Question: this is a multi part question, please answer all problems please!! The Camping Division of XG Company is operated as a profit center. Sales for

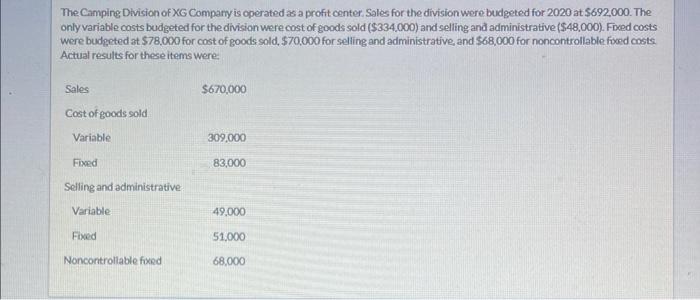

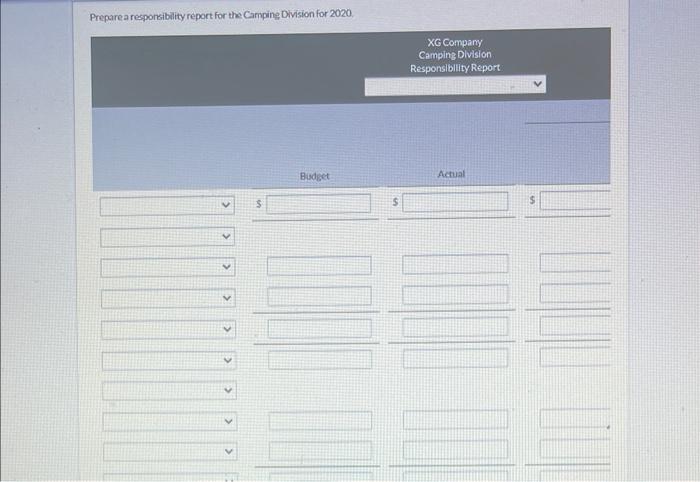

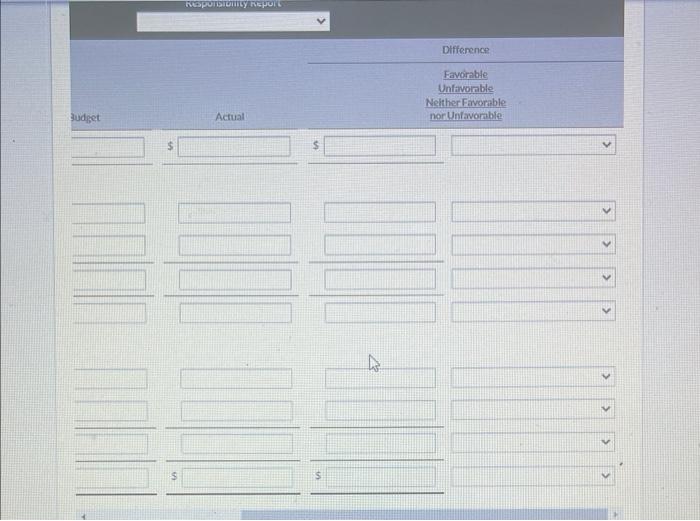

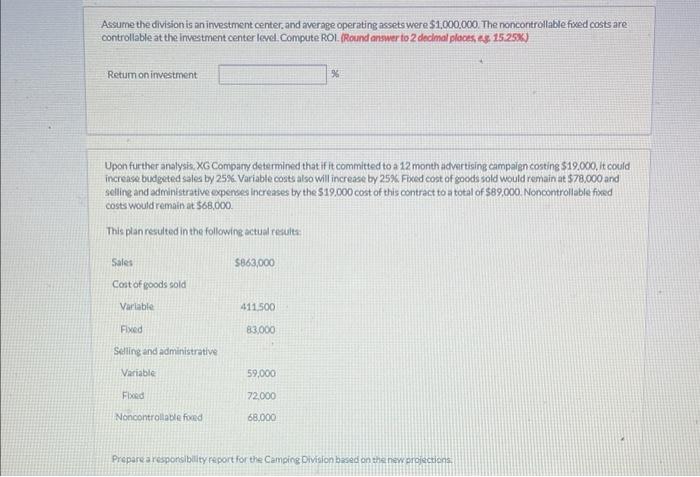

The Camping Division of XG Company is operated as a profit center. Sales for the division were budgeted for 2020 at $692,000. The onlyvariable costs budgeted for the division were cost of goods sold ($334,000) and selling and administrative ($48,000). FDed costs were budgeted at $78,000 for cost of goods sold, $70.000 for selling and administrative, and \$68,000 for noncontrollable food costs Actual results for these items were. Drwinare a roenonsiblitu renort for the Campine Division for 2020 Assume the division is an investment center. and average operating assets were 51,000.000. The noncontrollable fived costs are: controllable at the investment center level. Compute ROL. Round answer to 2 dechmal ploces, es. 15250W ) Retum on imestment Upon further analysis. XG Compary determined that if it committed to a 12 month advartising campaign costing $19,000, it could increase budgeted sales by 25% Variable costs also will increase by 25%. Fixed cost of goods sold would rem ain at $78.000 and selling and administrative epenses increases by the $19,000 cost of this contract to a total of $89,000. Noncontrollable fixed costs would remain at $68,000. This planresulted in the following actual resulte: Preparearesponsibutity report for the Camping Division based on the new erefectient Did the increase in advertising benefit the compary? The increasein advertising the compary. Assume the division is an imvestment center, and average operating assets were $1,000,000. The noncontrollable fixed oosts are controllable at the irvestment center level. Compute ROI. (Round answer to 2 decimel plocks t. . 15.25\%) Return on imvestment of Indicate the impact of the change on ROH. (Round onswer to 2 decimol placith e.s. 15.25% ) Returnon impstment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts