Question: This is a financial maths problem. Exercise 4 (20 points) Consider the Heston model for the Q-dynamics of a risky asset S: dSt = S4(rdt

This is a financial maths problem.

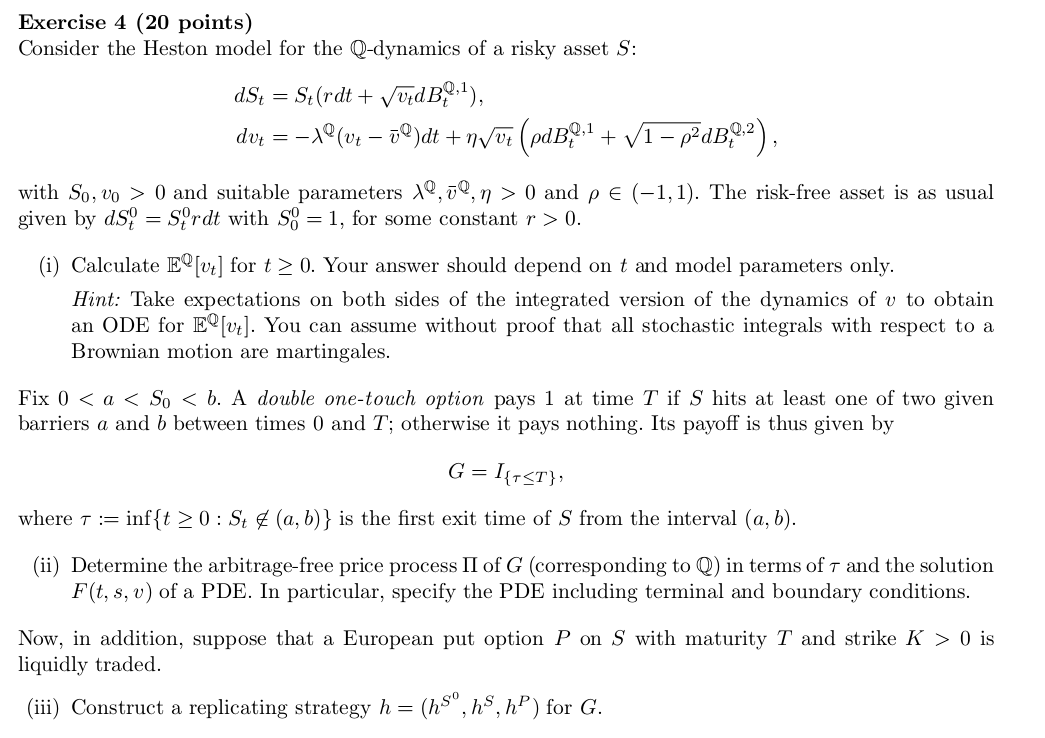

Exercise 4 (20 points) Consider the Heston model for the Q-dynamics of a risky asset S: dSt = S4(rdt + VvdB9,1), dut = - --1(v2 @)dt + n vor (pdBo:1 + V1 p2dB.2), with So, vo > 0) and suitable parameters 10,7Q, n > 0) and pe (-1,1). The risk-free asset is as usual given by ds; = Syrdt with so = 1, for some constant r > 0. (i) Calculate E (vt] for t > 0. Your answer should depend on t and model parameters only. Hint: Take expectations on both sides of the integrated version of the dynamics of v to obtain an ODE for E@ [ut]. You can assume without proof that all stochastic integrals with respect to a Brownian motion are martingales. Fix 0) 0: St& (a,b)} is the first exit time of S from the interval (a,b). (ii) Determine the arbitrage-free price process II of G (corresponding to Q) in terms of t and the solution F(t, s, v) of a PDE. In particular, specify the PDE including terminal and boundary conditions. Now, in addition, suppose that a European put option P on S with maturity T and strike K > O is liquidly traded. (iii) Construct a replicating strategy h = . (hso ", h, hP) for G. Exercise 4 (20 points) Consider the Heston model for the Q-dynamics of a risky asset S: dSt = S4(rdt + VvdB9,1), dut = - --1(v2 @)dt + n vor (pdBo:1 + V1 p2dB.2), with So, vo > 0) and suitable parameters 10,7Q, n > 0) and pe (-1,1). The risk-free asset is as usual given by ds; = Syrdt with so = 1, for some constant r > 0. (i) Calculate E (vt] for t > 0. Your answer should depend on t and model parameters only. Hint: Take expectations on both sides of the integrated version of the dynamics of v to obtain an ODE for E@ [ut]. You can assume without proof that all stochastic integrals with respect to a Brownian motion are martingales. Fix 0) 0: St& (a,b)} is the first exit time of S from the interval (a,b). (ii) Determine the arbitrage-free price process II of G (corresponding to Q) in terms of t and the solution F(t, s, v) of a PDE. In particular, specify the PDE including terminal and boundary conditions. Now, in addition, suppose that a European put option P on S with maturity T and strike K > O is liquidly traded. (iii) Construct a replicating strategy h = . (hso ", h, hP) for G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts