Question: This is a long question. So could you just answer questions as many as you can? Thank you very much. Consider the four bonds having

This is a long question. So could you just answer questions as many as you can? Thank you very much.

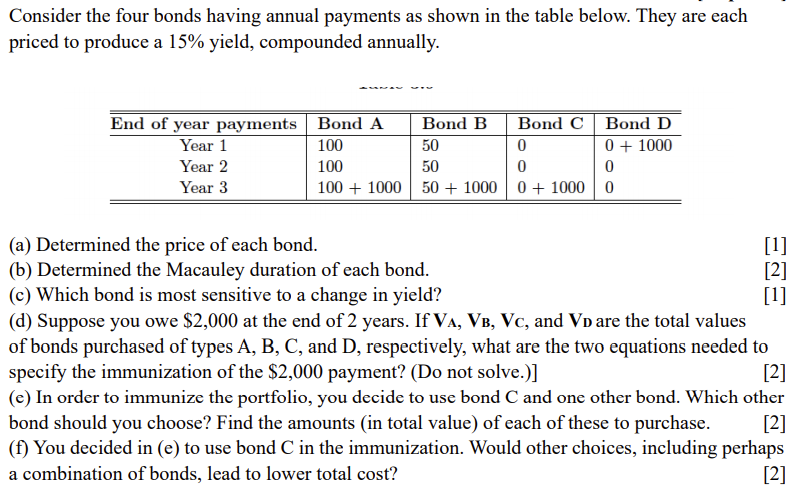

Consider the four bonds having annual payments as shown in the table below. They are each priced to produce a 15% yield, compounded annually. 50 End of year payments Bond A Year 1 100 Year 2 100 Year 3 100 + 1000 Bond B Bond C Bond D 0 0 + 1000 50 0 0 50 + 10000 + 10000 (a) Determined the price of each bond. [1] (b) Determined the Macauley duration of each bond. [2] (c) Which bond is most sensitive to a change in yield? [1] (d) Suppose you owe $2,000 at the end of 2 years. If Va, VB, Vc, and Vd are the total values of bonds purchased of types A, B, C, and D, respectively, what are the two equations needed to specify the immunization of the $2,000 payment? (Do not solve.)] [2] (e) In order to immunize the portfolio, you decide to use bond C and one other bond. Which other bond should you choose? Find the amounts (in total value) of each of these to purchase. [2] (f) You decided in (e) to use bond C in the immunization. Would other choices, including perhaps a combination of bonds, lead to lower total cost? [2]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts