Question: This is a management decision making questions. I need this back later on ASAP. A stock market advisory service offers three irvestments portfolios for one

This is a management decision making questions.

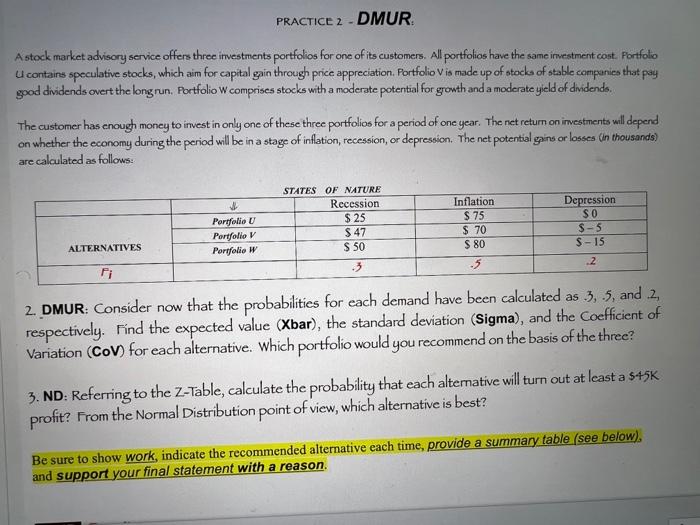

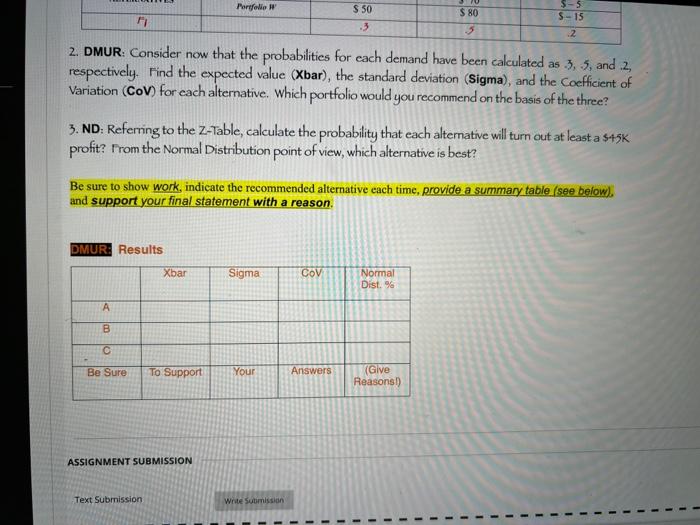

A stock market advisory service offers three irvestments portfolios for one of its customers. All portfolios have the same investment cost. Fortfolio U contains speculative stocks, which aim for capital gain through price appreciation. Portfolio V is made up of stocks of stable companies that pay good dividends overt the long run. Portfolio W comprises stocks with a moderate potential for gowth and a moderate yield of dividends. The customer has enough money to imvest in only one of these three portfolios for a period of one year. The net return on imestments will depend on whether the economy during the period will be in a stage of inflation, recession, or depression. The net potential gains or losses (in thousands) are calculated as follows: 2. DMUR: Consider now that the probabilities for each demand have been calculated as 3,.5, and, 2, respectively. Find the expected value (Xbar), the standard deviation (Sigma), and the Coefficient of Variation (CoV) for each alternative. Which portfolio would you recommend on the basis of the three? 3. ND: Referring to the Z-Table, calculate the probability that each alternative will turn out at least a 545K profit? From the Normal Distribution point of view, which alternative is best? Be sure to show work, indicate the recommended alternative each time, provide a summary table (see below). and support your final statement with a reason. 2. DMUR: Consider now that the probabilities for each demand have been calculated as 3,.5, and .2, respectively. Find the expected value (Xbar), the standard deviation (Sigma), and the Coefficient of Variation (CoV) for each alternative. Which portfolio would you recommend on the basis of the three? 3. ND: Referning to the Z-Table, calculate the probability that each altemative will turn out at least a \$45K profit? From the Normal Distribution point of view, which alternative is best? Be sure to show work, indicate the recommended alternative each time, provide a summary table (see below). and support your final statement with a reason. DMUR: Results ASSIGNMENT SUBMISSION

I need this back later on "ASAP".

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock