Question: This is a problem involving the following interest rate tree of 1 -year rates in which all transition probabilities are 50%, and all rates given

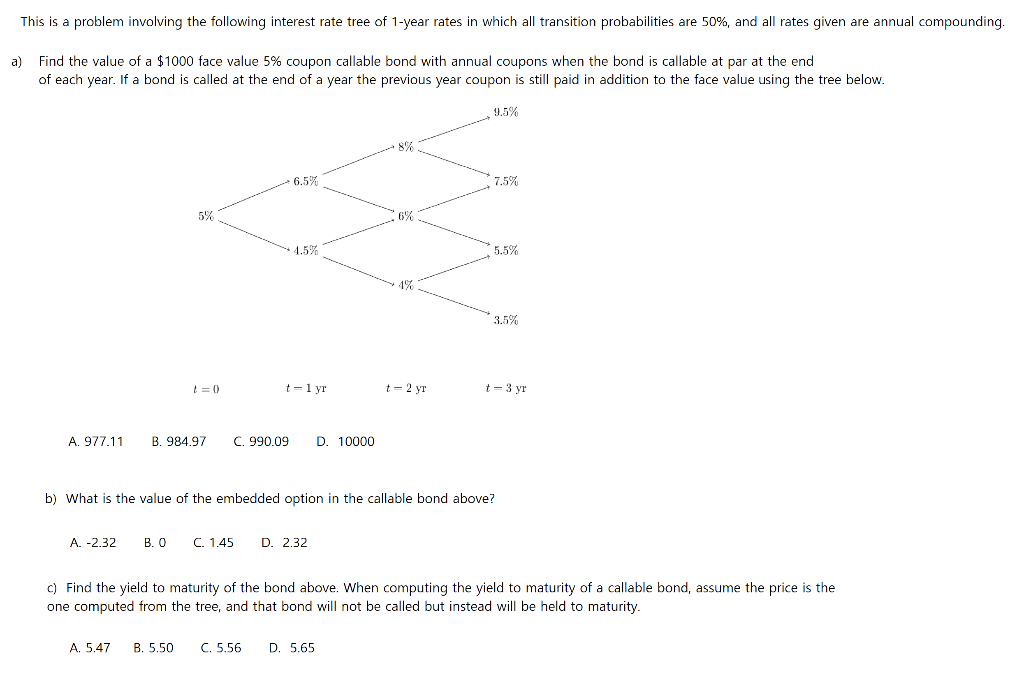

This is a problem involving the following interest rate tree of 1 -year rates in which all transition probabilities are 50%, and all rates given are annual compounding. a) Find the value of a $1000 face value 5% coupon callable bond with annual coupons when the bond is callable at par at the end of each year. If a bond is called at the end of a year the previous year coupon is still paid in addition to the face value using the tree below. t=0t=1yrt=2yrt=3yr A. 977.11 B. 984.97 C. 990.09 D. 10000 b) What is the value of the embedded option in the callable bond above? A. -2.32 B. 0 C. 1.45 D. 2.32 c) Find the yield to maturity of the bond above. When computing the yield to maturity of a callable bond, assume the price is the one computed from the tree, and that bond will not be called but instead will be held to maturity. A. 5.47 B. 5.50 C. 5.56 D. 5.65 This is a problem involving the following interest rate tree of 1 -year rates in which all transition probabilities are 50%, and all rates given are annual compounding. a) Find the value of a $1000 face value 5% coupon callable bond with annual coupons when the bond is callable at par at the end of each year. If a bond is called at the end of a year the previous year coupon is still paid in addition to the face value using the tree below. t=0t=1yrt=2yrt=3yr A. 977.11 B. 984.97 C. 990.09 D. 10000 b) What is the value of the embedded option in the callable bond above? A. -2.32 B. 0 C. 1.45 D. 2.32 c) Find the yield to maturity of the bond above. When computing the yield to maturity of a callable bond, assume the price is the one computed from the tree, and that bond will not be called but instead will be held to maturity. A. 5.47 B. 5.50 C. 5.56 D. 5.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts