Question: This is a multiply choice 1. Catch Air 2. Zip 3. G-Force 4. Bogus Question. You cannot use NPV to compare projects with unequal lives.

This is a multiply choice

1. Catch Air

2. Zip

3. G-Force

4. Bogus Question. You cannot use NPV to compare projects with unequal lives.

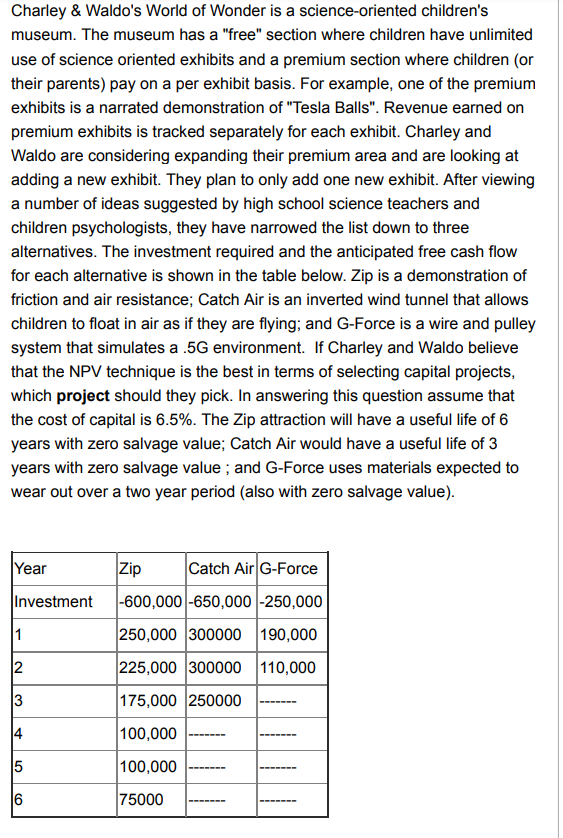

Charley & Waldo's World of Wonder is a science-oriented children's museum. The museum has a "free" section where children have unlimited use of science oriented exhibits and a premium section where children (or their parents) pay on a per exhibit basis. For example, one of the premium exhibits is a narrated demonstration of "Tesla Balls". Revenue earned on premium exhibits is tracked separately for each exhibit. Charley and Waldo are considering expanding their premium area and are looking at adding a new exhibit. They plan to only add one new exhibit. After viewing a number of ideas suggested by high school science teachers and children psychologists, they have narrowed the list down to three alternatives. The investment required and the anticipated free cash flow for each alternative is shown in the table below. Zip is a demonstration of friction and air resistance; Catch Air is an inverted wind tunnel that allows children to float in air as if they are flying; and G-Force is a wire and pulley system that simulates a .5G environment. If Charley and Waldo believe that the NPV technique is the best in terms of selecting capital projects, which project should they pick. In answering this question assume that the cost of capital is 6.5%. The Zip attraction will have a useful life of 6 years with zero salvage value; Catch Air would have a useful life of 3 years with zero salvage value; and G-Force uses materials expected to wear out over a two year period (also with zero salvage value). Year Zip Catch Air G-Force Investment -600,000 -650,000 -250,000 1 250,000 300000 190,000 2 225,000 300000 110,000 3 175,000 250000 4 100,000 5 100,000 6 75000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts