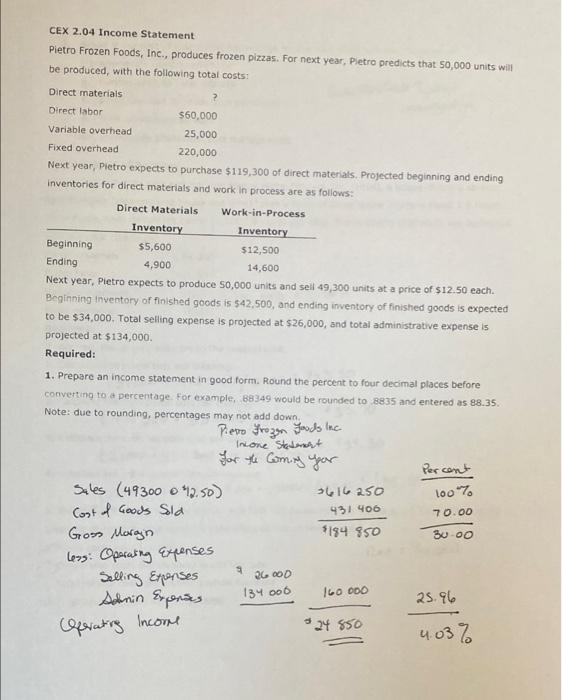

Question: this is a practice worksheet given to me from my cost accounting class. can someone please help me understand how to calculate the percentages given

CEX 2.04 Income Statement Pietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietro predicts that 50,000 units will be produced, with the following total costs: Direct materials Direct labor $60,000 Variable overhead 25,000 Fixed overhead 220,000 Next year, Pietro expects to purchase $119,300 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows: Direct Materials Work-in-Process Inventory Inventory Beginning $5,600 $12,500 Ending 4,900 14,600 Next year, Pietro expects to produce 50,000 units and sell 49,300 units at a price of $12.50 each. Beginning Inventory of finished goods is 542,500, and ending inventory of finished goods is expected to be $34,000. Total selling expense is projected at $26,000, and total administrative expense is projected at $134,000. Required: 1. Prepare an income statement in good form. Round the percent to four decimal places before converting to a percentage. For example, 38349 would be rounded to 8835 and entered as 88.35. Note: due to rounding, percentages may not add down Piero Frozen Foods Inc. In one Statement for the Comy you Percent Sales (49300 412.50) Cost of Goods Sold 70.00 Goss Morgan $194 950 3000 less: Operating Expenses Selling Expenses 160 000 Sanin Expenses 25. $24850 4.03% 1007 431 406 9 26000 134 006 Glerating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts