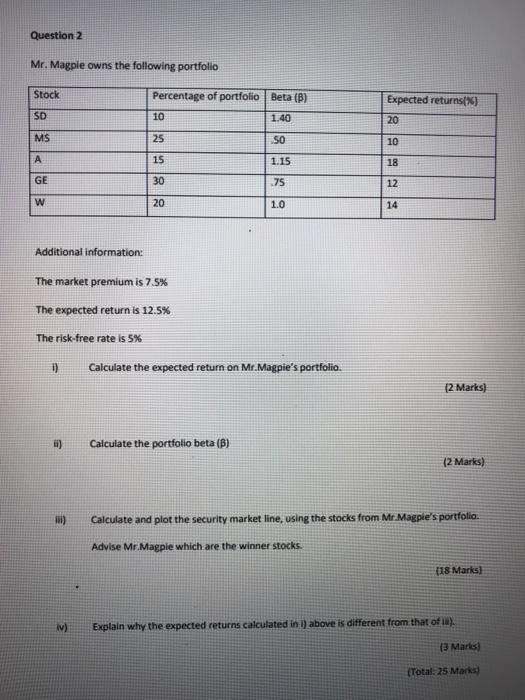

Question: this is a degree level question. Question 2 Mr. Magple owns the following portfolio Stock Percentage of portfolio Beta (B) 10 1.40 Expected returns(%) 20

Question 2 Mr. Magple owns the following portfolio Stock Percentage of portfolio Beta (B) 10 1.40 Expected returns(%) 20 SD MS 25 SO 10 A 15 1.15 18 GE 30 .75 12 w 20 1.0 14 Additional information: The market premium is 7.5% The expected return is 12.5% The risk-free rate is 5% 0) Calculate the expected return on Mr.Magpie's portfolio. 2 Marks) i) Calculate the portfolio beta (B) (2 Marks) 1) Calculate and plot the security market line, using the stocks from Mr. Magple's portfolio. Advise Mr.Magpie which are the winner stocks. 18 Marks W) Explain why the expected returns calculated in 1) above is different from that of l). (3 Marts) (Total: 25 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts