Question: This is a practice problem to get a basic understanding of these sheets. Can some one please help me out so I can use the

This is a practice problem to get a basic understanding of these sheets. Can some one please help me out so I can use the example. income statement, retained earnings and balance sheet.

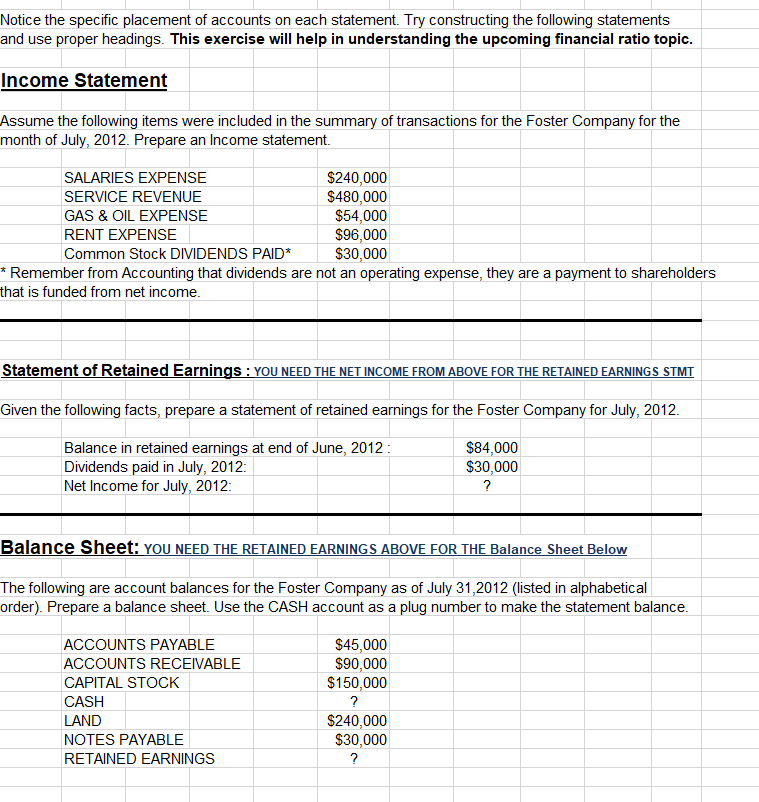

Notice the specific placement of accounts on each statement. Try constructing the following statements and use proper headings. This exercise will help in understanding the upcoming financial ratio topic. Income Statement Assume the following items were included in the summary of transactions for the Foster Company for the month of July, 2012. Prepare an Income statement. SALARIES EXPENSE SERVICE REVENUE $240,000 $480,000 $54,000 GAS & OIL EXPENSE RENT EXPENSE $96,000 Common Stock DIVIDENDS PAID* $30,000 * Remember from Accounting that dividends are not an operating expense, they are a payment to shareholders that is funded from net income. Statement of Retained Earnings: YOU NEED THE NET INCOME FROM ABOVE FOR THE RETAINED EARNINGS STMT Given the following facts, prepare a statement of retained earnings for the Foster Company for July, 2012. Balance in retained earnings at end of June, 2012: $84,000 $30,000 Dividends paid in July, 2012: Net Income for July, 2012: ? Balance Sheet: YOU NEED THE RETAINED EARNINGS ABOVE FOR THE Balance Sheet Below The following are account balances for the Foster Company as of July 31,2012 (listed in alphabetical order). Prepare a balance sheet. Use the CASH account as a plug number to make the statement balance. ACCOUNTS PAYABLE $45,000 ACCOUNTS RECEIVABLE $90,000 CAPITAL STOCK $150,000 CASH ? LAND $240,000 $30,000 NOTES PAYABLE RETAINED EARNINGS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts