Question: This is a multiple choice question but please provide an explanation using graphs and/or equations. thanks! b (10 points) Consider a monetary policy regime in

This is a multiple choice question but please provide an explanation using graphs and/or equations. thanks!

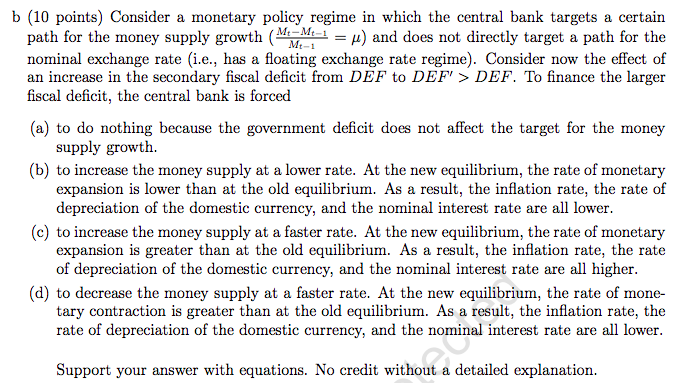

b (10 points) Consider a monetary policy regime in which the central bank targets a certain path for the money supply growth ( t-1 = p) and does not directly target a path for the nominal exchange rate (i.e., has a floating exchange rate regime). Consider now the effect of an increase in the secondary fiscal deficit from DEF to DEF' > DEF. To finance the larger fiscal deficit, the central bank is forced (a) to do nothing because the government deficit does not affect the target for the money supply growth. (b) to increase the money supply at a lower rate. At the new equilibrium, the rate of monetary expansion is lower than at the old equilibrium. As a result, the inflation rate, the rate of depreciation of the domestic currency, and the nominal interest rate are all lower. (c) to increase the money supply at a faster rate. At the new equilibrium, the rate of monetary expansion is greater than at the old equilibrium. As a result, the inflation rate, the rate of depreciation of the domestic currency, and the nominal interest rate are all higher. (d) to decrease the money supply at a faster rate. At the new equilibrium, the rate of mone- tary contraction is greater than at the old equilibrium. As a result, the inflation rate, the rate of depreciation of the domestic currency, and the nominal interest rate are all lower. Support your answer with equations. No credit without a detailed explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts