Question: This is a graded discussion: 10 points possible due Dec 2 Chapter 11 Discussion Board At 3 Sydnee Jacobs For this Discussion Board please post

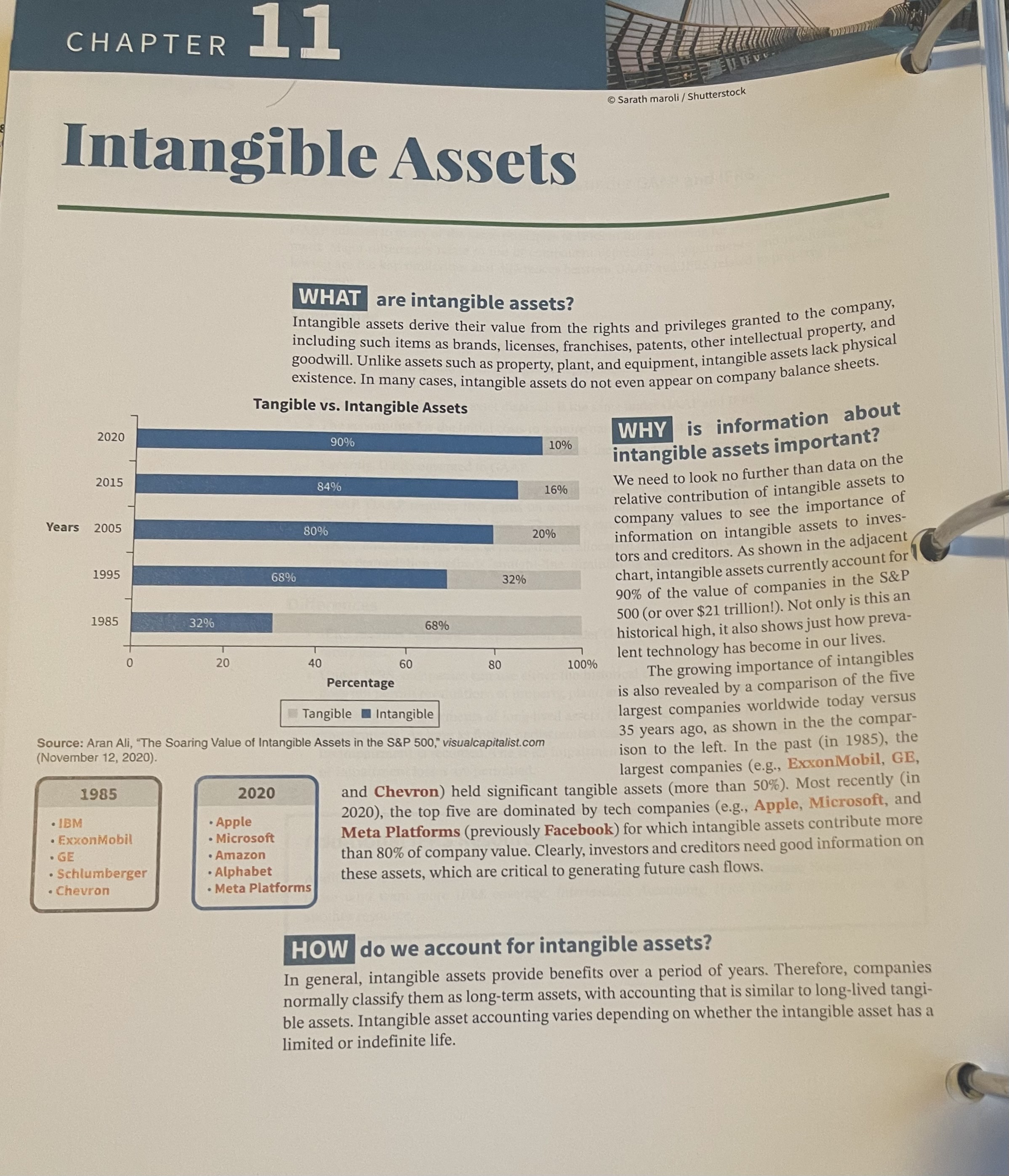

This is a graded discussion: 10 points possible due Dec 2 Chapter 11 Discussion Board At 3 Sydnee Jacobs For this Discussion Board please post about something you learned in this chapter. This is a chance to practice explaining an accounting topic which will help you solidify what you are learning. This should be in your own words, you will not get credit if you are simply copy and pasting something from the book. You will also need to reply to two other students in the discussion board. Lets get the conversation rolling!CHAPTER 11 Sarath maroli / Shutterstock Intangible Assets WHAT are intangible assets? Intangible assets derive their value from the rights and privileges granted to the company, including such items as brands, licenses, franchises, patents, other intellectual property, and goodwill. Unlike assets such as property, plant, and equipment, intangible assets lack physical existence. In many cases, intangible assets do not even appear on company balance sheets. Tangible vs. Intangible Assets 2020 90% WHY is information about 10% intangible assets important? 2015 84% We need to look no further than data on the 16% relative contribution of intangible assets to Years company values to see the importance of 80% 20% information on intangible assets to inves- tors and creditors. As shown in the adjacent 1995 68% 32% chart, intangible assets currently account for 90% of the value of companies in the S&P 1985 32% 500 (or over $21 trillion!). Not only is this an 68% historical high, it also shows just how preva- 20 40 60 lent technology has become in our lives. 80 100% Percentage The growing importance of intangibles is also revealed by a comparison of the five Tangible Intangible largest companies worldwide today versus Source: Aran Ali, "The Soaring Value of Intangible Assets in the S&P 500," visualcapitalist.com 35 years ago, as shown in the the compar- (November 12, 2020). ison to the left. In the past (in 1985), the largest companies (e.g., ExxonMobil, GE, 1985 2020 and Chevron) held significant tangible assets (more than 50%). Most recently (in IBM . Apple 2020), the top five are dominated by tech companies (e.g., Apple, Microsoft, and . ExxonMobil . Microsoft Meta Platforms (previously Facebook) for which intangible assets contribute more . GE . Amazon than 80% of company value. Clearly, investors and creditors need good information on . Schlumberger . Alphabet . Chevron . Meta Platforms these assets, which are critical to generating future cash flows. HOW do we account for intangible assets? In general, intangible assets provide benefits over a period of years. Therefore, companies normally classify them as long-term assets, with accounting that is similar to long-lived tangi- ble assets. Intangible asset accounting varies depending on whether the intangible asset has a limited or indefinite life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts