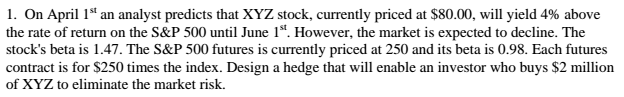

Question: This is a problem about hedging. Can anyone help me with this? On April 1st an analyst predicts that XYZ stock, currently priced a $80.00,

This is a problem about hedging. Can anyone help me with this?

On April 1st an analyst predicts that XYZ stock, currently priced a $80.00, will yield 4% above the rate of return on the S&P 500 until June However, the market is expected to decline. 'The stock's beta is 1.47. The S&P 500 futures is currently priced at 250 and its beta Is 0.98. Each futures contract is for $250 times the index. Design a hedge that will enable an investor who buys $2 million of XYZ to eliminate the market risc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts