Question: This is a financial reporting question. I do not understand where the 19200 and 0.6 came from in question 94. I also do not understand

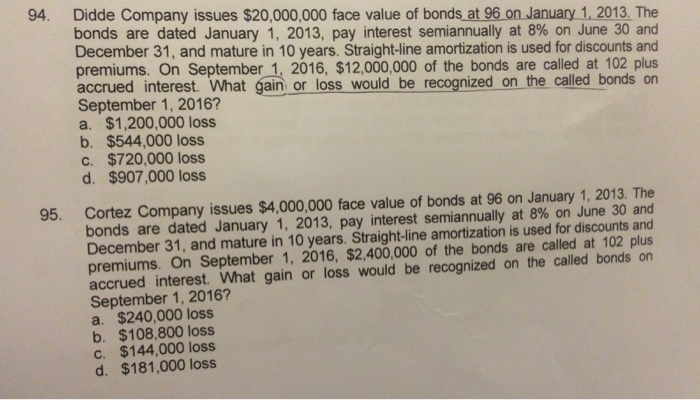

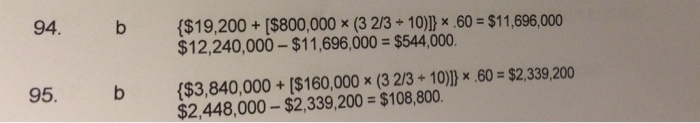

94. Didde Company issues $20,000,000 face value of bonds at 96 on January 1, 2013. The bonds are dated January 1, 2013, pay interest semiannually at 8% on June 30 and December 31, and mature in 10 years. Straight-line amortization is used for discounts and premiums. On September 1, 2016, $12,000,000 of the bonds are called at 102 plus accrued interest. What gain or loss would be recognized on the called bonds on September 1, 2016? a. $1,200,000 loss b. $544,000 loss c. $720,000 loss d. $907,000 loss Cortez Company issues $4,000,000 face value of bonds at 96 on January 1, 2013. The bonds are dated January 1, 2013, pay interest semiannually at 8% on June 30 and December 31, and mature in 10 years. Straight-line amortization is used for discounts and premiums. On September 1, 2016, $2,400,000 of the bonds are called at 102 plus accrued interest. What gain or loss would be recognized on the called bonds on September 1, 2016? a. $240,000 loss b. $108,800 loss c. $144,000 loss d. $181,000 loss 95. 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts