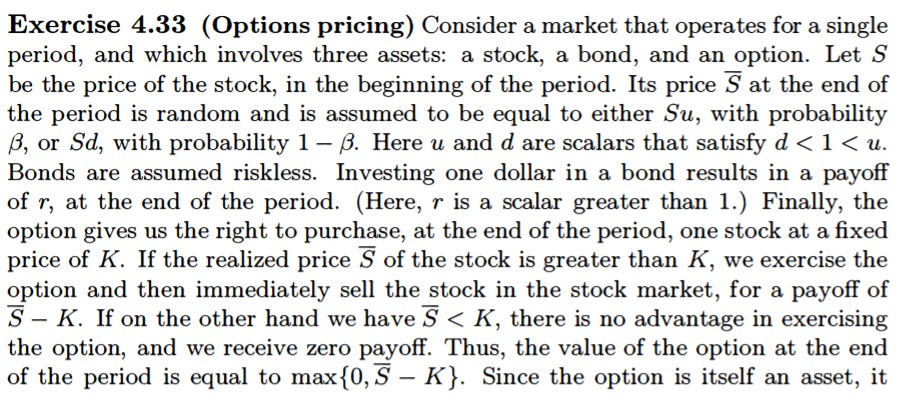

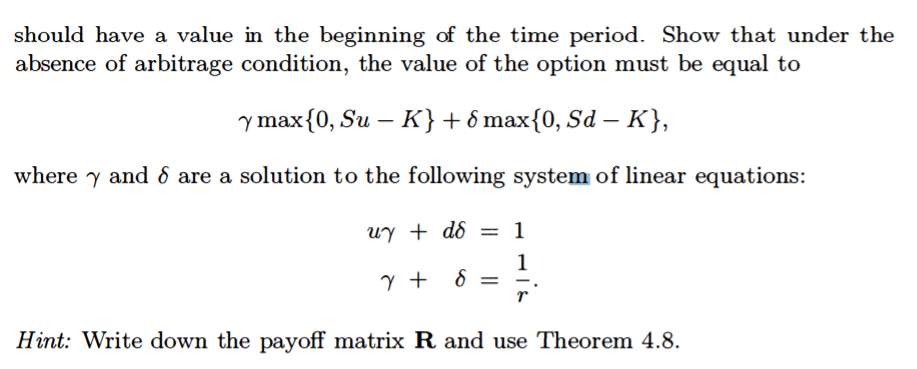

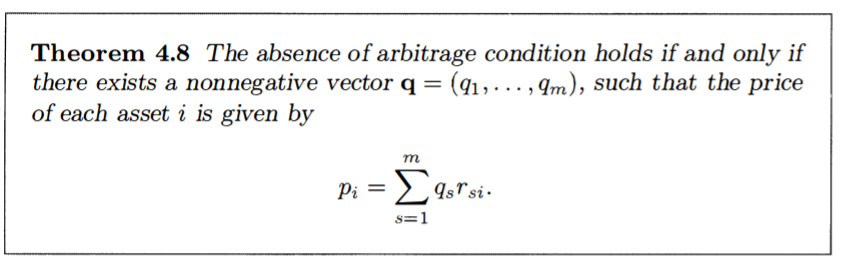

Question: This is a problem from Introduction to Linear Optimization by Dimitris Bertsimas and John N. Tsitsiklis . Exercise 4.33 (Options pricing) Consider a market that

This is a problem from

Introduction to Linear Optimization by Dimitris Bertsimas and John N. Tsitsiklis.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts